Insights

Investment Outlook: Are We Out of the Woods?

Chantal A. Brennan

Chantal A. BrennanResearch Director

FOR INVESTMENT PROFESSIONALS ONLY

Market outlook

The first quarter of 2016 was a volatile start to the year, with January being one of the worst starts to a year on record. While we view the low trajectory of global growth as a continued concern for markets going forward, we can draw some comfort from the fact that many of the risks which flared up in the first quarter are relatively discreet. For example, the fall in oil prices has been the result of a supply war between OPEC (Organisation of the Petroleum Exporting Countries) and the US Shale industry and not because of a lack of global demand. While lower growth in China is contributing to global volatility, the authorities are making a deliberate effort to rebalance its economy and liberalise its financial markets.

That is not to say we are out of the woods just yet. Despite the recent rally, we believe markets will remain volatile. When we look at some of the lingering issues, and especially some of the event risks on the horizon, we believe this quarter has the potential to define the year as a whole. June in particular is shaping up to be a very important month with a number of significant economic events including the UK Brexit referendum, and OPEC, the Federal Reserve (Fed) and European Central Bank (ECB) meetings.

Brexit looms large

Brexit probably has the greatest potential to agitate markets, given a country has never left the EU before and the markets have a strong dislike of uncertainty. While the ‘Leave’ campaign has been gaining in recent polls, we believe the odds still favour the UK remaining in the EU. Although, it is too close to call, we think it’s prudent to expect the market to grow increasingly anxious amid continued sterling weakness as we approach the referendum on 23rd June.

Next US interest rate hike

Despite Fed Chair Janet Yellen making ‘dovish’ statements, inflation is picking up in the US and the labour market is showing significant signs of growth. This may make the market concerned about a possible US interest rate hike in June. However, we think it is worth noting the Fed meeting will take place the week before the Brexit referendum, making it unlikely that the Fed will increase interest rates, given the potential external risks. The million dollar question is: How long is the Fed willing to trade off higher inflation in the long-term over short-term uncertainty? We still expect either one or two rate hikes during 2016.

Oil and dollar also key

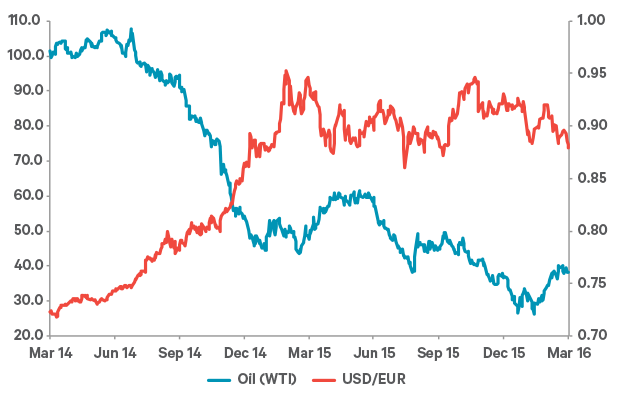

Along with the numerous event risks in June, weak earnings momentum and risks to the global growth outlook will also be an ongoing concern. Oil prices and the US dollar will play a key role in earnings’ growth. Both stabilised in Q1 (see Figure 1) and we believe there is a good chance they will remain range bound around current levels. This would be positive for market stability and US equities in particular.

Figure 1: Oil Price (WTI) USD versus dollar euro exchange rate

Source: Davy Asset Management and Bloomberg as at 31st March 2016

Source: Davy Asset Management and Bloomberg as at 31st March 2016

Although, US recession fears were overdone in Q1, at these unremarkably low growth levels (consensus analyst forecasts are calling for a GDP 2.0% growth rate for 2016 in the US) the market will remain nervous about upcoming event risks. We believe labour data will continue to be robust and we are encouraged by the improvement in the manufacturing sector. Unfortunately, consumer and retail spending has been disappointing recently. However, an improving labour market, a pick-up in wage growth and the benefit of lower energy prices should support a consumer rebound over the coming quarters.

China

We continue to believe the fear of a hard landing in China is overdone, as evidence suggests consumption by the Chinese middle class remains robust. We are expecting a pick-up in near-term growth prospects given the notable rise in policy-driven investment growth. Recent forward looking indicators such as the manufacturing and services purchasing manager indices also reinforce this view.Equities over Fixed Income

To conclude, we expect improving, but still unremarkable, global growth for the rest of 2016. While pending event risks, particularly Brexit clouds the near-term picture, we believe much of the recent market fears (e.g. a US recession and a hard landing in China) have been overdone. This should be supportive of equities and other risk assets for the remainder of the year. While global earnings growth is likely to be quite modest, with earnings forecast to grow around 8% for the calendar year, we do not believe equity valuations are particularly stretched at these levels.

Conversely, fixed income valuations remain stretched despite benefiting from a flight-to-safety in the first quarter. We believe it will be difficult to see government bonds continuing to deliver strong returns at these record low yields. By the end of the year, we will be surprised if government bond yields are not higher than current levels. On a relative basis, the prospects for corporate bonds look much brighter, supported by the ECB’s corporate bond purchase programme which will begin in late Q2.

As such we are defensively positioned, focused on preserving capital by investing in securities with good earnings visibility which we believe have the ability to withstand a period of greater market volatility. This is the cornerstone of our Quality investment philosophy.

Our opinion: 2016 outliers ('surprises')

Of the outliers we listed at the start of 2016, we believe the probability of these events happening has evolved over the quarter and we rate them now as follows:

Increased chance of occurring

- Donald Trump is elected the 45th US President beating the Democratic candidate Hillary Clinton but the Democrats gain control of the Senate.

- The refugee crisis in Europe becomes increasingly divisive, polarising national parliaments benefiting right-wing parties.

- Precious metals move sharply upwards in response to sustained global monetary easing.

No change in chance of occurring

- The Federal Reserve increases interest rates faster than the market anticipates negatively affecting the growth outlook and resulting in a stronger dollar.

- Brexit occurs as the UK votes to exit the European Union. The UK economy stalls, sterling weakens and the Bank of England doesn't raise interest rates. David Cameron resigns.

- The US and UK authorities refocus their efforts on domestic multi-nationals availing of international corporate tax rates.

- Russia continues to ignore international pressure and steps up its sabre rattling in Syria and Eastern Europe.

- Move from several proxy wars dividing Saudi Arabia and Iran and their respective allies to a full blown war.

- The luxury housing markets in New York and London experience a sharp downturn as buyers from the Middle East, China and Russia retrench.

Decreased chance of occurring

- The US market has another down year as stocks suffer from exceptionally higher wages with limited revenue growth.

- China devalues the renminbi against the US dollar to stimulate growth and avoid a hard landing.

- Abenomics works and the Japanese economy begins to show signs of growth coupled with the forced buying of equities by Japanese pension funds results in the market moving higher.

- Oil prices stay below $40 per barrel resulting in a blowout in High Yield spreads and a further selloff in energy related stocks becoming a ‘Black Swan Event’ for the entire market.

All sources are Bloomberg unless otherwise noted.

Please click here for Market Data and additional important information.

To read more Insights, click here