Insights

Be Wary of Long Dated Bonds

Oliver Sinnott

Oliver SinnottFixed Income Fund Manager

When ECB President Mario Draghi talks, the bond market listens very carefully - and it has good reason. In his famous 2012 speech, Mr. Draghi said he would do “whatever it takes” to save the Eurozone from the Eurozone Debt Crisis which was threatening to spiral out of control. His words were backed up by actions many never thought possible by the ECB, including Quantitative Easing and Negative Interest Rate Policy (NIRP). These pushed Eurozone bond yields to record lows and resulted in large gains for bond investors.

Therefore it was no surprise when bond markets sold off following his speech at the ECB Forum in Sintra on June 27th, where he indicated that the ECB is closer to removing the emergency policies which have been holding yields artificially low. His words sent bond yields across the globe higher and German bunds had their worst day in almost two years with 10-year yields surging 12.5 basis points higher.

The ECB is one of several central banks, including the US Federal Reserve and the Bank of England, which is beginning to reduce emergency supports which were put in place to overcome the global financial crisis and the Eurozone debt crisis. Over the coming quarters, we believe the relaxing of these measures will help lift bond yields to significantly higher levels, albeit yields will probably remain at lower levels than in previous cycles. Given bond prices have an inverse relationship to interest rates, (i.e. when rates rise, bond prices fall) the reduction in emergency support will cause bond prices to fall. While the timing and the extent of yields move higher can be difficult to forecast, it is much easier to see that most of the pain will be felt in longer-dated bonds.

Bonds are not risk free

Bonds are traditionally seen as a lowrisk asset class, however as we have argued before it is a mistake for investors to think of bonds as being “risk free”. Yes, if you buy an AAA-rated sovereign bond from say Germany, the risk that the German government won’t pay a coupon and return your capital is very low. As such, it can be considered a very low-risk investment. But, many investors are simply unaware that the value of a bond can change significantly over its lifetime, even for such a high-quality issuer.

For example, if you buy a bond today paying a high coupon and interest rates fall tomorrow, the price of that bond will rise as investors are willing to pay more for the higher coupon. But the reverse is also true. If you buy a bond today with a low coupon and interest rates rise tomorrow, that bond will no longer be as attractive, and its price will fall. Essentially, bond prices have an inverse relationship to interest rates, i.e. when rates rise, bond prices fall, and vice-versa.

Figure 1: German 10-year bund

Source: Bloomberg

The bond iceberg

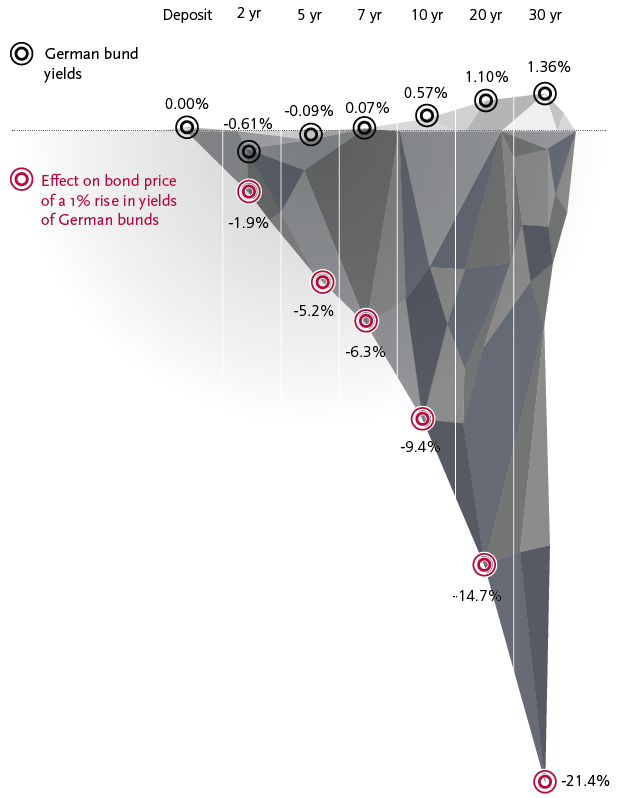

It is time to take out a diagram we have shown before. To try and assess what impact higher rates could have on a portfolio, a good way to think about the future return prospects for bonds is to imagine the profile of an iceberg. The small visible part above the surface represents the historically low yields available today, while below the surface lies a much greater potential fall in bond prices if interest rates rise.

Figure 2 illustrates the impact a 1% interest rate rise would have on German government bonds (bunds'). We think there are two main observations to take note of:

- Looking above and below the line - the current yields available are far less than the risk of a potential loss that could be incurred. In fact, German bunds with maturities up to six years are actually negative yielding, something we discussed in last month’s quarterly.

- As you move from left to right, from shorter to longer-dated maturity bonds, the potential for the bond’s price to fall is greater.

For example, if you invested in a 30-year German bund today you would receive a 1.3% yield to maturity, but would suffer a 21.4% fall in the bond’s price if rates rise by 1%. This is compared to someone holding a 10-year German bund that only pays a 0.5% yield to maturity, but would suffer a lower fall in price of 9.4%. This is known as duration risk, and essentially means that longer dated bond prices are more sensitive to interest rate movements.

Figure 2: Bond iceberg simulation

Source: Davy

Pensioners are most at risk

Unfortunately, we think the investors most at risk are either those already in retirement, or those nearing it, for two main reasons:

- The first and most obvious issue is that with the low-rate environment, pensioners who buy bonds (or annuities) will find it difficult to fund their retirement. Unfortunately, those who are primarily invested in bonds could see their retirement fund lose value as yields return to more normal levels.

- The second issue is that the majority of group pension schemes offer so-called ’lifestyle funds’ as a default to participants. These funds use a formulaic approach to investing, and over the course of an individual’s investment lifecycle they will automatically transition the assets from higher risk equities to 'lower risk' assets, such as bonds, as one nears retirement.

To compound the problem, a large percentage of participants in Irish pension schemes choose lifestyle funds (as often it is the default option), and the majority are likely to be exposed to a large amounts of bonds at a time when yields are at historically low levels. We question whether, in the current environment, these funds are still fit for purpose.

So what should investors do?

However, these low rates may be curtailing the ability of investors to generate enough income over the long term, and if yields rise, investors could see the value of their bonds substantially fall as illustrated by the Bond Iceberg.

We think there are three important steps investors could consider to limit the potential damage that rising interest rates could have on their portfolios:

- Stay in short duration bonds: As the Bond Iceberg has illustrated - the shorter the maturity, the less impacted the bond’s returns should be from rising rates. Unfortunately shorter-dated bonds have lower yields and, as discussed earlier, in the case of higher-quality bonds, such as Germany, their yields can be negative.

- Be patient: Alternatively, simply keep your portfolio in cash until yields rise to more normal levels, and the risk of potential loss will be reduced. The disadvantage of this option is of course the low and even negative deposit rates currently on offer.

- Diversify: This is our preferred approach for suitable investors. To be clear, we are not advocating that investors hold no bonds in portfolios. We believe bonds still retain a fundamental place in most portfolios. Bonds, may not currently provide an adequate income for many investors, however bonds will continue to insulate portfolios from volatility, deflation and bear markets in risk assets.

We believe combining bonds with other asset classes that are lowly correlated with bonds can help offset weakness in a rising rate environment. In addition, the other advantage to this approach is that income can also be derived from those other asset classes such as equities, in some cases, considerably above the levels currently available on deposits and bonds.

At Davy Asset Management we offer a number of solutions that could limit the potential damage that rising interest rates could have on portfolios. For more information please contact a member of the Davy Asset Management Sales and Relationship Management team.

Please click here for Market Data and additional important information.

To read more insights please click here.