Insights

Q2 2017 - Investment Outlook

Mark Seavers

Mark SeaversChief Investment Officer

FOR INVESTMENT PROFESSIONALS ONLY

So, reality bites for President Trump and his new administration. Three months ago we outlined what markets were expecting from the new president and his team: A $1 trillion infrastructure plan to repair America’s bridges and roads, corporate tax reform that would encourage investment in the US, a reduced tax rate on repatriation of overseas cash piles and substantially reduced personal tax rates.

Trump's first 71 days

What markets actually got in Trump’s first 71 days in office was a flurry of executive orders aimed at fulfilling campaign promises, most notably on refugees and immigration, and an embarrassing failure on Capitol Hill to replace the Affordable Health Care for America Act (AHCA or Obamacare).

Speaking after the Republican bill to replace the AHCA was pulled, President Trump, as only he could, blamed the Democrats for the failure and not the Freedom Caucus holdouts from his own party. However, in a sign that realpolitik is finally dawning on the president, he did acknowledge that the Democrats would “reach out, when they’re ready. And whenever they’re ready, we’re ready”. Had he started with an infrastructure plan rather than an attempt to undermine Obama’s legacy, the Democrats would surely have been more accommodating.

Euphoria subsided

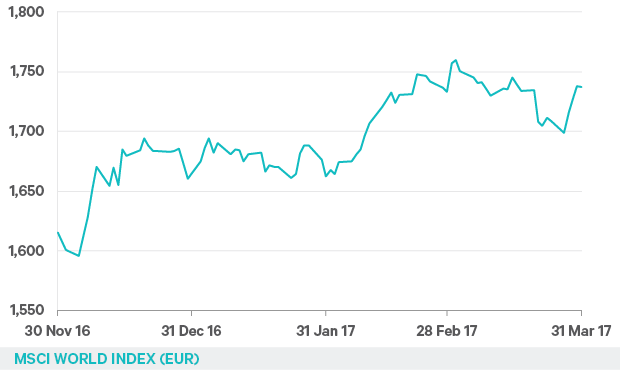

Reality has been dawning on investors too. Just as it began to look as if our forecast of “mid-to-high single-digit returns from equity markets in 2017” would be achieved in the first quarter alone, the euphoria subsided. If we had to pick the catalysts for these second thoughts, it would be Trump’s visit to Capitol Hill for the joint session of Congress on 28th February, followed shortly after by increased chatter from Fed officials about the possibility of a March rate rise. The MSCI World year-to- date return, in euro terms, peaked at +6.2% the day after the president’s somewhat underwhelming address, and has struggled to make headway since.

Figure 1: MSCI World performance

Source: Davy Asset Management and Bloomberg as at 31st March 2017

Since the end of January, there has been a resurgence in the performance of quality stocks, particularly those that also have growth characteristics, while the Trump Trade has spluttered.

The dollar, which had been giving back some of its gains from 2016 during January, slid further after Trump’s speech. This move has crimped some of the global equity that euro-based investors have enjoyed recently. As for the bond markets, US 10-year yields have been stuck in a range between 2.35% to 2.60% since the end of November. Our year-end forecast of 3.20% for the US 10-year yield will require some real action on the fiscal front in Washington, and rising inflation expectations. By the time the Fed actually

got around to raising rates by 0.25% at their meeting on 15th March, the move has been well discounted by markets. Since then, however, some Fed officials, notably Eric Rosengren and Charles Evans have floated the possibility of four rate rises in 2017.

Figure 2: US 10-year yield

Source: Davy Asset Management and Bloomberg as at 31st March 2017

No turning back

Speaking of dawning realities, the British government finally invoked Article 50 on 29th March, setting in motion the process in which “the (European) Union shall negotiate and conclude an agreement with that State (the UK), setting out the arrangements for its withdrawal, taking account of the framework for its future relationship with the Union”. Expect some GBP volatility as negotiating positions are adopted by both sides, especially regarding the final bill before exit. Britain is baulking at the notion of a £50 billion exit fee.

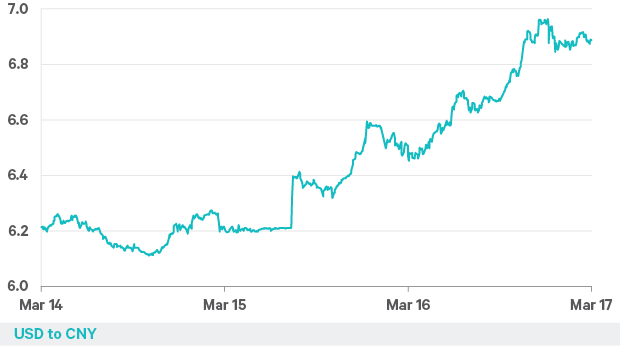

Chinese reserve depletion

Back at the start of the year we highlighted some risks to markets in 2017. China was struggling to support the yuan and its foreign reserve pile was dwindling. Reserve depletion seems to have eased and the currency has stabilised somewhat in Q1.

Figure 3: US dollar to Chinese yuan exchange rate

Source: Davy Asset Management and Bloomberg as at 31st March 2017

What may be of greater importance however, is the apparent thawing in relations between the US and China following a visit by Secretary of State Rex Tillerson in March. Many of us shuddered when we heard Trump on the campaign trail back in May say, “we can’t continue to allow China to rape our country. That’s what they’re doing. It’s the greatest theft in the history of the world.

After the constant China-bashing during the campaign, it was a relief to hear Secretary Tillerson talk of the administration’s commitment to “non-conflict, non-confrontation, mutual respect (and) win-win cooperation”. Oh well, that’s the campaign trail for you!

Europe's packed political calendar

We can’t complete a market update without reference to the European election obstacle course. Our stance in January went like this: “The packed political calendar in Europe in 2017 is likely to deliver a further shift from the mainstream towards the populists in some key economies”. Well, maybe/maybe not.

In the Dutch elections, the populist Freedom Party didn’t make quite as much headway as expected. France is up next, and was always going to be a little more interesting. Conventional wisdom has Le Pen and Macron in a tight race for the first round, followed by Le Pen’s defeat to Macron in round two. Markets would welcome that outcome.

After an eventful first quarter in which reality dawned for President Trump and investors generally, we remain committed to our returns forecasts for the year as a whole. However, if the negotiations on tax reform start to go the way of the healthcare plan, we will reassess.

Please click here for Market Data and additional important information.

To read more Insights click here.