Insights

Consumer Disruption: Differentiate or Die

Jonty Starbuck

Jonty StarbuckFund Manager

We see fundamental shifts in consumer behaviour, driven by millennials, and the rise of online retail disruption. These factors have led to a rise in new business models focussed on bringing these themes together, representing a challenge to incumbent operators across the Consumer sector. The extent of the unprecedented change and disruption is reflected in the rate of management change at the helm of some of the largest consumer goods companies in the world. In the last two years, new CEOs have been announced at Nestle, Coca Cola, Mondelez, General Mills, Kellogg and Hershey as these giants grapple with the sizeable challenges thrown up by the shifts in consumer behaviour.

The battle between suppliers and retailers

Friday, 2nd April 1993, widely known as Marlboro Friday in the investment community, marks the date when Philip Morris announced a 20% price cut to its Marlboro cigarettes to fight back against low price competitors. Investors have been worried about the “death of brands” ever since, but over the last 25 years or so suppliers have continued to hold the upper hand over retailers, dominating the profits pools within the industry to the benefit of shareholders over long time periods.

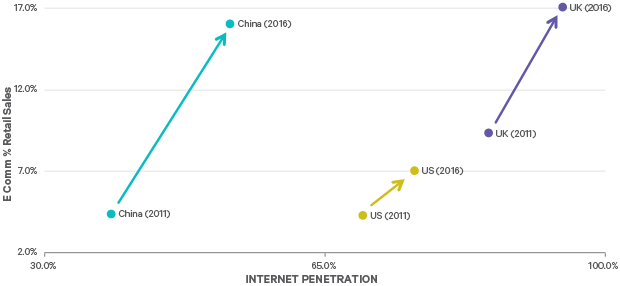

Investors need to understand the drivers of change today to assess the likelihood of a shift in the balance of power going forward. The factor that has received most attention is the rise of online retail and digital marketing. These trends are certainly global with emerging markets such as China now transacting around 15% of all retail spends online, ahead of developed market levels despite internet penetration levels well below those in the West.

Figure 1: Internet penetration and e-commerce as percentage of retail sales

Source: Davy Asset Management, Bloomberg and ICT as at December 2016

The idea of online retailers and platforms as brands is dominating competition and strategy across the wider consumer sector from media to leisure to consumer goods. In the consumer goods sector, barriers to entry have been lowered, as shelf space at least in theory becomes infinite and media campaigns have become more affordable for small suppliers. The net effect of this has been to increase price transparency and competition.

A second factor is that consumer preferences have shifted away from global brands towards local, authentic brands that Nestle management recently characterised as “born pure”. This trend is not new; it is evidenced by the growth of craft beer brands that have challenged the growth of large mainstream brands in many developed markets over the last 10-15 years. In recent years, however, this trend has proliferated across categories and geographies to the point where diversified manufacturers such as Unilever and Nestle now admit that smaller, local competitors are now gaining share in their categories on a global basis.

How are consumer goods companies adapting to this change?

The lines between online and offline retailers are set to become increasingly blurred, as evidenced in the last few months with the Amazon/Whole Foods and Walmart/Jet.com transactions. Ultimately, consumer goods management teams need to find a way to make these trends work for their businesses and investors. Many are now becoming more active in acquiring challenger business models (such as Unilever’s acquisition of Dollar Shave Club) or “born pure” brands (such as Anheuser-Busch InBev’s acquisitions of multiple craft beer brands).

Amazon: The epicentre of online retail

According to Morgan Stanley, Amazon’s market share is 28% of online retail spend in the US and gaining circa 50% of online retail growth in the US. It is simply too big and too important for most suppliers to ignore, and more and more companies are setting up dedicated teams to work with the group. Despite working actively with several online retailers (TMall in China and Zalando in Europe), it was recently that announced Nike would pilot a scheme whereby Amazon would carry a limited Nike assortment in the US. At the far end of the spectrum are companies like Estee Lauder and Starbucks that refuse to work directly with Amazon, citing concerns over brand control and positioning. The loss of distribution control is evident, even for suppliers that choose not to work directly with Amazon, with product available on the site through the activity of 3rd party sellers.

What are the implications for investors?

Digital disruption has led to the rise of pureplay online retailers and platforms, such as Amazon, Priceline, iTunes and Google Play, and the rise of digital advertising players such as Google and Facebook that together capture c.90% of all digital marketing spend. For online retailers to achieve sustainable and attractive returns, we believe the key question is whether the new business models overcome the limitations of traditional retailers. In part, we believe this will be linked to industry structures and consequently the ability of online retailers to leverage power over suppliers. In the long term, a retailer’s ability to sustain attractive returns will be determined by the ability to deliver services that customers are willing to pay for, hence intense investment by leading players in all aspects of customer service. For consumer goods suppliers, we believe the bar has been raised and there is likely to be increasing differentiation based on each company’s geographic and category exposures as well as innovation capabilities.

We have previously commented on the potential for widespread disruption across industries from the rapid adoption of new technologies enabled by the digital revolution (click here). We believe the challenge for investors is to understand the nuances of how technology will impact business dynamics in different industries. Investing in these themes requires investors to take a long term view, as often the impact of new technologies and processes will take several years to impact the bottom line. We believe this approach holds promise for active investors to capture excess returns over long time horizons.

To learn more about our investment strategies, please click here. Alternatively, please don’t hesitate to contact our relationship management and distribution team.

Please click here for Market Data and additional important information.

To read more Insights please click here.