Insights

Investment Outlook Q2 2018

Mark Seavers

Mark SeaversChief Investment Officer

At one point in mid-January, it looked as if our full-year 2018 expectations of mid-to-high single digit returns from equity markets, and a 2.9% US 10-year yield, would be fulfilled within weeks as the positive momentum in equities witnessed in 2017 spilled over into the New Year. However, volatility has returned in earnest since the end of January, driven by technical factors and plain old-fashioned politics. We stick with our forecasts for now, but will be watching the hard economic data and earnings reports closely for evidence that confidence and investment intentions are adversely affected by the changed political environment.

Earnings expectations for the year ahead have continued to rise in the recent pull-back, allowing equity valuations to fall somewhat. Global equities are currently trading on a 2018 P/E of 15.8x, compared with 17x back in January.

Volatility Returns

The first few weeks of 2018 were a continuation of what had gone before: rising markets led by large-cap Technology stocks, with volatility levels hovering around the lows seen for much of the previous 12 months. In our 2018 Investment Outlook, released in early-January, we pointed out that “the current extended period of low volatility is not without precedent, but periods such as these increase the likelihood of elevated volatility and meaningful falls in equity markets in the future.” Three weeks later, we got our first sight of an extreme volatility event for some time.

Figure 1: Volatility spike February 2018

Source: Bloomberg as at 30th March 2018

The source of the equity selloff was the group of products known as the “Inverse Vix” ETFs, which would pay off if volatility remained low, but would suffer large losses if there were a spike in volatility. It was widely known that the persistently low levels of volatility had encouraged many investors into these funds in order to bet that such benign conditions would continue. On Feb 5th, the Vix index rose from 16 to 37 causing massive losses to holders of the funds. An inflation scare from the Friday before was blamed for starting the move. As with so many market events in recent years, equities showed their resilience and had recovered most of the Vix-related losses by mid-March.

Trade Tensions

The return to calmer trading was short-lived however. In recent weeks we have seen further bouts of volatility driven by rising trade tensions sparked by the US administration. A full-blown trade war, if it were to start, could quickly undermine the synchronised global growth that we were observing at the start of the year. The seemingly ad-hoc nature of the US administration’s decisions on policy and personnel has brought renewed anxiety. Trade tensions had been rising at the time of our 2018 Investment Outlook when president Trump’s recently announced National Security Strategy appeared to pose risks to global trade, with a number of investigations underway into China’s trade practices. In the event, the president ordered tariffs on steel and aluminium imports of 25% and 10% respectively, bypassing Congress by citing national security concerns. Temporary exemptions from the tariffs have been granted to allies such as Europe, Canada and Mexico, confirming the notion that China is the intended target. Trump has followed up with a 25% tariff on $50bn of Chinese goods, targeting sectors such as flat-panel TVs, automobiles and electronics exports, and has since suggested that officials look into a further $100bn of Chinese exports.

China has responded swiftly with tariffs of up to 25% on politically sensitive sectors such as cars, aircraft and food imports from the US and appears set to match the US for every move. The prospect of escalating tariffs will undoubtedly impact business confidence in the coming months and, if they are enacted, might start to show up in the inflation figures by year-end. This is not positive for global growth or financial market returns. While Treasury Secretary Steven Mnuchin has expressed cautious optimism that an agreement with China can be reached, stating on Fox News that “we are having very productive conversations with them”, Chinese officials have denied that meaningful conversations are taking place.

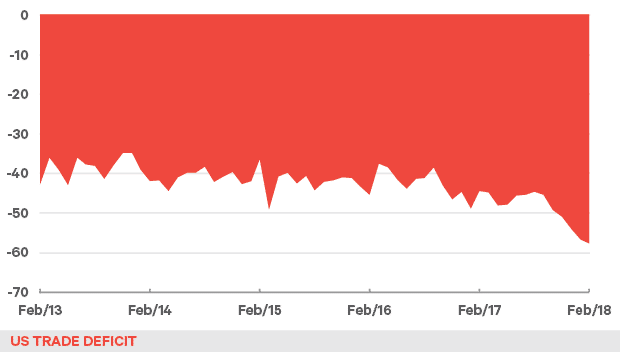

Figure 2: Growth in the US trade deficit

Source: Bloomberg as at 30th March 2018

Of course, there is an obvious contradiction in the actions of the US administration: if you want to reduce a trade deficit, you don’t provide a fiscal boost, such as the president’s $1.5 trillion tax cuts, to an economy that is already at full capacity. Rising imports and a widening deficit are a guaranteed outcome in this scenario. While talking tough on trade plays well with Mr. Trump’s core vote in the run-up to the November mid-term elections, China will seek to ensure that it is those same voters who will be most negatively impacted by retaliatory action. Contrary to the president’s belief, trade wars are a no-win strategy. Given the pain that it would have on US firms, we believe that the odds are against a full-blown trade war.

America First

Another potential source of volatility in the next few months centres on US foreign policy. The removal of Secretary of State, Rex Tillerson (by tweet), and National Security Advisor, H.R. McMaster, and their replacement by Mike Pompeo and John Bolton reinforces the “America First” stance of the administration. Bolton’s appointment sets the scene for further foreign policy tensions, including a potential imminent withdrawal from the Iran nuclear deal.

He has referred to the agreement as a “diplomatic Waterloo” in the past, and is unlikely to advise the president to waive the sanctions by the May 12th deadline unless there are changes to the terms. If the president follows this path, he may also seek to force others to withdraw investment in Iranian oil production, resulting in an oil price spike and further pressure on markets.

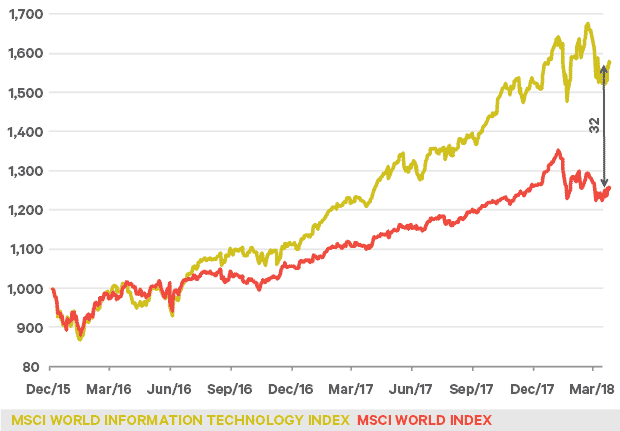

Tech Wreck

The Technology sector, which has been the standout winner in equity markets since mid-2016, suffered a rare correction in March, following revelations that Facebook had allowed third-parties to access its users’ data without permission. A large part of the appeal of these stocks, to investors and users alike, has been their oligopolistic grip on that most valuable of commodities – our data. The market is increasingly concerned about more aggressive regulatory scrutiny and possible anti-trust measures against the big players. The Federal Trade Commission is investigating Facebook for its data practices while the president has been tweeting against Amazon for impoverishing the US postal service and hurting retailers. Investors will be assessing whether any changes in data practices that may be forced on the big data players will impact their profitability.

Figure 3: MSCI World Technology versus MSCI World Index since January 2016

Source: Bloomberg as at 30th March 2018

European Politics

Closer to home, with less than a year to go before the UK exits the EU and enters a two-year transition period, the seemingly intractable question of the Irish border will return to the agenda in upcoming discussions. The ECB has added to the sense of uncertainty by instructing UK banks not to rely on the transition period and to prepare for a hard Brexit. The wrangling to form a coalition government in Italy is ongoing following the indecisive election result. Any realistic combination of parties that could form a government is likely to slow, or possibly reverse recent moves to reform the Italian economy. This has the markets wary of the ongoing talks.

The Earnings Engine

With policy uncertainty pervading markets at the moment and economic momentum slowing, investors will be listening closely to what companies are saying about their investment intentions during the upcoming earnings season. Investors have enjoyed accelerating earnings growth in recent quarters, which has supported equities and reduced valuation levels. US corporate tax rate reductions were the main contributor to the recent upward move in earnings, but these have largely been priced into stocks now.

Bonds and Monetary Policy

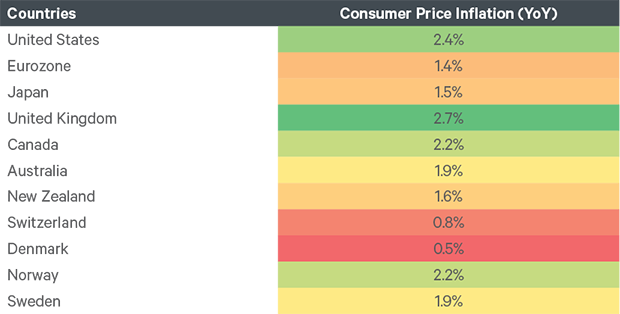

Global government bond markets fell by -0.18% during the first quarter, as measured by the euro-hedged JP Morgan Global Bond Index. Bond holders have been worried by the approval in January by Congress of a large increase in government spending at a time when economic momentum was stronger than expected. Expectations for central bank interest rates were also pushed up at the time. Since then, leading indicators of growth in the Eurozone and US have disappointed somewhat and the bond market rout has been stalled. While yields look to be contained in a range for now, we think it likely that they will be challenging the February highs in most jurisdictions before the year is out. Despite recent softness, global growth remains robust, inflation is creeping up in most major economies and central banks will continue to gradually withdraw liquidity.

Figure 4: G10 inflation expectations

Source: Bloomberg as at 30th March 2018

Regarding the much anticipated end to QE by the ECB, it is worth noting that although net QE purchases will probably end in September, support from ECB reinvestments will be significant; a fact that is probably underappreciated by many. The ECB will reinvest c. €12.3bn per month in H2’18 versus €30bn per month net purchases currently. This support should reduce the risk of a disorderly widening in spreads. Although we expect global bond yields to rise from here, (though only modestly in the US), investors have had a chance to see how government bonds can continue to act as a diversifier within portfolios. During the Vix melt-down and during the current trade-war posturing, bonds have rallied when equities have fallen. Our year-end forecast for US 10-year yields is 2.9%.

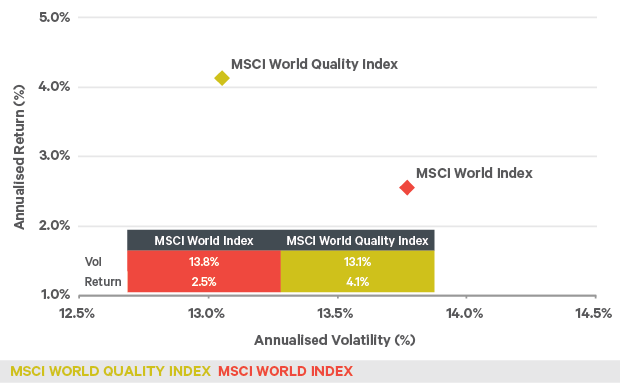

Sticking with Forecasts

The global economic expansion has just entered its tenth year with synchronised growth in most developed markets and inflation rising, but below targets. As we have seen in recent months, there is ample scope for politics to undermine the economic backdrop and bring the cycle to an end. With global markets, as represented by the MSCI World Index, down 3.7% at end of March, we need some calm waters to get to our equity and bond forecasts by year- end. Our focus on quality stocks has paid off during the recent turmoil and we think it will sustain our funds through this cycle as has historically been the case.

Figure 5: 18 years of quality

Source: Bloomberg as at 30th March 2018

The greater risk to equity markets in the short term is that the US administration’s misguided trade policies are enacted and lead to a trade war. We believe the odds of this are low and note the words of newly appointed National Economic Council Director, Larry Kudlow, who said of the president, “you know, there are carrots and sticks in life, but he is ultimately a free trader.” An interesting quarter lies ahead.

Please click here for Market Data and additional important information.

To read more Insights please click here.