Insights

Top Trump - Presidential Primaries

Chantal A. Brennan

Chantal A. BrennanResearch Director

FOR INVESTMENT PROFESSIONALS ONLY

2016 is an election year in the US and as we noted in our January 2016 Outlook, the US stock market has historically delivered a 7% return in election years since 1928. This year the race is particularly interesting with the increased likelihood of Hillary Clinton (Democrat) and Donald Trump (Republican) battling it out on 8th November. At the moment, we are watching the weekly presidential primaries and caucuses results. This five-month, state-by state process of choosing presidential nominees can be confusing.

In the end, it comes down to simple maths - the candidates who secure a simple majority of their parties’ delegates win the nomination. These mini-elections are staggered amongst the 50 states, Washington DC, and US territories. Each party has a different number of delegates required to win the nomination, coupled with a slightly different election timetable over the coming months. The eventual winners of these contests are ratified at their respective parties’ conventions in mid-July and will then have the opportunity to run for the office of the 45th President of the United States.

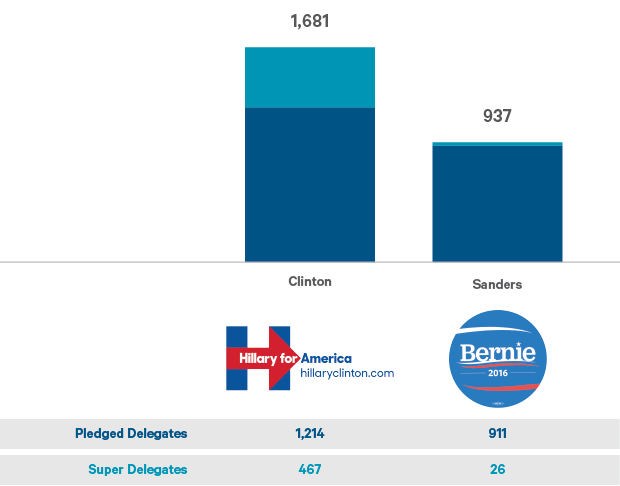

Figure 1: Democrats - 4,051 delegates - 2,383 delegates needed for nomination · 2,157 remaining

Source Davy Asset Management and Google as of 23rd March 2016

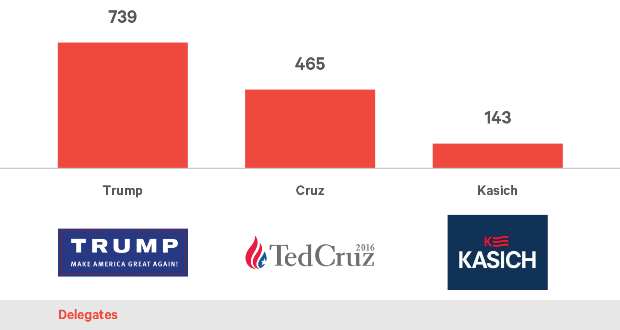

Figure 2: Republicans – 2,472 delegates - 1,237 needed for nomination · 944 remaining

Source Davy Asset Management and Google as of 23rd March 2016

The important dates to watch out for are

26th March (Democrats – Washington State)

5th April (Democrats and Republicans – Wisconsin)

19th April (Democrats and Republicans – New York)

26th April (Democrats and Republicans – Maryland, Pennsylvania)

Davy Asset Management view

As investors, we are uneasy about the success Donald Trump has had to date. His potential candidacy has seriously concerned senior members of the Republican Party, given his polarising rhetoric. Surprisingly the more extreme his statements, the more popular he has become. Unfortunately, it may be too late for the party elders to stop the Donald Trump juggernaut by endorsing Ted Cruz, especially at this stage in the primary election cycle.

While in the Democratic camp, Hillary Clinton who was expected to win the nomination outright, has been rattled by Bernie Sanders unexpectedly winning several key states. Although he is expected to eventually drop out, he may not concede his candidacy until May, after the results of the FBI probe into Secretary Clinton’s private email server, which is a political hot-potato given its timing. So, despite these potential headwinds, we are backing the bookies' favourites – Hillary Clinton and Donald Trump.

How will the next President affect the global economy?

Unsurprisingly, the leading candidates have varying views on important topics such as trade liberalisation, financial sector reform, welfare reform, taxation and spending.

Trade liberalisation: If elected, Donald Trump’s ideas would reverse decades of bipartisan American leadership in trade liberalisation, with large tariffs on foreign imports from countries such as China and Mexico, not to mention building a wall between the US and Mexico. Although Bernie Sanders is against free trade, Hillary Clinton has flip-flopped on the issue and now opposes Canada’s Keystone XL pipeline and Trans-Pacific Partnership, both of which she promoted as Secretary of State.

Financial sector reform: The Democrats tend to favour loose monetary policy, low interest rates, and a depreciated dollar whereas the Republicans are against bailouts and the Federal Reserve (Fed) having too much discretion. These differences are very important as the next US President will appoint a 'new' Fed chair (or reappoint Janet Yellen), thereby having an indirect influence on interest rates, exchange rates, and global financial markets. If inflationary pressures rise as the global economy gains strength, the Fed’s response will be a key determinant of global economic stability. Hillary Clinton has moved towards Bernie Sanders’s position on financial-system reform, as his verbal attacks on her for taking large donations and speaking fees from Wall Street have clearly struck a chord among younger voters.

Welfare reform: Constraining welfare spending growth isn’t easy, particularly with an aging population which fuels rising healthcare and pension costs. Other countries including Canada, the UK and Sweden have historically found it difficult to constrain welfare spending. Republicans and Democrats differ on how to reform these costs which have unfunded liabilities several times the national debt. The Republicans, with the exception of Donald Trump who rejects future social security 'cuts', would propose to gradually slow their growth, whereas the Democrats propose increasing social security benefits. The policies proposed by Bernie Sanders and Hillary Clinton would take the US closer to a European-style social welfare state, where as the Republicans consistently point out, Europe’s standard of living is 30% lower than that of the US, it faces slower growth, higher unemployment, and heightening social tensions.

Taxation and Spending: Bernie Sanders is proposing approximately $18 trillion of additional spending over the next decade to cover a single-payer healthcare system, infrastructure investment, and 'free' (that is, taxpayer-paid) tuition at public colleges . The $11.5 trillion deficit would eventually have to be covered by a gigantic future tax hike. Hillary Clinton has similar spending and tax priorities, though with smaller increases. Of course, the Republicans want to lower personal income tax rates and broaden the tax base. They propose to reduce the US’s corporate-tax rate from 35% (the highest in the OECD) to a far more competitive level. Additionally, the Republicans propose to slow growth in spending in most areas, while increasing defence spending.

These last three points are important areas of fiscal and monetary differences between the two parties and are why Republican candidates for the presidency, the House, and the Senate want to roll-back President Barack Obama’s tax and spending increases, expensive health care reform, and regulatory overreach.

We believe, given the views above and extensive media coverage, a Democratic president could be positive for the Healthcare, Consumers and Alternative Energy sectors.

On the other hand, a Republican President could be positive for Energy (shale gas, E&P and refiners), Speciality Financials, Defence and general domestic corporations, given a lower US corporate tax rate. While, in our opinion, both parties could be negative for corporates using inversions to avoid taxes.

In reality, either side’s ability to enact these reforms will depend on the degree to which the President’s political party has control over the House and the Senate. It is these pillars of government which tend to determine his or her political strength as they control the President’s ability to pass legislation, ratify treaties and have cabinet members and judges approved. In the event of a Donald Trump presidency, it’s a Republican Congress which is going to create hurdles for his idiosyncratic conservative agenda, whereas if it’s a Bernie Sanders or Hillary Clinton presidency, the concern is they could be 'lame ducks' as Congress could still be solidly Republican. So, the political situation would probably be similar to how it is now and their ability to pass landmark legislation would effectively be blocked.