Insights

Investment Outlook Q3 2017

Mark Seavers

Mark SeaversChief Investment Officer

Global equities delivered 8.6% in local currency terms in the first six months of the year – the strength of the euro translated that impressive underlying return into just 2.7% for euro-based investors. After an eventful first half in financial markets, what do the next six months have in store for investors?

WHERE TO FROM HERE?

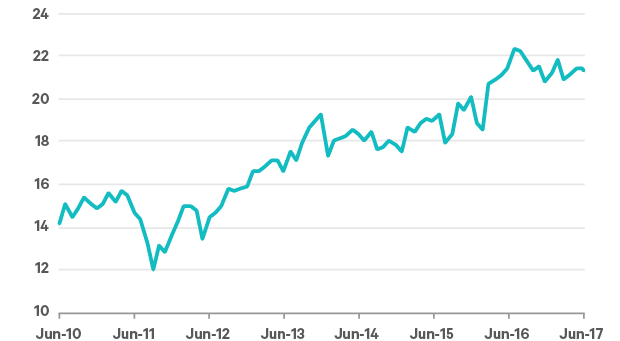

The strong performance of stocks this year has pushed equity markets to the upper end of the valuation range in the current cycle. While company earnings have also been rising, global equity prices have been outpacing earnings over the past six months, leading to higher valuations.

On a forward-looking basis the current 2017 P/E is 17.3x, up from 16.5x at the start of the year, so regarding valuations some caution is required at this point.

If earnings growth is delivered as expected, this would certainly support equity markets at current levels. The market is expecting over 13% profit growth in 2017 and a further 10% in 2018. If companies can deliver on these expectations, equity markets can progress from here.

TRUMP FISCAL REFORMS

What could drive earnings and markets from here? The much-anticipated Trump fiscal package, coupled with continued progress in Europe would help. Our expectation going into 2017 of mid-to-high single digit equity returns was predicated to some extent on a growth-oriented fiscal package from the Trump administration and the avoidance of a political upheaval in Europe. As at the half-year stage, while the Trump administration’s fiscal plans stalled, the political environment in Europe is much more benign than it might have been.

On Trump’s fiscal plans, the administration has so far failed to put forward a detailed plan of what the fiscal stimulus will look like. In early June, the president reiterated his pledge to use $200 million of tax breaks to incentivise private capital to invest in Infrastructure, with the intention of getting spending up to the magic $1 trillion level. In reality it may be difficult to get private investors to fund repairs to roads and bridges without an obvious source of cash flows to generate a return.

Figure 1: MSCI World trailing price-to-earnings

MSCI WORLD INDEX (EUR)

Source: Davy Asset Management and Bloomberg as at 30th June 2017

There is also much scepticism about the administration’s budget proposals, which hinge on a forecast that US GDP growth will rise to 3% and stay there in the medium term in order to balance the books. The World Bank expects US GDP growth in 2018 and 2019 of 2.2% and 1.9%, far below the 3% that the administration expects. The IMF also cut its forecasts for US GDP for both 2017 and 2018 to 2.1% on account of the lack of progress on tax reform as “it became evident that many details about these plans are still undecided.”

As the 2018 mid-term election comes to the fore, we would expect greater urgency on the part of house Republicans to push for a credible tax reduction package, which would give a boost to their re-election prospects and support economic momentum. This should translate into higher earnings and, ultimately, to stronger equity markets.

GOLDILOCKS ECONOMY

So, if the big hope for global growth and healthy equity markets in 2017 has been a non-event, how come many developed world equity markets were making new highs at the half year stage? Macro momentum and earnings growth have certainly been supportive.

On the earnings front, we came into 2017 looking for 11% growth for developed equity markets for the year – just enough to justify market valuations at the time. By mid-year, earnings growth expectations have been revised up to around 13%, while developed market valuations have moved to P/E of 17.3x 2017 earnings. Nevertheless, the market is clearly enthused by the momentum in corporate profits generally.

Upward revisions have been a rarity in recent years, during which time growth expectations have generally been dashed.

Trading on a 2017 P/E of 15.6x, the European equity market offers investors some valuation support. As noted above, the political background in Europe has brightened considerably over the past six months. The Dutch rejection of populism was followed by Emmanuel Macron’s victory in the presidential election and En Marche’s triumph in the Parliamentary elections. This outcome sets France on course for some long-needed reform, helped by the recovering French economy.

ITALY – EUROPE’S WEAK LINK?

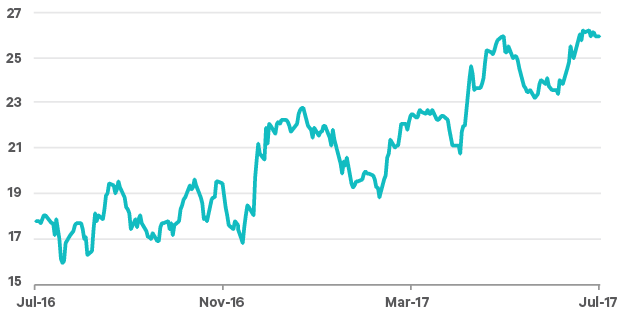

Elsewhere in Europe, political instability in Italy has been one source of concern for investors since the emergence of the eurosceptic Five Star Movement (now called M5S). After a strong showing in the polls earlier this year, investors were relieved when the group suffered setbacks in recent municipal elections.

The other great Italian risk has centred around the problem of the banks. In June, Italy managed to provide €17 billion of state assistance to two failing banks, Veneto Banca and Banca Popolare di Vicenza, without bailing-in senior bond holders. The resolution of Monte dei Paschi di Sienna, the world’s oldest bank and Italy’s biggest banking problem, also looks to be nearing completion.

Continued momentum towards a final resolution of Italy’s banking problems will reduce a major source of investor anxiety about the eurozone and attract investors into European equities.

Figure 2: Italian bank share back on track

MSCI ITALY INDEX

Source: Davy Asset Management and Bloomberg as at 30th June 2017

BREXIT FINALLY IMPACTS THE UK

The UK economy fared much better than most had expected in the aftermath of the Brexit vote. The excuses given were varied: A weaker sterling was giving a boost to exporters, the political situation had stabilised within weeks, the consequences of the Brexit decision seemed unreal to the average citizen – so consumers continued to borrow and consume.

Much has changed in recent months: Political instability is back centre-stage following the misjudged general election decision; sterling’s weakness has delivered an inflation rate heading towards 3% which is pressuring real wages; and Britain’s negotiating position is comparing unfavourably with that of a united EU.

This deterioration in the economy is reflected in recent data that suggests the UK economy is beginning to diverge from the rest of Europe. Q1 GDP growth of just 0.2% followed weakening surveys of business. It is clear that business investment is not accelerating against the uncertainty. With credit growth finally slowing and consumers retrenching, we doubt that governor Carney will adjust rates until there is some clarity on the direction of the Brexit negotiations.

CLOUDS GATHER OVER BOND MARKETS

What about the bond markets? For bond investors, things may be about to get more problematic. In the US, the Federal Reserve is raising rates and contemplating allowing its $4.5 trillion balance sheet to run down. The ECB has become more optimistic on eurozone growth and markets have begun to price some normalisation of monetary support here. This has been reflected in rising European stocks, falling bond prices and a strengthening of the euro.

Figure 3: US 10-year bond yield

US 10-YEAR YIELD

Source: Davy Asset Management and Bloomberg as at 30th June 2017

Bond investors have had an interesting journey so far in 2017. At the start of the year, with US 10-year yield standing at 2.6% (up from 1.9% on presidential election night), we thought that global bond yields would continue to rise and that the US 10-year would reach a yield of 3.2% by year end. As at end of June 2017, US 10-year is nearing trading around 2.3%. What might cause the rise in yields to resume?

Well, it appears that the prospect of a reduction in the Fed’s balance sheet is on the cards for later in the year. This, combined with relatively hawkish tones from Fed officials about the federal funds rate, may undermine bonds during the second half of 2017.

Recent signals from the ECB have been mixed to say the least. At the ECB Forum in Sintra, Portugal, the ECB President Mario Draghi said that “all the signs now point to a strengthening and broadening recovery in the euro area.” Market reaction was immediate, with the euro rising strongly and eurozone bonds selling off. The moves clearly spooked ECB officials who were out the next day saying that the market was misinterpreting the president’s comments

Either way, the general direction of policy is clear: There is a tightening of monetary conditions in prospect around the globe, possibly even in the UK. Given, what is at stake, the journey back from excessive liquidity will be long and gradual but the course appears set. It is against this backdrop that we would not recommend monetary assets.

Implied and realised volatility have been unusually low of late. We attribute this to the implicit assumption that central bankers will step in and print money if there is any sign of trouble in financial markets. We believe this backstop is being removed and that the process of gradual tightening of monetary conditions will result in bouts of volatility such as we saw in the second half of 2015. In this context, we believe it is important to focus on quality companies that have the ability to continue to generate returns through the cycle.

Please click here for Market Data and additional important information.

To read more insights please click here.