Insights

Investment Outlook 2019

Mark Seavers

Mark SeaversChief Investment Officer

As 2019 got underway, global equity markets were trading on 13.4x 12-month forward P/E, cheaper than they have been in over five years. Following what was a very strong year for company profits in 2018, earnings are expected to grow again this year by over 6%. The uncertainty that was created by Brexit, the US/China trade war, rising interest rates and slowing growth resulted in a market correction in the fourth quarter which took global equity returns into negative territory for the year. We expect to get more clarity on some of these risk factors in the coming months.

BREXIT ENDGAME?

While the chances of a no-deal Brexit have risen since Prime Minister Theresa May postponed and subsequently lost, the vote on the Withdrawal Agreement, our base case scenario remains that there will be an agreed deal with the EU27, perhaps after an extension to the Article 50 timeframe. Under Article 50, a no-deal Brexit is the default option now that the Withdrawal Agreement has been voted down. However, the UK Parliament could now suggest amendments to the agreement that could go back to the EU27. The UK could also revoke Article 50 unilaterally, as the European Court of Justice has stated, or even call a second referendum.

The economic consequences of a nodeal exit could be severe for the UK (and Ireland), and a majority of MPs in the House want to avoid that scenario. To add to the stakes, if there is no deal, there will be no transition period, regarded as an essential by UK businesses to plan for future arrangements with the EU. With all this in mind, we think it more likely that there an agreement will be reached between the UK and the EU27.

TRADE WARS

2018 ended with some positive statements from the US and Chinese administrations regarding progress in the trade dispute between the two countries. On December 29th, President Trump tweeted that the “deal is moving along very well… Big progress being made!” China’s commerce ministry spokesman confirmed that progress was being made, and that talks would resume in January. We have held the view over the past year that the self-defeating nature of imposing tariffs would eventually be recognised by the Trump administration and that the tariff escalations would end. If “big progress” is indeed being made, this should provide relief to the markets in general in 2019.

EUROZONE SLOWDOWN

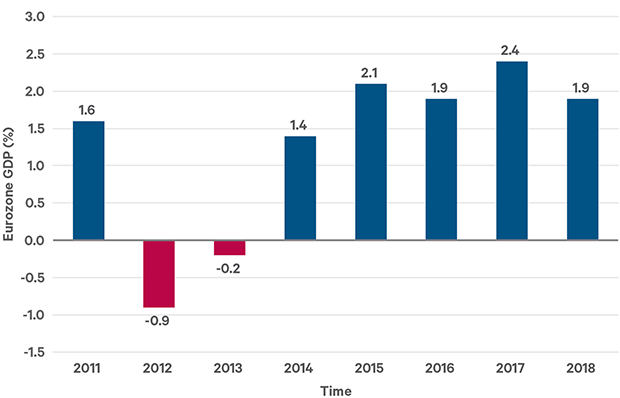

There have been some downgrades to global GDP growth forecasts in recent months. In his December press conference, ECB President Mario Draghi noted “a climate of great uncertainty” in the

Eurozone, attributing this to trade tensions and financial market volatility. The ECB has cut its forecast for 2018 GDP to 1.9%. You might recall that at the end of March 2018 the market was expecting eurozone GDP growth for the year of 2.4%. A series of one-off factors, including a winter flu epidemic in Germany, strikes and protests in France, disruption to auto manufacturing and the water levels in the Rhine and Danube all conspired to crimp growth in the euro area last year. As these temporary factors unwind, it is likely that the trajectory of growth forecasts should settle down with the potential for renewed upgrades.

The ECB also expects to wind down its bond-buying programme this year, which has accumulated €2.6trn of assets since 2015 and has undoubtedly led to cheaper financing for eurozone corporates. The ECB is expected to follow the US Federal Reserve (Fed) playbook by moving gradually with clearly-signalled changes to policy, in an attempt to minimise the impact on markets.

Figure 1: Eurozone GDP economic forecasts

Source: Davy Asset Management and Bloomberg 31st December 2018

FED TIGHTENING TO CONTINUE

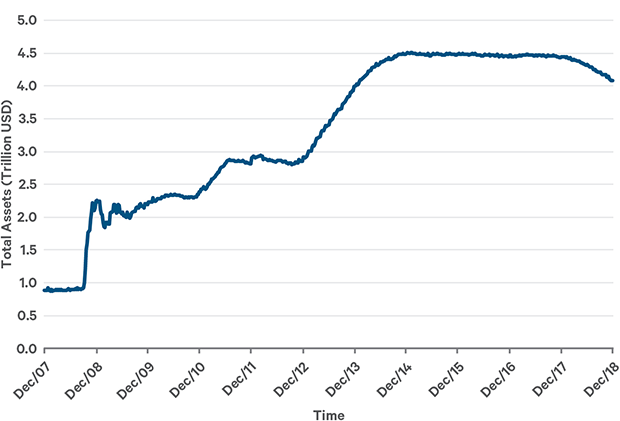

The Fed stopped adding to its hoard of bonds in 2014 and allowed that balance to decline last year; so-called “quantitative tightening”. So, it is now up to the bond market, and not the Fed, to refinance these maturing bonds. This process will be an additional drain on market liquidity until the Fed decides that its balance sheet is appropriately sized. Any expectations that that process would be slowed were dashed by Jerome Powell, chairman of the US Federal Reserve, at the Fed’s December meeting; Quantitative Tightening is to remain on “autopilot”.

While this quantitative tightening process has been ongoing, the Fed has also been raising its target interest rate. During 2018, US rates were raised four times taking the Fed funds rate to 2.5%, drawing the ire of President Trump in the process. The president’s attacks on the Fed appear to have undermined the confidence of investors. Rumours that the president was about to fire the Fed Chairman led to a sharp fall in US equities on Christmas Eve, resulting in back-tracking by the administration. When asked if Powell’s job was safe, White House economic adviser Kevin Hassett replied “yes, of course, 100 percent.”

In any event, we believe this issue will be resolved in 2019 as the Fed has been signalling that the “neutral” interest rate is within sight. The committee now sees just two further hikes in the year ahead – down from a predicted three back last September.

Figure 2: Federal reserve balance sheet

Source: Bloomberg and US Federal Reserve 31st December 2018

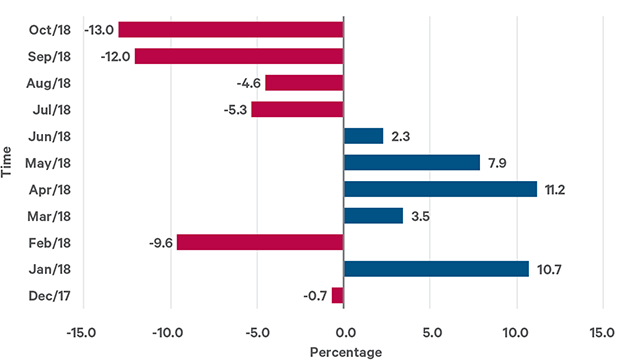

CHINA STIMULUS

Back at the start of last year, the Chinese authorities were also tightening monetary policy to curb wasteful lending. Twelve months on, this policy has gone into reverse in response to a slowdown in economic activity in some sectors during the past year. For example, property prices have been falling, leading to angry protests from recent buyers and car sales have collapsed; concerns about tariffs and trade are not helping. The rapid escalation of the trade dispute between the US and China has unnerved investors and company managements alike. However, if the current truce in the trade war holds, or is turned into a lasting agreement, we believe that the Chinese economy will stabilise in 2019.

In the past, the Chinese economy has reacted positively to stimulus, and investors will be hoping that the current policy gets a similar response.

GOVERNMENT BONDS DIVERSIFY

A year ago, our bond team’s forecast of 2.9% for the benchmark US 10-year yield by end-2018 was below consensus. As it turned out, even their fair-value model was too bearish on bonds. Admittedly, the yield peaked above 3.2% in September but then fell back towards our target as equity market volatility spiked. We retain our view that, despite global liquidity being drained from markets, bonds have a place in a balanced portfolio as they rise in price when equities are under pressure – as evidenced throughout 2018.

Figure 3: China car sales year-on-year % change

Source: Bloomberg as at 31st December 2018

EQUITY REGIME CHANGE

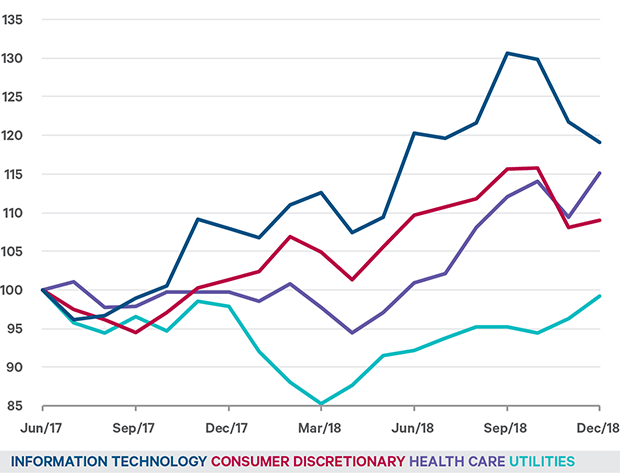

There has been a sharp change in leadership within the equity markets since last summer. Investors have switched their focus from those stocks that had been the winners over the previous 18 months, including technology and consumerfocused stocks, and instead have favoured stocks that have greater earnings certainty, such as utilities and health care stocks.

A healthy equity market is driven by a broad and diverse range of stocks, rather than a narrow group and we believe this “rotation” is helpful for market prospects for the year ahead.

Recent equity market weakness, coupled with further corporate earnings growth to come in 2019, means that equity markets offer better value to investors now than any time in the past five years.

Figure 4: Sector performance June 2017 to December 2018

Source: Davy Asset Management and Bloomberg as at 31st December 2018

QUALITY* INVESTING

As active managers, we have the scope to adapt to changing drivers of the global equity markets. In our opinion, the combination of higher volatility and a broader range of stocks and sectors driving equity returns will give active investors a greater opportunity to outperform the market in 2019. The degree of macroeconomic and political uncertainty that markets may have to endure in 2019 underlines the importance of having a disciplined investment process focused on Quality investments for the long term.

*Davy Asset Management - “Quality Matters” White Paper – Chantal Brennan, Paraic Ryan, Hannah Cooney: 2016.

Please click here for Market Data and additional important information.

To read more Insights please click here.