Market Updates

2015 Investment Outlook: Rational Inexuberance*

Davy Asset Management

Davy Asset ManagementDublin, Ireland

FOR FINANCIAL ADVISORS ONLY

Part 2: Be wise, not greedy

Last year’s outlook was titled ‘Rational Inexuberance’, and contained a relatively conservative forecast that global equity markets would produce a mid-to-high single-digit total return for 2014.

* “Irrational exuberance” is a phrase coined in December 1996 by the then US Federal Reserve Board Chairman, Alan Greenspan, speaking about financial market valuations. Investors interpreted this as a warning from Mr Greenspan that the US stock market might then have been overvalued, prompting a brief correction.

Equities: three steps forward, two steps backwards

The global equity market return for 2014, as measured by the MSCI World Daily Net Total Return Index (in euros) was 19.5%. The same index in local currencies (i.e. not translated back to euros) rose only 9.8% in 2014, illustrating the significant (beneficial) effect last year to Euro-based investors of the stronger US dollar and sterling (the US$ strengthened by almost 12% versus the euro in 2014).

The medium-term outlook for global equities remains positive. This view is driven by the persuasive macro background, as follows:

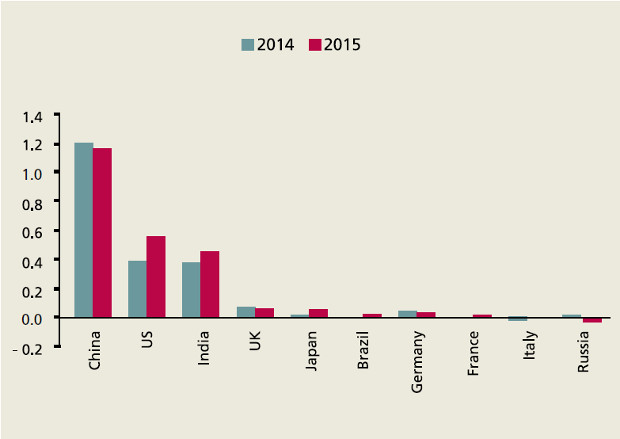

- 2015 should see global growth accelerate modestly to about 3.5%, driven largely by the US, China and India.

Figure 1: Contribution to Global GDP Growth 2014-15

(PPP weighted)

Source: IMF, DB Estimates

- We expect interest rates and inflation to remain very low globally, although we expect, as does the market, that US and UK interest rates will start to rise slightly sometime in 2015. We have seen evidence last year that the very low deposit rates are pushing investors to look at other potentially higher yielding asset classes such as equities.

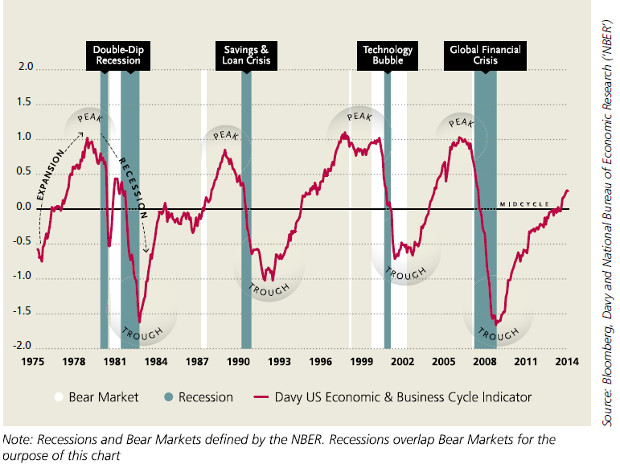

- Wall Street is the driver of equity market direction, so we take comfort from our analysis that the US economy seems to be still mid-cycle, and also is a beneficiary of the faltering oil price, thus suggesting a recession/profits collapse is still some time away – see the chart below which shows the ‘Davy US Economic & Business Cycle Indicator’ developed by J&E Davy’s Head of Global Investment Strategy, Brian O’Reilly and his team.

Figure 2: Davy US Economic & Business Cycle Indicator

Source: Davy

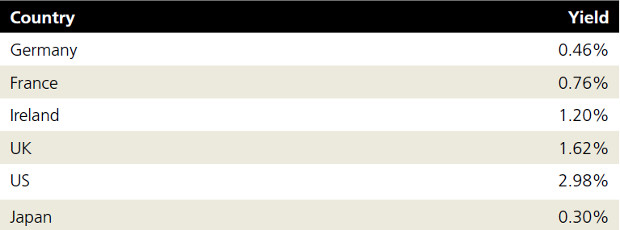

- Bonds remain unattractive, with yields in the major sovereigns at extremely low levels:

Table 1: 10-year Sovereign Bond Yields

Source: Bloomberg

I know I sound like ‘The Boy Who Cried Wolf’, but we believe monies will flow from bond assets into potentially higher yielding assets such as equities and property.

So why the note of conservatism in the heading for this article?

Firstly, history suggests some caution following the recent good years. According to SG Cross Asset Research (Outlook 2015 report), since 1875 the S&P 500 (US stock market index) has never risen for seven calendar years in a row. 2014 was the sixth in a row since 2008, so not a promising historical context for 2015.

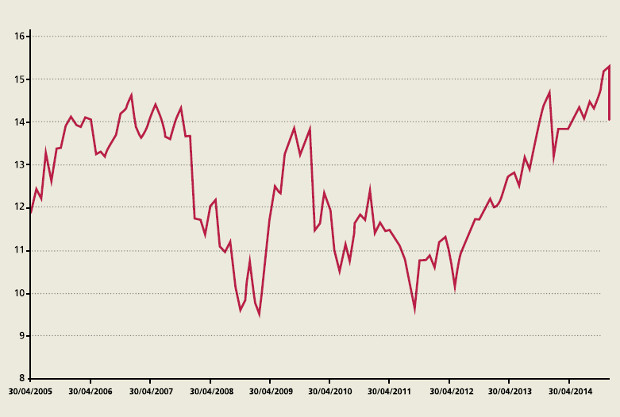

Secondly, valuations continued to move higher in 2014, so that today they are around the long-term average – the chart below illustrates the price-to-earnings ratio for global equities (MSCI World Index). You can see the 50% re-rating in equity valuations since late 2011.

Figure 3: MSCI World Index (F) P/E Ratio

Source: MSCI

Equity valuations could of course continue to increase, but it’s our view that we need reasonable earnings growth in 2015 to justify current levels. We remain constructive that global earnings can grow meaningfully in 2015 (high single digits), given our economic growth forecasts, but in our opinion, current valuations do not provide much of a safety net if there are some earnings disappointments during the year.

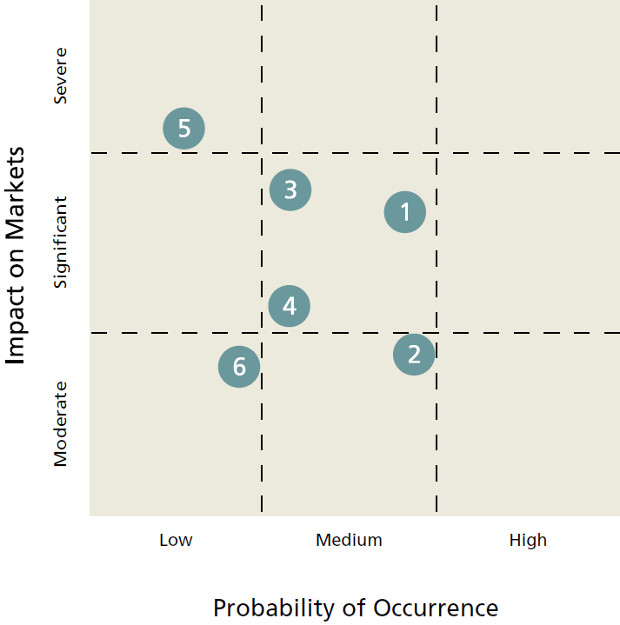

Thirdly, there are a number of known risks ahead of us in 2015, which, at the very least, could cause market setbacks and increased volatility. Downside risks include:

- Another crisis returns to Europe: The market’s faith in the ECB and its ability to stimulate growth weakens further.

- The Fed raises rates in the US at perhaps a faster rate rise cycle than is currently priced surprising investors negatively and leading to a sell-off.

- China hard landing: growth fails to rebalance itself to the ‘magic’ 7.5%, with the risk of a financial/property crisis.

- Geopolitical Risk: further rise in geopolitical tensions, in particular Russia, Syria and North Korea. Russia has been a constant risk since it invaded Ukraine, but had not really impacted financial markets until the recent oil price collapse put huge pressure on its economy. Meanwhile, tensions with North Korea are growing after recent Sony hacking incident.

- High Yield and/or Emerging Market bond market(s) collapse(s), bringing to the forefront the potential illiquidity issues which I have highlighted a number of times last year. This could cause a knock-on negative effect on other asset classes.

- EM contagion: brought on by the start of US Fed’s QE tightening, or a slowdown in China, or an escalation of the Russian crisis.

We can map the probability of these risks becoming reality and also their likely impact on financial markets in the chart below.

Figure 4: Impact/Probability of Risks

So history, valuations and potential risks conspire to make us more cautious about our 2015 outlook for global equities. We see a mid single-digit return from equities, but with the possibility of increased volatility, more setbacks and a 10%+ correction at some stage. But our medium-term outlook remains positive overall – we forecast a 15% to 20% total return in global equities from today by early 2017, as the longer-term positive factors kick in, indicating that market pullbacks should continue to be viewed as opportunities to add to equity holdings.

Summary

- We remain positive on equities over the next two to three years, but expect a below-average, mid single-digit return in 2015.

- In addition, we believe volatility will increase and that there is a significant probability of a 10% setback over the course of 2015.

- These corrections should not deter long-term investors from retaining their equity weighting, and perhaps to use them to add to their equity holdings.

- We know it’s boring to hear, but ‘quality’ stocks should outperform with less volatility in this environment.

Remain underweight bonds (in multi-asset portfolios)

The big surprise of 2014 was the continuing decline in bond yields, particularly in the US and Europe. The BoAML Euro Over 5 Year Bond Index produced a return of 20.5% in 2014, confounding many forecasts, including our own, that bond yields would rise in 2014. Instead the German 10-year bond yield fell from 1.66% to 0.54% over the year, while the Irish 10 year bond ended the year yielding 1.25%. It seems incredible that Ireland, Spain and Italy can all borrow 10-year money today for less than the US. Weak growth in Europe and an increasing threat of deflation means the ECB is likely to keep interest rates extremely low for several years and also introduce stimulatory measures. These moves by the ECB suggest that bond yields in Europe will remain at very low levels for longer than previously anticipated, but with the yields so low we maintain our underweight stance.

Overweight Irish commercial real estate

Property continues to perform strongly, particularly in the UK and Ireland. We believe Irish commercial property returns for 2014 will exceed 20%, and will be high single-digit in 2015.

The bulk of the activity in the Irish sector was initially driven by international investors but more recently domestic institutional investors, including REITs and hotel operators, have become more active.

Note that the managed/balanced/diversified growth funds we manage currently have an overweight allocation to Commercial Property (Prescient Select Portfolio – The Managed Fund, Trilogy 2 and LOGIC).

Please click here for Market Data and additional important information

CONTACT THE TEAM

For more information, call or email us to discuss your requirements or arrange a meeting.