Insights

Case for Media in the 'Trump Trade'

Brian Kennedy

Brian KennedyFund Manager

When one imagines the definitive “Trump Trade” one thinks of; cyclical businesses highly leveraged to the US domestic economy, high domestic tax rates which would benefit from reduced corporate tax and dollar earnings which will benefit from the rise in interest rates. Given that advertising spend is highly linked to GDP growth, Media companies make perfect candidates for the Trump Trade.

As a result, we have lately focused our fundamental research efforts on this vital subsector, where the Davy Ethical Equity Fund carries a 2.4% overweight to the sector.How we pick stocks in the Media space

When we apply this framework to our Quality-based investment process we seek companies in the media space with:

1. Dominant market position and significant barriers to entry;

2. Consistent strong profitability at a reasonable valuation and;

3. Exposure to the Trump Trade.

This approach led us to three differentiated, high-quality examples in the media space; WPP, Walt Disney and Nielsen which may be suitable for our Funds.

WPP

The world’s largest advertising agency, WPP is heavily reliant on GDP growth to spur advertising spend. WPP has a strong US exposure (53% of sales) and is a high-Quality, cash-generative business with an attractive dividend. As the market leader, WPP’s scale confers advantages in terms of M&A and also attracting new business. WPP has shown itself to be an intelligent acquirer and shaper of a fast- moving industry. WPP’s valuation also marks it as attractive.

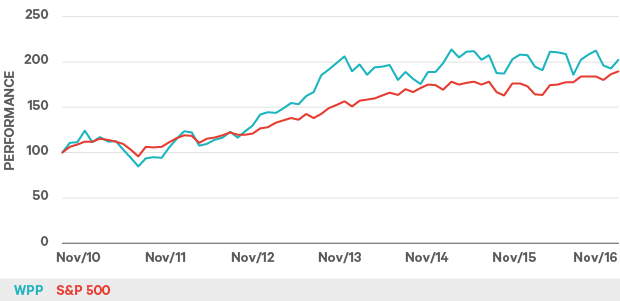

Figure 1. WPP has been an outstanding stock over the last five years, more than doubling the returns of the S&P 500

Source: Davy Asset Management and Bloomberg 25th Jan 2016.

Walt Disney

Walt Disney is one of the world’s most recognisable brands. It has a well-diversified business with studio, TV, theme parks and merchandising segments. Despite concerns over US cable subscription decline, Disney has proven itself to be able to generate outstanding returns alongside consistent sales and earnings growth. Its high tax rate and domestic exposure (77% of sales) are attractive in this reflationary environment and its valuation, while at a premium to peers, leaves room for upside.

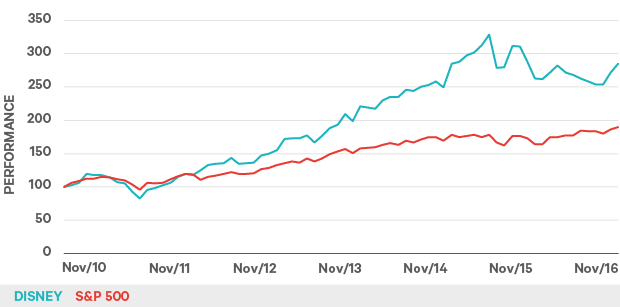

Figure 2. Disney has been a stable performer over the last five years

Source: Davy Asset Management and Bloomberg 25th Jan 2016.

Nielsen

Nielsen is the world’s largest marketing analytics company, providing data analytics on consumer spending and media consumption to a wide range of clients, primarily in the consumer packaged goods sector. Nielsen is a high-quality, cash-generative company with a high proportion of recurring revenues, a dominant market position, a well-diversified client base and a healthy dividend. The stock recently fell considerably on a profit warning. However, we feel that the market overreacted and the stock was oversold as a result, leaving Nielsen with significant potential for share price appreciation.

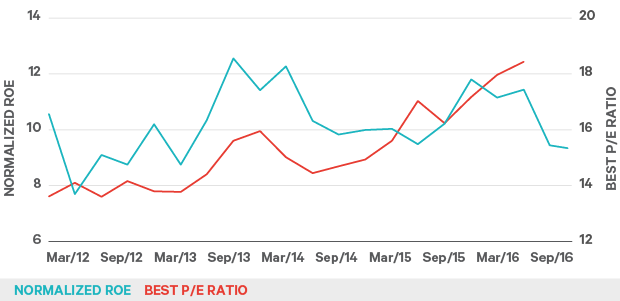

Figure 3. Nielsen’s returns have steadily increased over the last five years while its valuation sits at a three-year-low.

Source: Davy Asset Management and Bloomberg 25th Jan 2016.

Environmental, Social and Governance (ESG) Angle

Within the Davy Ethical Equity Fund, we view a company’s ability to manage ESG risk as a strong proxy for how a company manages its business risks. We use ESG research provided by MSCI to complement our bottom-up fundamental research, excluding companies which are deemed worst-in-class in our investment universe according to stock-specific ESG ratings.

Companies such as Nielsen and WPP who handle large quantities of sensitive client data are judged largely on their risk management procedures around data management. This is less of an issue for Walt Disney, who given its merchandising business must concern itself with the management of its supply chain, which provides large reputational risk as well as business risk. All three companies, and their peers, are subject to risk around their management of human capital, given that these are all people-driven businesses. As with all our companies, corporate governance is also a key risk.

Please click here for Market Data and additional important information.

To read more insights please click here.