Insights

Investment Outlook Q4 2017

Mark Seavers

Mark SeaversChief Investment Officer

The global economy is in reasonably good shape entering the final months of an eventful 2017. Economic output is expected to grow by 3.6% this year and accelerate modestly to 3.7% in 2018. Positive economic momentum has fuelled solid earnings growth for companies, which has in turn supported equity markets so far this year. We expect this to continue into the New Year. Central bankers are responding to the improved growth environment by preparing to reduce monetary support. We expect this process to be gradual, if not glacial, but nonetheless will put pressure on bond prices in the years ahead.

Retain negative view on bonds

We have had a negative outlook on bonds for some time and see no reason to change that view at this stage. It is true that bond markets have held up better than we had expected so far this year, mainly as a result of the Trump administration’s lack of progress on fiscal reform, and the persistence of low inflation. However, with the 2018 mid- term elections heaving into view, we expect that the Republicans will want something tangible on tax to show voters ahead of polls in November 2018.

Turning off the QE taps

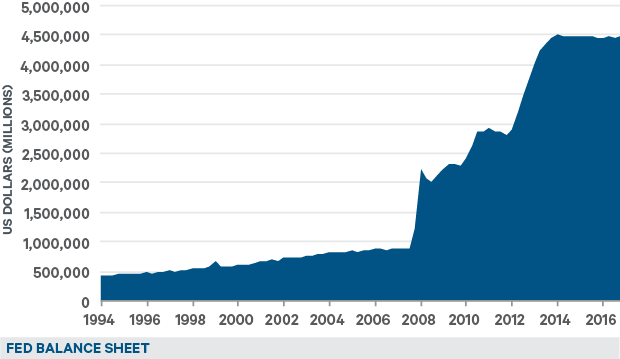

The bigger issue for all asset classes, not just bonds, is the ending of the great monetary support experiment, which has underpinned asset prices in the wake of the global financial crisis. Since 2009, central banks have bought $11 trillion of assets for their own balance sheets in order to suppress interest rates and support growth. They are now getting more hawkish on rates.

The US Federal Reserve is about to outline to the markets the manner and pace at which it will run down its $4.5 trillion balance sheet, and is signalling that another rate rise is on the cards for December.

Figure 1: US Federal Reserve balance sheet normalisation

Source: Davy Asset Management and Bloomberg September 2017

The Fed has shown itself to be very sensitive to adverse market reactions and the current governor, Janet Yellen, expects the process to be “something that will just run quietly in the background over a number of years”. Investors will certainly hope so. However, with Trump deciding on Yellen’s replacement, and three other Fed appointments, a less accommodative Fed is likely in 2018.

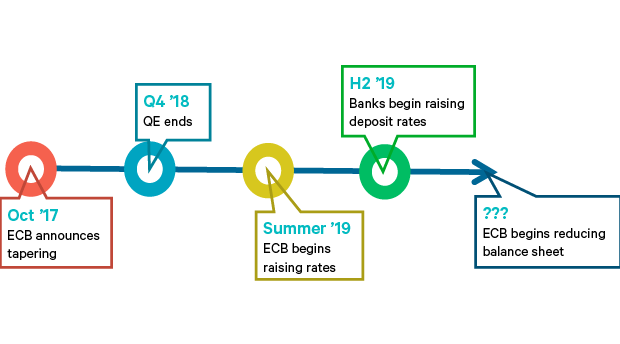

Eurozone growth forecasts have been rising consistently since the post-Brexit nadir in September 2016. The ECB is set to further reduce the pace at which it is adding to its own balance sheet, and only then will it consider raising interest rates. We do not expect bank deposit rates to rise in the Eurozone until 2019.

Figure 2: European Central Bank potential timeline

Source: Davy Asset Management

Source: Davy Asset Management

Brexit uncertainty continues to impact investment decisions and rising inflation squeezes real wages (the Consumer Price Index rose to 2.9% in August in the UK). In spite of this uncertainty, Bank of England Governor Mark Carney has joined the hawkish chorus on rates, and a majority at the bank think that “some withdrawal of monetary stimulus is likely to be appropriate over the coming months”. We don’t believe that interest rate increases are warranted at this time given the deteriorating economic outlook.

We believe that China will continue to tighten monetary conditions. Having consolidated his position, President Xi will continue with policies to curb the lending spree that is driving the property price boom.

The withdrawal of liquidity around the globe will be taking place while inflation expectations remain perplexingly low. Central bankers, however, regard this as a temporary phenomenon and appear determined to get “ahead of the curve” in order to reduce the risk of asset price bubbles. However, there are other forces that are weakening the relationship between unemployment and inflation, and these are likely to persist. Demographic trends in developed markets combined with globalisation and greater price transparency through technology are acting against price rises for many goods.

Equity market performance

Growth stocks have outperformed value stocks significantly in 2017, with the technology sector the clear winner. Disillusionment with the reflation trade was undoubtedly a contributor to this rush to growth. We expect a more balanced tone to equity markets over the next 12 months as the Republicans revisit the fiscal reform agenda and global growth holds up. This will give a boost to value stocks.

There are other risks around our generally positive view on equities. Last quarter,we underlined the need for continued positive earnings momentum in light of rich valuation levels, particularly in the US market. Current equity valuations leave little room for any earnings disappointments. European equities, however, trade at a discount to US and notwithstanding the recent strength of the euro, will benefit from robust global growth.

Figure 3: Relative performance value underperforms growth

Source: Bloomberg as at 2nd October 2017

As ever there are geopolitical risks that could shake the market out of its current state of ultra-low volatility. If we are indeed in the “calm-before-the-storm” phase in respect of North Korea (or indeed Iran), as President Trump has suggested we may be, then military action would certainly knock markets.

To add to the concerns, Europe’s ability to dish up political anxiety has been on show again in recent weeks. The standoff between Catalonian separatists and theSpanish government has the potential to result in further bouts of elevated volatility.

Back at the half-year stage, we described the “unusually low” level of market volatility and ascribed it to the implicit guarantee that central banks were giving markets through their QE programmes. That ‘put option’ is being gradually withdrawn and we reiterate our preference for quality companies that can generate returns through the cycle.

Please click here for Market Data and additional important information.

To read more Insights please click here.