Market Updates

2014 Investment Outlook: Rational Inexuberance

Davy Asset Management

Davy Asset ManagementDublin, Ireland

FOR FINANCIAL ADVISORS ONLY

“Irrational exuberance” is a phrase coined in December 1996 by the then US Federal Reserve Board Chairman, Alan Greenspan, speaking about financial market valuations. Investors interpreted this as a warning from Mr Greenspan that the US stock market might then have been overvalued, prompting a brief correction.

Today, as we enter 2014, investors seem to be confident about the prospects for another strong year in equities. Many of the conditions necessary for a continuation of the positive market environment we have experienced since late 2011 remain in place, namely:

- A continuation of very low interest rates and low-inflation globally.

- Encouraging economic data, suggesting global growth in 2014 may be in the 3% to 4% range.

- While global equity valuations have re-rated strongly over the past two years, they are still in line with the long-term average and inexpensive.

Figure 1: Global PE multiple, in line with the long-term average

Source: Barclays Global Equity Strategy 2013

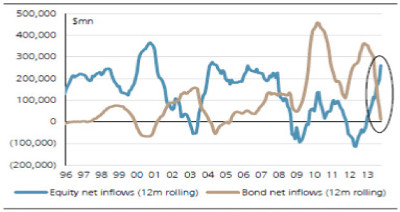

- After several years of outflows, positive inflows into equities and equity funds had only just commenced in 2013, and are likely to continue into 2014, which should put further upward pressure on equity prices.

Figure 2: For US-based mutual Funds and ETFs, 2013 net flows favour equities by a widening margin

Source: UBS Research December 2013

- Bond yields globally are still very low by historical standards, and if 2014 global growth is in the forecasted range of 3% to 4% then this could put further upward pressure on bond yields, encouraging investors to switch from bonds to equities.

So why our more cautious heading for this article?

Firstly, we have had two very good years for equity markets back-to-back in 2012 and 2013; in fact in each of these two calendar years the US stock market, as measured by the S&P500 index, never went under its starting point – which is unusual.

Secondly, there is a strong consensus among the major investment banks we talk to that 2014 may be a good year for global equities, with the range from +10% to +17% (Source: Citigroup, Barclays, Goldman Sachs, UBS, Deutsche Bank). In our experience, a strong bullish consensus view is also unusual and has a good chance of not coming through - it suggests that there is significant investor complacency and a lot of good news priced into markets, which could easily be turned into nervousness on relatively insignificant poor news.

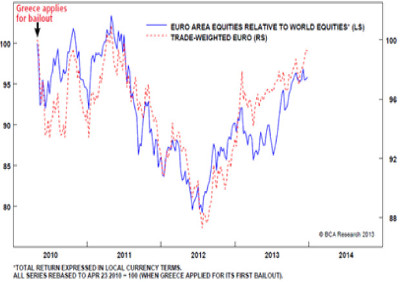

Even in Europe, where we have had a series of very worrying crises in recent times, the stock markets have recovered strongly in anticipation (correctly in our view) of better times ahead.

Figure 3: The Easy Money Is Over: Euro Area Equities and the Euro have regained crisis losses

Source: BCA Research

In our opinion, a continuation in 2014 of the double digit returns we have experienced over the past two years requires good earnings growth. For example, according to Ned Davis Research (November 20th 2013), buyers of European stocks are now paying 47% more than in June 2012 with roughly similar growth expectations. We believe we will get earnings growth in 2014, but will it be at a level high enough to propel equity markets significantly higher?

Let’s be clear: we are not negative on our 2014 view, simply ‘inexuberant’ and ‘rational’ taking account of recent strong moves. A mid to high single digit global equity market total return for 2014 is our expectation, with the risks skewed to the upside if we are wrong. Equities are still, in our opinion, the asset class of choice, and we believe any significant volatility/downside moves can be used by investors to increase equity weightings, where suitable. We believe that investors in our funds, which have had good returns over the past couple of years, will like our modest 2014 forecast; our projections may be worth consideration for those investors looking to put new monies in our funds- it is important the markets don’t run strongly upwards before the monies are invested, so as to give further upside potential into 2015.

Please click here for Market Data and additional important information

CONTACT THE TEAM

For more information, call or email us to discuss your requirements or arrange a meeting.