Insights

Investment Outlook Q4 2018

Mark Seavers

Mark SeaversChief Investment Officer

The recent correction in equity markets has been attributed to many factors, the most prominent of which has been the sharp rise in US bond yields that preceded it. However, a rise in rates need not necessarily derail equity markets, particularly if firming rates are reflecting robust growth within the US economy. This economic momentum should deliver earnings growth to US exposed companies and support equity prices.

Recent Developments

As we enter the final quarter of 2018, volatility has returned in earnest to equity markets. The rise in real yields in the US in response to the strength in the economy has been cited as the driver of the correction. However, at the time of writing, yields have drifted back as the equity market has fallen and the current malaise is now being attributed to a host of factors including a slowdown in China, uncertainty over the effects of tariffs, disappointing earnings from some technology companies, and a Fed that appears determined to continue tightening policy.

The immediate reaction of investors has been to sell those stocks that have been winners over the past 18 months, including technology and consumer-focused stocks, and to “rotate” into stocks that have been laggards such as utilities and banks. A healthy equity market is driven by a broad and diverse range of stocks, not a narrow group, and we have been expecting to see a greater balance of performance between various sectors since our October 2017 update. However, the gap widened further until July of this year, at which point sector performances started to even out. This process was given a sharp boost in the recent correction. While technical factors undoubtedly exacerbated the size of the recent moves, we would expect a more even contribution to total equity market performance from the various sectors from here.

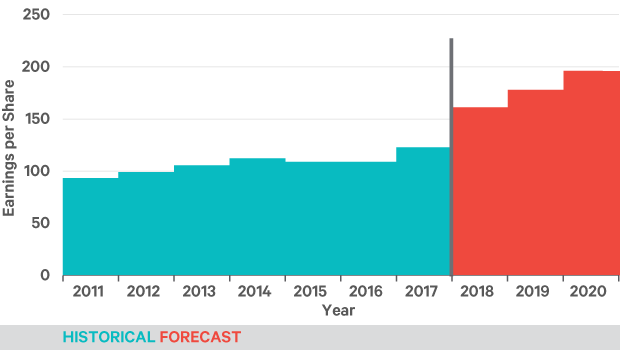

As active investors running global mandates, we have the scope to seek out relative opportunities between sectors and regions if the underlying earnings prospects deteriorate. Those earnings have been strong in 2018, particularly in the US where tax cuts have helped. This in turn has prevented equity valuations rising by much. In fact, while earnings expectations for the 12 months ahead of us are similar to the levels we were seeing back at the start of the year, valuation levels are now lower.

Figure 1: S&P 500 Index Earnings Per Share realised and forecast as at September 28 2018

Source: Davy Asset Management and Bloomberg 28th September 2018

Global Trade

Many of the risks that have concerned investors for the past few months look set to continue to influence markets into the year-end and beyond. The escalating trade war between the US and China is front of mind for both investors and company managements alike. President Trump decided to go ahead with 10% tariffs on another $200bn of Chinese imports and that tariff rate will rise 25% in the new year. The delay in raising the tariff rate to 25% is designed to allow US firms the time to find an alternative to the Chinese import - preferably American-made.

While companies that have been dealing with China through the years have reason to feel aggrieved at many of the conditions imposed on them, we believe the notion that the current strategy will lead to jobs flowing back to the US is fanciful. The US has no competitive advantage in the sort of low-wage manufacturing with limited environmental regulations that China has specialised in. Nor does the US have the labour force needed to fill these roles if there was the demand.

Source: Davy Asset Management and Bloomberg 28th September 2018

US company managements know this and have been at the front of the queue to tell the administration so. In fact, the public hearings into this latest tranche had to be extended, such were the numbers of submissions from small and large firms alike. Equity markets had been reasonably calm in the face of this escalation; some of the sectors most exposed to trade have underperformed those that are domestically focused, but overall the market had held up well. That may change if we start to see a significant reaction from consumers to increased prices.

There is a limit to how far this can go in terms of the range of imports that can be targeted, and at $500bn, we are almost there - although tariffs rates can be hiked again. But the most obvious limitation centres on the self-defeating nature of the strategy. The first victims of these tariffs are the US companies that rely on cheap Chinese inputs for their competitive advantage. Consumers will also feel the pinch as the tariffs on finished goods are passed directly to them. Remember it is the US importer who pays the tariff to get their goods through customs not the Chinese exporter.

Up to this point, the US administration had been designing the lists of Chinese goods in such a way as to minimise the impact on consumers, and again in the recent list we saw FitBits and Apple Watches exempted. However, the more goods that come into the frame as the escalation goes on, the harder it will be on US consumers, who are by far the largest contributor to GDP in the US.

The trade war will undoubtedly hurt global growth – the IMF has just downgraded its global GDP forecast for 2019 from 3.9 to 3.7% - but judging the effects of trade wars on growth on growth is difficult because there will likely be an official response from the governments in the affected countries to lessen the impact. As a small example, the US has already set aside a $12bn fund for farmers affected by China’s tit-for-tat tariffs on US farm produce imports. However, while the scope for further fiscal stimulus in the US is limited, it is likely that the Fed will consider any growth slowdown and perhaps adjust its tightening schedule accordingly. After all, their Chinese counterparts have already reversed the tightening stance they were adopting back in January in response to signs of weakness in the Chinese economy.

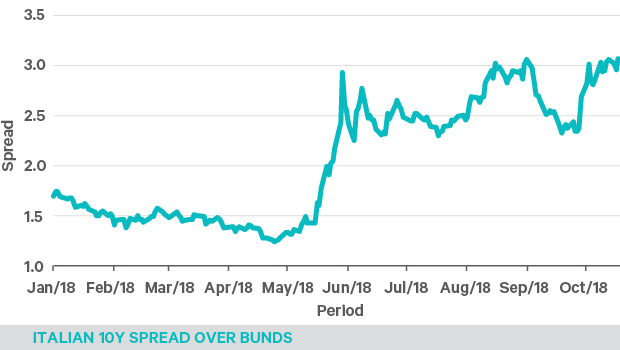

Clashing with the EU

Italy’s new eurosceptic coalition government has been a worry for investors since it was formed earlier this year. Between the two parties, Lega and M5S, they have promised tax cuts and spending increases setting them on course for a clash with the EU. The recent budget proposals, which will result in a deficit of 2.4% of GDP in 2019 have been criticised by EU leaders, as has the Italian arithmetic used that shows the deficit falling over the following two years. Even the county’s own parliamentary budget office has refused to validate the GDP assumptions contained in the proposal. At 132% of GDP, Italy’s indebtedness is second only to Greece within the EU.

Figure 2: Italian 10 year Spread over Bunds, 1st January to 17th October 2018

Source: Davy Asset Management and Bloomberg 17th October 2018

Italian assets have been under pressure as a result, and the local equity market lurched downward on the budget announcement. It is the bond market, however, where the pressures are most visible. The bond spread over German benchmark yields has risen to over 3% in recent weeks, reflecting fears of a downgrade by ratings agencies. We are more sanguine about Italy in the short term. We believe that, while Italy may be downgraded in the coming weeks, the country will remain investment grade and that the market is pricing a worse scenario than this. In the longer term, we think that the lack of structural reform and the high level of total debt mean that Italy will remain a concern for markets.

Close to Home

The Brexit time frame is getting shorter and the posturing and rhetoric is building. The reality is that a hard Brexit would be a very poor outcome for all parties in this negotiation, not least Ireland. So, we believe that a negotiated departure is still the most likely outcome given the damage to all if the UK leaves without a deal. In the event that it looks like we are heading for a hard Brexit, we expect the timeframe to be extended beyond March 2019.

Source: Davy Asset Management 28th September 2018

While we believe that the uncertainty has contributed somewhat to the underperformance of UK equities in recent months, a no-deal exit will result in a more adverse reaction in UK equities than that experienced in the aftermath of the Brexit vote itself, where sterling took the brunt of the shock and equity markets recovered quickly given the weighting to global revenues.Contrary to Bank of England Governor Mark Carney’s assertion in September that a hard Brexit might lead to rising UK interest rates to stave off the inflation caused by a fall in sterling, we believe the bank will look through any temporary rise in inflation and cut rates to support the economy.

Despite the ongoing geopolitical risks, the market is currently focused on the positive economic backdrop its implications for equity returns, and we think this is the right approach. We are sticking to our philosophy of seeking out Quality investment to hold over the longer term. As active managers, we have the scope to adapt to changing drivers of the global equity markets.

Please click here for Market Data and additional important information.

To read more Insights please click here.