Insights

Big Boots to fill - will Draghi’s successor have “whatever it takes”?

Oliver Sinnott

Oliver SinnottFixed Income Fund Manager

While speaking with a Bank of Italy representative at an investment conference in London in 2011, I asked what she thought of the then Governor of the Bank of Italy, Mario Draghi, who had just been announced as the next European Central Bank (ECB) President. “Mario operates at a different level and he is going to go in there and change everything” was her memorable and seemingly over-effusive reply.

I was sceptical. I wondered if the ECB was capable of change, but eight years later her prediction has proven extraordinarily accurate. Draghi has done much to change the ECB’s DNA.

To understand how big the transformation has been one needs to look at the ECB’s history. Established in 1998 it was based in Frankfurt and modelled on the German Bundesbank which had zero tolerance for above-target inflation. This was to placate Germany who, still haunted by their 1930’s hyperinflation experience, worried about giving up control to potentially less disciplined central bankers.

Contagion rips through the Eurozone

When Draghi took over as ECB President the eurozone debt crisis was reaching a crescendo. The crisis that spread through Greece, Ireland and Portugal was now beginning to impact the borrowing costs and debt sustainability of larger peripheral countries (and banks) in Spain and Italy. It was threatening the very existence of the eurozone itself.

To make matters worse, just before Draghi took over, the ECB under his predecessor Jean-Claude Trichet raised rates twice in order to dampen inflation. This horrified many market participants, as it further demonstrated that the ECB was overly focused on inflation and had underestimated the crisis. After all, inflation would be a minor issue if the eurozone imploded, surely prompting a much more severe recession and banking crisis across the entire region.

“Super Mario”

Defeating the eurozone debt crisis was going to have to be Draghi’s first and most important challenge and he did not disappoint. Within 6 weeks of his appointment he reversed the two interest-rate hikes engineered by Trichet and provided cheap loans to help banks.

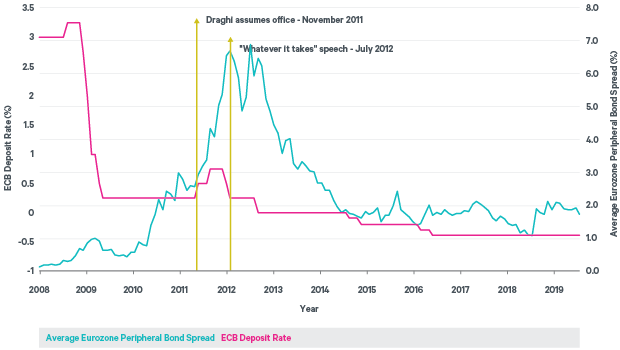

Then in July 2012, he uttered the words for which he is famous: “… within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.” This warned eurozone breakup speculators that they could be betting against all of the ECB’s resources. It proved to be a masterstroke. Default risk in all peripheral government and bank debt tumbled as a result. Figure 1, which shows peripheral government bond spreads (a proxy for default risk) illustrates this.

Figure 1: Eurozone peripheral spreads and ECB deposit rates (31st December 2007 to 30th April 2019)

Source: Bloomberg, OECD

Breaking Taboo’s

While, under Draghi’s stewardship, the ECB successfully turned the corner on the financial crisis, inflation continued to undershoot the ECB’s target of “below but close to 2%”. In order to stimulate the economy and inflation, in addition to keeping the financial crisis at bay, he introduced two controversial policies.

1. In 2014 he cut interest rates below zero, effectively charging institutions for placing money at the ECB. One rationale for this was that if banks were penalised for holding excess cash, they might be more inclined to lend it out and help revive the broader economy.

2. In 2015 the ECB began a Quantitative Easing (QE) programme, which in its most basic form is “printing” money to buy bonds. In theory this would boost activity by increasing money supply to the economy and lowering borrowing costs. In addition, it was probably hoped (unofficially) that it would depreciate the euro. QE faced huge opposition from Germany in particular.

Draghi has his Critics

Despite all this stimulus, critics of Draghi would point out that inflation has been below its target for over five years. This is not in doubt. However, this is a problem experienced by almost all developed market central banks in recent years. There are many reasons for this, many of which are structural in nature, such as aging demographics, globalised cheap labour and technological advancement. In addition, it is widely accepted now that central banks have much more power to lower inflation than they do to raise it.

Perhaps Draghi’s biggest critic will be his successor, who may complain that after so much stimulus there is not enough ammunition to fight the next crisis. Certainly, given interest rates are negative and QE approached legal and operational limits, they may need to be even more inventive going forward. However, it is possible that his successor goes down a different path.

New President New Direction?

There is growing speculation that the next President will be a Northern European, or perhaps even the German Bundesbank President Jens Weidmann who has consistently opposed Draghi’s unconventional policies. The appointment of Weidmann, or a similar minded person, may mean the ECB will be less willing to act as a circuit breaker during future crises leading to potentially more financial market volatility and putting more onus on governments to intervene.

However, a still fragile eurozone economy and the lack of a proper eurozone fiscal union suggests stepping back from interventionist polices may be a luxury the next ECB President cannot afford. Certainly, Draghi did not have that option when he took over at the height of the eurozone debt crisis.

Thankfully he recognised the ECB was on the wrong path and, despite considerable criticism, had the courage to change course and step in when European politicians and institutions did not. While I am not keen on negative interest rates and acknowledge QE may have negative consequences in the future, I believe survival of the single currency during those critical early years owes more to him than anybody else and for that reason I believe history will judge him kindly.

Contact a member of our team to find out more

+353 1 614 8874