Insights

Investment Outlook Q3 2019

Mark Seavers

Mark SeaversChief Investment Officer

Equities and bonds have been rallying simultaneously since the Federal Reserve (Fed) changed tack on interest rates earlier this year. A recent comment from Fed chairman, Jerome Powell, suggesting that the central bank would cut interest rates to help the US economy if the trade dispute threatened the growth outlook, neatly sums up the two major opposing forces currently driving asset prices: the US/China trade war and the direction of interest rates.

While the S&P500 recently made a new all-time high, US 10-year yields have fallen below 2% for the first time since November 2016 driving bond prices higher. Falling yields usually precede an economic slowdown, while rising equity markets typical depend on the opposite scenario. So, what are these seeming contradictory moves telling us?

Federal support

There has been an extraordinary change of tone from the world’s most important central bank since the end of last year. Entering 2019, the Fed appeared determined to tighten monetary conditions in response to sustained positive economic momentum in the US. Interest rates were on the rise and the Fed was allowing its balance sheet to shrink. However, as we move through the third quarter, investors are now expecting two rate cuts in 2019 and two more next year. Comments from Powell, when speaking in Chicago in June, suggested the US central bank is open to cutting interest rates. The context was interesting: At the time, Powell was being asked about the escalation in the trade war and the potential negative effects on economic growth.

In reply, Powell referred to “recent developments involving trade negotiations,” and said that the Fed would “act as appropriate to sustain the expansion”. The market immediately interpreted the words “act as appropriate” to mean “cut interest rates”. The remarks highlight just how seriously the Fed is taking the threat to growth from the trade war. It was the second time in 2019 that the Fed chairman’s words soothed anxious investors and drove asset prices higher. Equities and bonds rallied simultaneously following the speech.

The shift in tone brings the Fed more in line with what the bond market has actually been telling us since late last year: The trade war will hurt the US economy and the Fed will be forced to cut interest rates to support growth. The Fed now appears to have been convinced of this assessment.

US vs China - The long game

Central to the Fed’s current thinking is the deterioration in relations between the US and China. The recent G20 summit seems to have assuaged some fears regarding an immediate worsening of the trade war. However, there are plenty of voices on both sides of the political divide in the US, and within Trump’s own team, calling for a tougher approach to China.

From the moment the Trump administration turned its sights on Chinese imports, we have held the view as the only global supplier of many of the goods imported into the US, the scope for imposing draconian tariffs on China would be limited. Tariffs are paid by American importers, not Chinese exporters. Therefore, imposing tariffs is inflationary in the US and self-defeating. However, the Trump administration has proceeded regardless. The G20 meeting merely held off imposing punitive tariffs on “essentially all” Chinese imports. As far back as October last year we warned that “the more goods that come into the frame as the escalation goes on, the harder it will be on US consumers, who are by far the largest contributor to GDP.”

The US National Retail Federation (NRF) underlined this point recently when it warned of the inflationary implications of the most recent tariff threats. The NRF echoed our point, saying that “for most of the consumer products on this list, there are very few alternative sources of supply,” and that “retailers would be forced to continue to use Chinese suppliers and pass on higher costs to their customers – just in time for the holiday shopping season.”

However risky the tariff ploy may be to the US economy, it is beginning to look like just one element of a broader, long-term strategy to curb the growth of China’s power and influence; and central to this strategy is technology. The executive order banning US companies from supplying technology to Chinese mobile technology giant, Huawei, was predicated on security concerns about the company’s links to the Chinese state. The centralised nature of their economy has allowed the Chinese to race ahead in the development of the next generation of ultra-high-speed mobile communications, a technology described in China’s 13th Five-Year Plan as a “strategic emerging industry.” This advantage would give Huawei an edge in the deployment of its network technology globally, and this has clearly unnerved many in the US.

Huawei was given some respite by the US at the G20 meeting. Nevertheless, US technology companies sell around $11bn of technology to the Chinese company every year, and blacklisting it created considerable uncertainty about this revenue stream. This makes the job or estimating earnings and placing a fair value on US tech stocks more complicated. These stocks have been among the most sensitive to the ebb and flow of the trade dispute.

Macro consequences

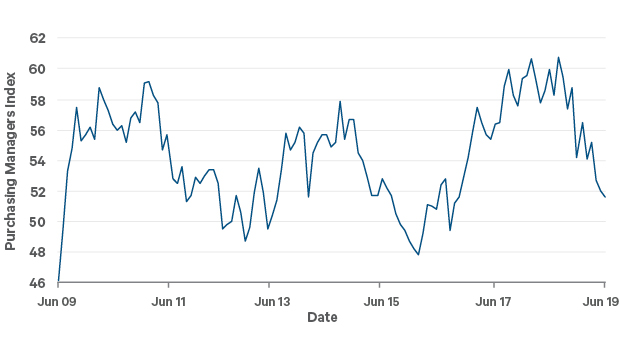

The recent sharp fall in manufacturing confidence across all developed economies reflects the uncertainties about the ultimate end-game in this trade war. This lack of visibility is already translating into reduced capital expenditure by companies. One company’s capital expenditure is another company’s revenue, so investors will be listening out for company managements’ take on the investment slowdown during the current earnings season.

Figure 1: US manufacturing confidence

Source: Bloomberg as at 30th June 2019

Closer to home, the last thing the eurozone needs right now is a trade war induced hit to corporate confidence. The region has had to shake off several one-off effects over the past 18 months and also has to contend with another looming Brexit deadline. As if that weren’t enough, being so leveraged to global trade, the eurozone economy has been experiencing downdraughts which we believe are related to the Trump administration’s policies recently. Business confidence is low and labour market conditions in its largest economy are beginning to deteriorate. The lead runner to be the new European Central Bank (ECB) president, Christine Lagarde, may find herself having to launch a new bond-buying programme to drive down rates and support growth in the region.

Equities are currently valued at a P/E of 15.8x, higher than they were back in January as the market has moved ahead of underlying earnings, but by no means at extreme levels. It is tempting to think that this reflects the market’s high conviction that company earnings are about to recover in the near term. However, given the timing of the recent moves, the equity market has, in all likelihood, been responding to the promise of yet more liquidity from the Fed if markets fall for any reason. Remember, the Fed’s change of heart in January followed the worst December for equity markets since the Depression era. So far in this long cycle, it has not paid off to doubt the Fed’s influence on markets.

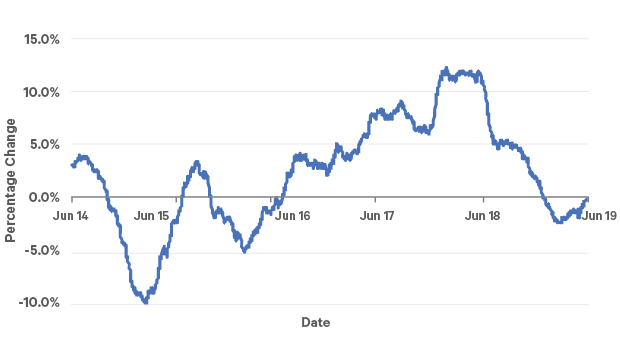

Figure 2. MSCI world 6 month earnings growth change

Source: Bloomberg as at 30th June 2019

From here, renewed earnings momentum is key if equities are to progress. Encouragingly, the six-month change in earnings expectations made a low in March and has been recovering since then.

Bond markets

We believe that the direction of bond yields in the near term will be driven by developments in the trade war. A resolution to the dispute would result in rising yields, whereas a deterioration from here, or even a continuation of the current standoff, would almost certainly drive yields to lower levels as economic confidence wanes. How much lower is debateable. The market is already pricing four cuts in the US totalling 1% - two this year and two next.

In Europe, the ECB has pushed back its timeframe for tightening policy and may now commence cutting rates unless the current economic conditions improve. Its chief, Mario Draghi is due to retire in October and will be remembered for promising to do “whatever it takes” to preserve the euro. In his last act as ECB President he may find himself manning the pumps yet again.

Conclusion

The trade war has already had a negative effect on the global economy through reduced investment and business confidence. A worsening of the situation from here would, in all likelihood, lead to a stock market correction and further falls in bond yields. The Trump administration has shown itself to be very sensitive to stock market volatility in the past, and has sought to move the blame for falling markets to the Fed. However, with the Fed’s recent “pivot” towards lower rates, that excuse will no longer be available to the president.

We had expected that there would be a resolution on trade between the US and China sometime this year. But with rhetoric from both parties in the US hardening, it is possible that the current impasse will drag on into election year 2020. In the meantime, investors will be looking for reassurance about current trading conditions and the prospects of further positive earnings revisions during the Q2 earnings season.

QUALITY* investing

As active managers, we have the scope to adapt to changing drivers of the global equity markets. In our opinion, the combination of higher volatility and a broader range of stocks and sectors driving equity returns will give active investors a greater opportunity to outperform the market in 2019. The degree of macroeconomic and political uncertainty that markets may have to endure in 2019 underlines the importance of having a disciplined investment process focused on Quality investments for the long term.

*Davy Asset Management - “Quality Matters” White Paper – Chantal Brennan, Paraic Ryan, Hannah Cooney: 2016

Please click here for Market Data and additional important information.

To read more Insights, click here