Insights

Investment Outlook: Keep Calm and Carry On

Chantal A. Brennan

Chantal A. BrennanResearch Director

FOR INVESTMENT PROFESSIONALS ONLY

Global equity markets were seasonally soft in June, the MSCI World Index fell by -0.9% despite the UK electorate voting to Brexit on 23rd June. Although the equity market fell on the news, it subsequently rebounded, deciding to look through the long-term implications of the result. In the first half of 2016, the MSCI World Index had been particularly volatile, falling -5.0% in the first quarter before rebounding by 3.6% in the second. It is now only off -1.6% year-to-date, in euro terms. This masks a dramatic -15.3% fall between January and February which was subsequently offset by a deep value rally of 17.3% from February to the end of May.

Brexit

The last time the UK broke away from Europe was in 1532 under the rule of Henry VIII when Rome was “viewed as oppressive, unaccountable and governed by a clerical elite” consequently its assets were confiscated by the crown. Similarly, the British voters are equating Brussels to an undemocratic giant monopolistic state enterprise whose membership cost is £17.9bn to the UK (or £8.4bn after rebates).

Investors and markets assumed the UK would vote to remain on 23rd June, which is why the markets rallied in days prior to the vote and fell sharply on the morning of the result. Less than a week later the markets looked through the effects of Brexit and were broadly back to where they began prior to the referendum result. The UK government’s “Project Fear” strategy (otherwise known as the ‘Better Together’ or ‘Remain’ campaign) failed as it lacked conviction. Some anecdotal evidence from colleagues, who were in the UK at the time, highlighted the lack of regional advertising from the Remain campaign relative to the Brexiteers who had ‘Vote Leave’ signs everywhere. The consequences of Brexit have been far more severe for politicians; it has wiped out a generation of MPs including the Prime Minister, the Leader of the Opposition, the Chancellor and even the leaders of the Brexiteers, Boris Johnson and Nigel Farage. We expect the UK to remain volatile, causing protracted uncertainty for the rest of the world especially Europe.

Implications for Europe and global markets

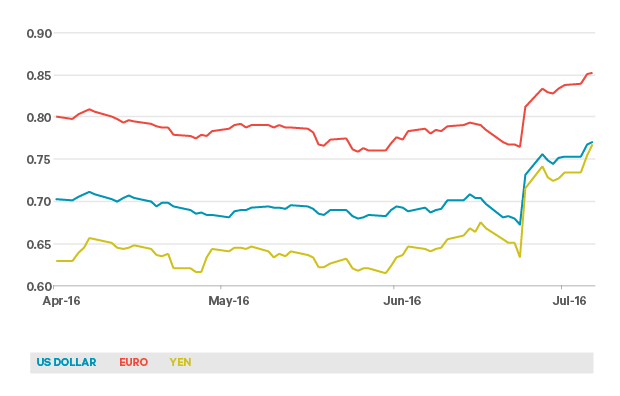

In Europe, over the last 12 months there have been constant worries regarding the stability of the European Union (EU). In 2016 general elections in Ireland and Spain resulted in hung parliaments as voters abandoned the centre, favouring instead the populism of the left or right. The result of the EU referendum in the UK has removed an important “brick in the wall”, quoting Pink Floyd. The initial double-digit falls in Italian, Spanish and French markets point to the concern this vote implies for the future of the Eurozone. In the wake of the UK’s Brexit vote, investors’ attention has been drawn to the slow-burn banking crisis in Italy and its potential impact on the EU’s credibility. Now more than ever European investors need to take a global view. Currency markets quickly and relentlessly priced the impact of the Brexit referendum. The immediate aftermath saw sterling fall twice as much as on “Black Wednesday” when the pound crashed out of the Exchange Rate Mechanism (ERM). Anything deemed safe rose. Gold surged over 10%, the benchmark German 10-year bond yield fell below zero for the first time and the yen rose to 102 versus the US dollar. The Japanese currency has now regained half of the value which Abenomics has laboured so hard to destroy over the last three years.

Figure 1:Sterling versus its main trading partners, April to July 2016

Source: Davy Asset Management and Bloomberg as at 4th July 2016.

The collapse of the pound is a positive for UK large capitalisation stocks whose revenues are generated internationally. We are already seeing earnings upgrades for those stocks in our portfolios. Obviously, the reverse holds true for stocks with UK exposure as they are now experiencing downgrades.

Interestingly, China used the turmoil to quietly reset its currency intervention bands in order to help its exporters. While investors’ focus has been diverted towards Brexit and the potential impact for the global economy, the relevance of the Chinese economy to global markets cannot be ignored. The surge in the US dollar has given Fed Chair, Janet Yellen, another reason to bury prospects of any further rate increases until late 2016.

Next US interest rate hike?

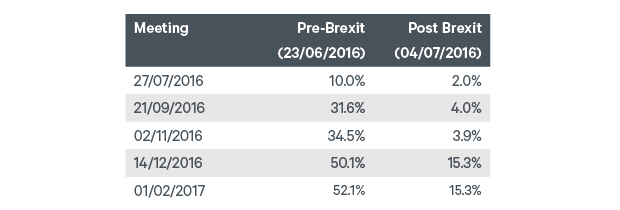

Since the announcement of Brexit, the markets have stabilised faster than expected. Global equities are back to pre-Brexit levels coupled with a sharp fall in volatility. Central banks once again have shown their willingness to intervene. Investment markets are now speculating that the US Federal Reserve (Fed) will place interest rate increases on hold again. The Fed will most likely wait for the US Presidential election and the level of uncertainty surrounding the UK exit to diminish before taking action. The probability of another US rate hike this year has diminished significantly from c.50% before the Brexit vote to just 15.3% (see Table 1).

Table 1: Implied US rate hike probabilities

Source: Davy Asset Management and Bloomberg as at 4th July 2016.

We have all but forgotten that at one point in the first quarter of this year, a Trump-Sanders electoral battle was a distinct possibility. Both are anti-establishment candidates who polled strongly in the primaries and while the final result is a Trump-Clinton contest, as the election is a binary result we shouldn’t underestimate Trump’s ability to defy the odds.

Equities over fixed income

From a top down perspective, the market has reduced global Gross Domestic Product (GDP) by approximately 20 basis points (global GDP forecasts 2016: 1.8%). Equally the broader global economic environment is not expected to dramatically change over the next six months. We expect low growth, low interest rates, low returns and periods of high volatility. Oil prices are marginally lower as markets anticipate lower GDP growth while other ‘safe haven’ assets such as gold and silver have performed strongly.

Merger and acquisition activity (Microsoft & LinkedIn) and initial public offerings continue apace even though global earnings growth is likely to be quite modest in 2016. The market is still expecting a sharp rebound in the fourth quarter and we do not believe equity valuations are particularly stretched at these levels. While we expect a low growth environment with periods of high volatility, a portfolio of large global companies with diverse revenue streams combined with “growth enhancements” from smaller companies could help investors navigate these uncertain times.

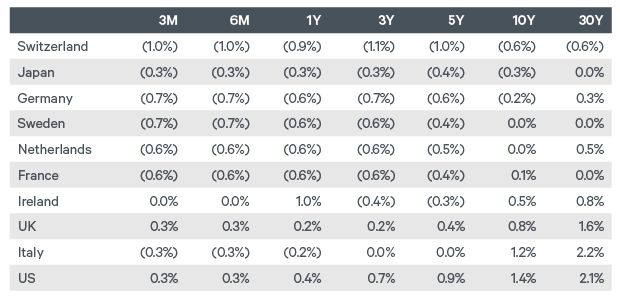

Bond yields have remained low anticipating the resumption of monetary easing in the UK and the US Fed placing interest rate increases on hold. It is important to note, the universe of government bonds trading with negative yield has jumped to a new record high of over $10 trillion.

Table 2: Global government bond yields, July 2016

Source: Davy Asset Management and Bloomberg as at 6th July 2016.

Thus, Fixed Income valuations have become increasingly stretched after benefiting from a flight-to-safety. We continue to believe that the ability of government bonds to deliver strong returns at these record low yields is strained. On a relative basis, the prospects for corporate bonds look much brighter, supported by the European Central Bank’s (ECB) corporate bond purchase programme.

The political vacuum in the UK has delayed the triggering of Article 50, thus reducing volatility as there is no timeline for markets to focus on. Despite this, the list of pitfalls in 2016 remains significant given that the Trump-Clinton US presidential election, Brexit negotiations and the future of the EU itself are all uncertain. As such we are defensively positioned, focused on preserving capital by investing in securities with good earnings visibility, which we believe have the ability to withstand periods of market volatility. This is the cornerstone of our Quality investment philosophy.

Our Opinion: 2016 outliers (‘Surprises’)

We mentioned in our updated outlook in Q4 2015, there still is a long list of potential crises which could cause market uncertainty in 2016. The impact of these outliers will depend on numerous political, economic and market driven events.

Of the outliers we listed at the start of 2016, we believe the probability of the below events happening has evolved over the last two quarters as outlined in Table 3 below.

Table 3: 2016 outliers probability update

Source: Davy Asset Management and Bloomberg as at 4th July 2016.

All sources are Bloomberg unless otherwise noted.