Insights

Equity Income Investing in a Rising Rate Environment

Davan Byrne

Davan ByrneAssociate Fund Manager

Companies with above average dividend yields have outperformed during rate tightening cycles. In this insight Davan Byrne, Fund Manager, demonstrates that dividend-paying companies can outperform the market over a rate tightening cycle.

Companies with above average dividend yields have tended to outperform during the most recent US rate tightening cycles. The Davy Equity Income Fund range targets high-quality, global, large cap companies such as these.

World GDP growth is accelerating and economic data is surprising on the upside, driving company earnings growth. This has led policy makers and central bankers to contemplate the withdrawal of the extraordinary monetary stimulus measures that have been in place since the global financial crisis. The Federal Reserve began to raise rates tentatively in December 2015, but the pace has been slow. The European Central Bank and Bank of England have spoken openly about the prospect of withdrawing monetary stimulus and a gradual rise in interest rates.

The prospect of rising rates marks a significant departure from policy since the financial crisis, and presents new challenges to investors. Some of the key issues that will be front-of-mind for investors in the new policy regime will be how various asset classes behave during rate tightening cycles, and within equities, what kinds of stocks can outperform.

Bad for bonds

Fixed income assets have been volatile for some time as the market has worked to anticipate the likelihood and timing of the next rate rise. Rate tightening cycles are bad for bonds because as central banks increase interest rates, the fixed coupon payments paid on bonds become less valuable. Therefore, bond prices must fall. The effect on long dated bonds is more pronounced as there are more coupon payments in the future to be discounted and the impact on capital value will be more severe.

The stock story

The effect of rate rises on equities is not so clear. Rates are typically raised when the economy is growing. This backdrop allows companies to grow their earnings as sales volumes and prices increase. As long as the economic outlook remains positive stocks can continue to perform as rates rise.

Some investors are concerned that dividend paying stocks will underperform during rate hiking cycles, as the dividend payments resemble the coupon payments on bonds. However, unlike bonds which have fixed coupons, dividend payments are likely to be growing in this environment.

In equity income investing a distinction is drawn between those stocks that offer the highest yield and those that offer potential for dividend growth. There is a trade-off between high dividend and high dividend growth. Both features are important in the context of a rising rate environment and, while not necessarily mutually exclusive, one often precludes the other. Companies that pay the largest dividends will tend not have the highest dividend growth and vice versa.

At Davy Asset Management, we seek to invest in companies with a dividend yield greater than the market and that demonstrate an ability to grow those dividends in a sustainable way.

The case for equity income equities

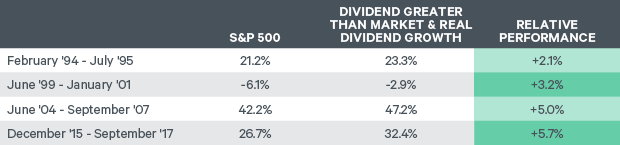

We have carried out research using Bloomberg data on the S&P 500 to test whether companies with a dividend yield greater than the market and real dividend growth can outperform as rates rise. The results of this analysis, shown in the table below, show that in each of the past four rate tightening cycles, companies with greater than average dividend yield and real dividend growth have outperformed the market.

Table 1: Market performance during rate tightening cycles

Source: Bloomberg and Davy Asset Management. Rate hike dates sourced from Federal Reserve Website (https://www.federalreserve.gov/monetarypolicy/openmarket.htm) defined as 04/02/1994 - 05/07/1995, 30/06/1999 - 02/01/2001, 30/06/2004 - 17/09/2007, 17/12/2015 - 30/09/2017.

The average level of outperformance over a rate tightening cycle is 4%. This result may seem surprising, but demonstrate that investing in solid dividend paying companies that grow their dividends can reap rewards for investors too.

At Davy Asset Management we seek to invest in companies that offer an above average dividend yield but also that demonstrate an ability to grow that dividend. We believe that our philosophy of investing in Quality companies will lead to outperformance over the course of the economic cycle. Investing in the Global Equity Income Fund provides investors with the opportunity to maintain exposure to equities, while also providing an income stream greater than that offered by the broader market. Additionally we offer the Davy Defensive Equity Income Fund which uses the same equity portfolio of equities, but with an added layer of protection to reduce the impact of drawdowns during market corrections.

To learn more about our investment strategies, please click here. Alternatively, please don’t hesitate to contact our relationship management and distribution team.

Please click here for Market Data and additional important information.

To read more Insights please click here.