Insights

Investment Outlook Q3 2018

Mark Seavers

Mark SeaversChief Investment Officer

Global equity and bond markets have failed to make much progress since our last update in April. In that note, we observed the start of the trade skirmishes that have escalated to become major concern for investors. At the time we said that “a full-blown trade war, if it were to start, could quickly undermine the synchronised global growth that we were observing at the start of the year”. The capricious nature of the Trump administration’s foreign policy moves makes it difficult to forecast the extent of the damage that will be done to the global economy if the escalations continue. Market reaction so far has been muted. In this update we discuss the state of play on trade and other areas of concern such as Italian politics and the ongoing Brexit negotiations, and give an update on our market forecasts.

Of Tariffs and Trade

On 6th July the US imposed a 25% tariff on $34bn of Chinese goods in response to what it perceives as China’s abuseof technology transfer and intellectual property practices in its dealings with US companies. Within days, China responded in kind, targeting food, beverage and auto imports.

On 10th July President Trump upped the ante yet again, starting the process of reviewing a further $200bn of goods imported from China for a new 10% tariff, and promising to go to $500bn if China retaliates. To put that in context, $500bn would represent substantially all of China’s exports to the US, including components that are vital to US manufacturers. Having taken care so far to avoid hitting products that US firms would struggle to source elsewhere, if the US feels the need to get to €500bn, self-inflicted pain is unavoidable, and this is why we don’t think it will get to that point.

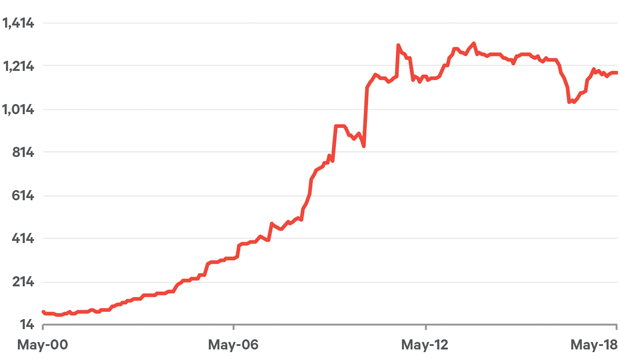

In response to the $200bn move, China has signalled that it will “fight back as usual”. However, Chinese imports of US goods last year totalled $130bn, which puts a limit on China’s ability to retaliate in a like-for-like fashion. Nonetheless, China has said it will adopt “comprehensive measures”, which could include obstructing the operations of US companies in China. Having a centrally planned, authoritarian state gives the Chinese huge latitude to hurt US companies’ interests in China. It has been said that the Chinese could even manipulate US bond yields through its massive holding of US treasuries, although this would ultimately be self-defeating.

Figure 1: China holdings of US Treasuries May 2000 – May 2018

$ BILLION

Source: Bloomberg

As the tariffs start to work through the system, the immediate effects will be on inflation as importers pass on the higher costs to consumers and on business confidence in general. According to minutes of the Fed’s June FOMC meeting, the uncertainty over trade is having an impact on the capital expenditure plans of US companies and may yet tilt the Fed towards a more wait-and-see approach to monetary tightening. Supply-chain disruptions are inevitable as manufacturers seek alternative suppliers in order to avoid tariffs. Ports such as Los Angeles are seeing record imports of Chinese goods as importers look to beat the tariff deadlines. These volumes will almost certainly shrink as the tariffs take effect. Higher input costs will also hit the margins of companies buying imported products and hurt the revenues of exporters. A number of large companies, including brewer Molson Coors and motorcycle maker Harley Davidson, have warned of the impact of a trade war on their revenues.

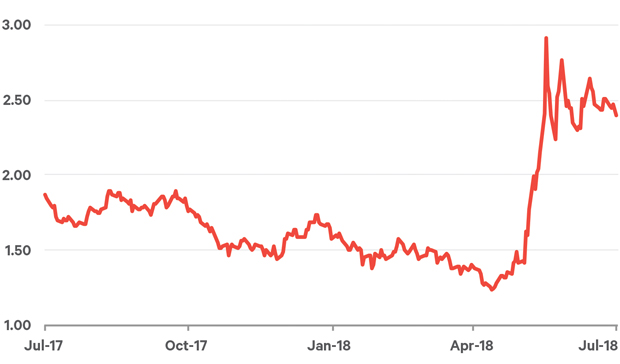

Figure 2: Italy/Germany 10-year spread

YIELD SPREAD

Source: Bloomberg

As if to underline the political nature of the disputes, those on the receiving end of the tariffs have been targeting goods produced in key swing states such as Florida (orange juice), and traditional Republican voting states in the US farm belt such as Wisconsin (soya beans and cotton). The aim is clearly to put pressure on Republicans ahead of the mid-term elections in November.The unintended consequences of this escalating trade war were best illustrated by German auto maker Daimler, which issued a profit warning on 21st June. Ironically, the warning was not related to the ongoing threat by the Trump administration to impose tariffs on European auto exports to the US, but by China’s decision to target imports of US-made cars, including cars made by Daimler and BMW in their US plants. The two European auto companies have been caught in the crossfire between the US and China and may have more to lose from these actions than their US competitors. Daimler reckoned that €150m (1%) of operating profit was at risk. In his battle against the US’s European trading partners, Trump may be encouraged by the fact that the German automotive trade body, the VDA, which represents BMW and Daimler, has responded positively to US suggestions that all auto tariffs between the EU and US blocs be dropped. The share prices of Europe’s car makers rose strongly on the news.

Italy’s Populists

Our last quarterly update went to print just as negotiations to form a coalition government in Italy got underway and the worst-case-scenario of a M5S/League coalition was unfolding. Italian bond spreads ballooned on the formation of the anti-establishment government and remain at elevated levels. Meanwhile the equity market, which had outperformed Europe before the election, lost all of those gains in its aftermath. Within days of taking on his new role as finance minister, Giovanni Tria reassured investors that Italy was committed to remaining inside the euro and that the government was “determined to avoid the materialisation of market conditions that push us towards an exit in any way”.

The coalition’s original eurosceptic candidate for finance minister, Paolo Savona, who was rejected by President Mattarella, has been using his post as European affairs minister to openly recommend a Plan B to euro membership. It is against this backdrop of conflicting messages that the new coalition will craft a budget aimed at delivering on its populist election promises. In spite of Tria’s reassurances on Italy’s debt trajectory, if the coalition tries to implement the €780 minimum income, the flat tax and the scrapping of pension reform, it would be impossible for Italy to avoid having to renegotiate its budget with Brussels. This process would undoubtedly take place amid howls of protest from Italy’s Northern neighbours and further bouts of market volatility.

If the coalition thought that the ECB would be prepared to support their plans with a more accommodative interest rate policy, Mario Draghi, ECB president, disabused them of this notion stating, “Our mission and our mandate are not aimed at protecting national budgets”. Once the summer break is over, we will start to see how committed the coalition is to its election promises. We can expect a bit more euro-related volatility in the run up to the budget in October.

Brexit Twists

Depending on your point of view, recent events in the UK have either cast the Brexit process into disarray or opened up a path to a softer exit than looked likely a few months back. Teresa May appeared to have recognised the economic reality of an increasingly integrated global supply chain in which much of British industry operates and has proposed retaining the status quo for trade in goods after the UK leaves the EU. While that may sound a lot like having your cake and eating it, the reaction in Berlin and Dublin to the proposal had been more positive than might have been expected considering it crosses the EU’s “four freedoms” red line. The EU’s chief negotiator, Michel Barnier, reminded the British government of this fact in his response to the white paper.

However, internal Tory wrangling led to the white paper being amended to appease hard-line Brexiteers before passing a vote in the Commons.

Market reaction to the twists and turns has been relatively low key so far, with sterling modestly weaker against the euro. Forecasting the eventual outcome is no easier now than it was at the start of the year given that, between here and October, there could be a Tory leadership challenge or even a general election in the UK. Taoiseach Leo Varadkar summed up the situation: “It’s not evident or not obvious that the government in Britain has a majority for any form of Brexit, quite frankly.”

Equity Valuations

As equity markets have treaded water this year, earnings expectations have ticked up resulting in the 2018 valuation falling from a P/E of 16.9X in January to 15.4X at end- June, the cheapest since Trump’s election victory in 2016. Given the heightened risks arising from US trade policies, we look forward with interest to comments from company managements about the impact of the nascent trade war on their earning in the Q2 earning season.

Figure 3: Forward P/E

FORWARD P/E

Source: Bloomberg

At the half year stage, euro-based investors had seen a return of just 3.3% from global equities. We still expect that to get “mid-to-high single-digits” by year end. Perhaps wary of the president’s record of flip-flopping, the market has not moved to price-in a lasting negative impact from the trade war. This is currently the biggest risk to our 2018 equity and bond forecasts.

Bonds Range-Bound

Bond yields have also been trading in a relatively tight range since Q1. Core eurozone yields actually fell when the Italian coalition government was finally formed. Bonds had been rallying since February when a run of poor economic news caused downward revisions to GDP. The lacklustre start to the year has been blamed on temporary factors such as bad weather, French strikes and a German flu epidemic that, according to UBS, had up to 7% of the adult workforce off sick in February/March. Eurozone growth is set to resume over the summer and into year-end provided the trade war doesn’t intensify.

The minutes of the May FOMC meeting revealed a less hawkish Federal Reserve that was more relaxed about inflation than the market had assumed. The US 10-year benchmark yield dropped back to 2.8% on the news, where it remains today; our year- end target is 2.9%.

So, just as in April, it is politics that presents the biggest and least forecastable risks to the global economic and to markets. We stick with our bond and equity forecasts for now and believe our investment process, which aims to identify Quality investments, will deliver for our clients in these volatile times.

Please click here for Market Data and additional important information.

To read more Insights please click here.