Insights

US Healthcare Reform

Brian Kennedy

Brian KennedyFund Manager

FOR INVESTMENT PROFESSIONALS ONLY

Healthcare reform has emerged as one of the main talking points in the upcoming US presidential elections. The campaign trail has been filled with election promises and criticisms of previous policies. In this article Brian Kennedy, a member of the Davy Asset Management Global Equity Investment team and co-manager on the Davy Ethical Equity Fund, outlines his view on potential healthcare reforms.

“Price gouging like this in the specialty drug market is outrageous”.

This tweet from Hillary Clinton preceded a precipitous fall in pharmaceutical sector stock prices when the then prospective presidential candidate signalled that she had the pharmaceuticals market in her crosshairs. The tweet in question was specifically directed at the 5,500% price increase by Turing Pharmaceuticals on Daraprim, a drug used to treat the rare disease toxiplasmosis. As an aside, their now ex-CEO, Martin Shkreli, was last seen auctioning off the opportunity to punch himself in the face, proving karma does exist.

Clinton proposals

While this tweet did put the market in a spin, Hillary Clinton has since been more specific around her proposed healthcare reforms, which are likely to centre around the following areas.

1. Negotiate directly with pharmaceuticals companies, capping rebates

One proposal is for government to negotiate directly with pharma (which it is currently prohibited) and apply a 23% discount to all drugs. A proposed increase in the discount from the current level of 15% to 23% would certainly materially affect pharmaceutical companies.

2. Reduce patent lives

This is an attempt to increase competition in the drugs market by reducing the exclusivity period of certain complex drugs from 12 to 7 years. The effect on pharma is uncertain as some patents involved in the production of the drug still cannot be breached and may be covered for longer periods.

3. Prohibit “pay for delay”

Pay for delay is the process whereby drug companies pay generic companies to delay the production of generic drugs. While this would be a negative for pharma companies this is not a widespread practice and is unlikely to have a significant sector-wide impact.

4. Allow the purchase of drugs from abroad

Importing drugs has been mooted for a long time but has never come to fruition. The main reason is that it would be difficult for the Food and Drug Administration (FDA) to verify the quality of drugs produced abroad.

5. Cap 'out of pocket” expenses

Another proposal is to cap the excess which elderly Americans covered by Medicare are exposed to at $250. This is expected to have a very small impact as this only applies to a small demographic and is already in effect in some states.

Trump proposals

Trump has focused his rhetoric on other policy areas, most famously immigration, but he has said he will attempt to dismantle the Affordable Care Act (‘Obamacare'). Conversely, his lack of clarity on how this will be dismantled and what will replace it could create an air of uncertainty in the healthcare sector which could be equally damaging.

In this regard, Clinton may well be considered “better the devil you know”.

Probability of success

Given how opaque Trump’s likely approach to Healthcare will be, we will instead focus on Clinton here. The likelihood of Clinton's proposals coming to pass is seen as reasonably small. Many of Clinton's proposals would require changes in legislation which would only be achievable through control of the senate which is currently in the control of the Republicans (54 versus 46 seats).

There are other reasons why legislation regarding pharmaceuticals may never pass;

- On average, pharmaceuticals have represented less than 11% of total healthcare spending between 1977 and 2014.

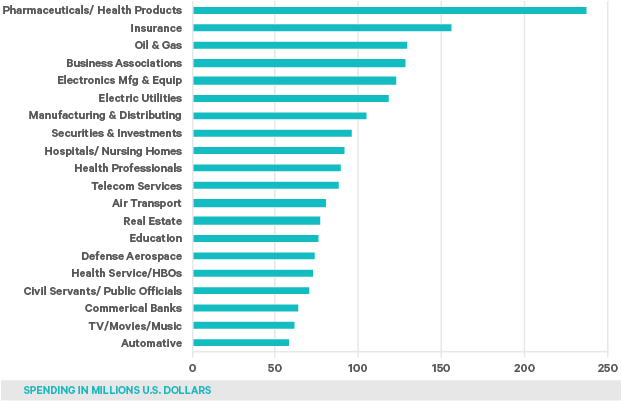

- The pharmaceutical lobby is powerful, outspending the insurance, oil and gas and defence and aerospace over the period from 2008 to 2012 in lobbying Congress.

Figure 1: US lobbying expenditure 2015

Source: Statista as at 3rd October 2016

However, should Clinton win, it is highly likely that companies which engage in exploitative pricing practices would face congressional hearings, in which case the damage may be more reputational than material.

Outlook

It is important to note that Clinton's tweet was directed specifically at companies who had engaged in exploitative price increases on existing drugs. We must highlight that the vast majority of large pharma companies do not follow this practice and instead rely on driving innovation to achieve pricing power.

In the Davy Ethical Equity Fund, we believe that companies at the cutting edge of innovation in key life-preserving treatment areas such as oncology, immunology and rare diseases are the most protected from political risk. As such, we seek to invest in pharma companies that aim to further the treatment of chronic diseases rather than simply imitate established treatments. We believe that these companies are preferable from both an ethical and investment viewpoint.

Therefore, we favour companies that maintain high Research & Development (R&D) spend, while maintaining budgetary discipline. In our opinion well diversified drug pipelines that arise from high quality R&D are the best indicator of future earnings growth and protect against the risk of drugs failing to pass through rigorous FDA testing.

For more information on the Davy Ethical Equity Fund please contact a member of the Davy Asset Management Relationship Management & Distribution Team.

Please click here for Market Data and other important information

To read more Insights click here