Market Updates

M&A and the Mid-Cap Opportunity

Davy Asset Management

Davy Asset ManagementDublin, Ireland

FOR FINANCIAL ADVISORS ONLY

Global mergers and acquisitions (‘M&A’) activity looks set to accelerate in 2014 and mid-cap equities are best placed to benefit.

2014 is shaping up to be a year of very significant global M&A activity. Already, deal flow year-to-date is running at very healthy levels and we are confident that 2014 will represent a sizeable improvement on the $2.2 trillion1 of deals completed in 2013. High profile deals already announced this year include Comcast/Time Warner ($69 billion) and Suntory/Jim Beam ($16 billion) while closer to home we have seen the announcement that Fyffe’s will merge with US peer Chiquita to create the global leader in fruit distribution.

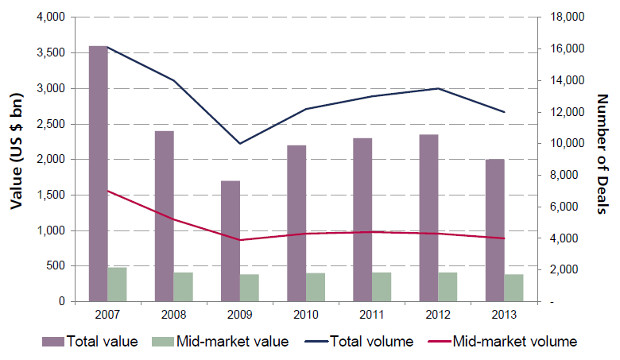

Figure 1: Global M&A Trends

Source: MergerMarket Monthly M&A Insider, December 2013

The value of M&A deals announced year to date hit the $1 trillion mark in late April, reaching that level at the fastest pace in seven years. According to Bloomberg “If deal making continued at April’s rate for the rest of the year, 2014 would see almost $4 trillion of deals announced, making it the second most active year for M&A ever2. This, in our view, is reflective of a much improved global M&A environment. Midcap equities have historically been a key beneficiary of M&A activity and we believe this trend will be repeated in 2014.

Investors looking to benefit from improved M&A activity should therefore consider including mid-cap equities as part of their overall allocation to equities.

Why the Rebound in Deal Activity?

A combination of factors leads us to conclude that the environment for acceleration in M&A activity this year is now in place. These include improving global economic stability, increasing corporate confidence, reasonable valuations and the significant level of deal capacity available to both strategic buyers and private equity.

Improving Economic Stability

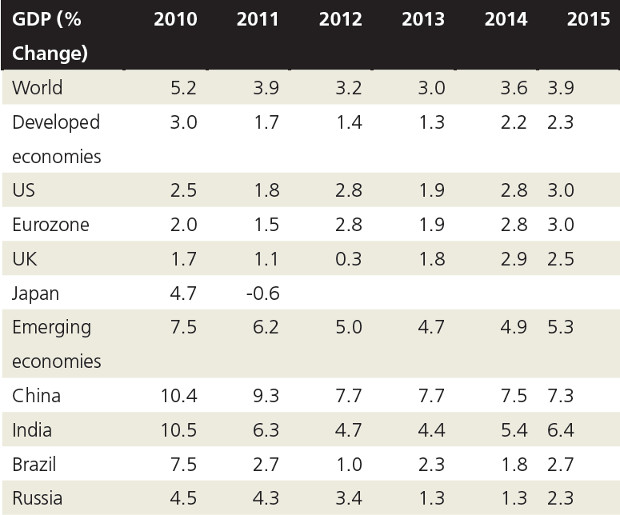

Global Gross Domestic Product (‘GDP’) is forecast to expand by 3.6% in 2014, an improvement on the 2.9% growth achieved in 2013. The economic recovery, although slow in places, is now broadly-based and higher growth rates are likely to be achieved across most regions of the world this year. As reflected in the forecasts in Table 1, significant acceleration is anticipated in the US and UK, while the Eurozone should return to positive, albeit tepid, growth. Growth in China, although decelerating, and the subject of much attention, should remain within the 7% to 7.5% range, healthy outpacing growth in the developed world.

‘The consensus is that both strategic buyers and private equity have cash or dry powder to deploy. This trend, coupled with the generally improving global financial markets, will drive M&A deal-making upwards in the next year’.

RR Donnelley, 2014 Deal Making Outlook

Table 1: GDP, 2010-2015

(Please note, 2014 & 2015 figures are forecasts)

Source: IMF, April 2014, J&E Davy

Increasing Corporate Confidence

M&A represents a very significant capital allocation decision for corporate executives. Visibility and confidence in the economic outlook is therefore imperative. It is our view that a combination of headwinds in 2013, including the on-going European crisis and US fiscal uncertainty to name but a few, served to impede corporate confidence.

However, as we look at the year ahead, we would argue that some of these headwinds, although not resolved, are now abating. Most importantly, European systemic risks have eased significantly (as reflected in the significant reduction in dislocation in the European debt markets). Indeed, in a recent survey3 of corporate executives, KPMG found that 63% of respondents said that they planned to be acquirers in 2014. In addition, respondents indicated that the three primary reasons for undertaking M&A were

- opportunistic

- to expand their customer base and

- to expand their geographic reach

Valuations

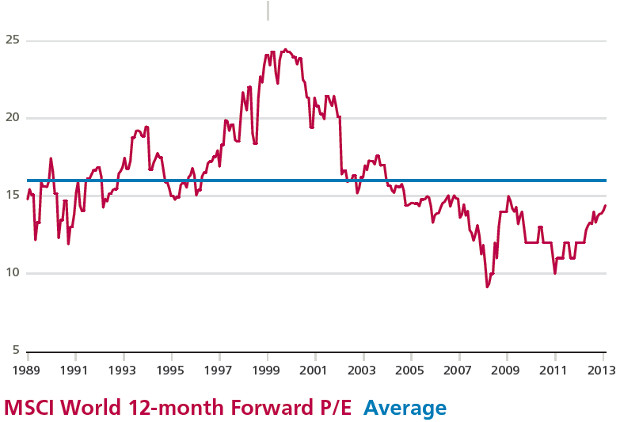

Although global equity markets have experienced a sizeable valuation re-rating over the last 12 months, valuations are still reasonable when viewed in a historical context. Our view is that the valuation expansion is justified by the improved outlook for both economic growth and corporate profitability.

Figure 2: MSCI World 12-month forward P/E multiple

Source: IBES, Davy

KPMG’s M&A Predictor January 2014

Deal Capacity

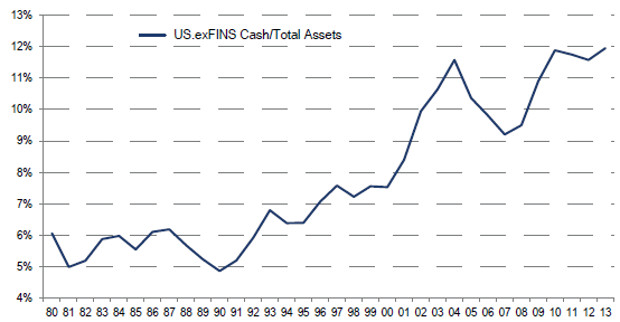

In an effort to protect profitability, companies responded to the economic slowdown following the global financial crisis by cutting costs and moderating spending. However, as the global economy has recovered, profits have rebounded strongly and these companies are now sitting on record levels of cash.

It is estimated that the top 1,000 non-financial companies globally are holding $2.3 trillion in cash4. In addition, private equity firms have amassed significant resources and it is estimated the industry now sits on over $1trillion in unallocated funds5. When combined with the historically low rates at which high quality companies can raise capital in the corporate debt markets, it is clear that there is a significant amount of deal capacity to undertake M&A in 2014.

Deloitte M&A Perspectives May 2013

Figure 3: Cash/assets is at an all-time high

Source: Citi Research

Which Industries?

In a recent survey6 of over 1,000 M&A professionals, KMPG identified a number of industries which look set to benefit from a potential uptick in M&A activity in 2014. 44% of respondents highlighted that technology; telecom and media would be the most active industries for deals in 2014. A close second was healthcare, pharmaceuticals and life sciences (41%).

Davy Discovery Fund (‘The Fund’)

Launched in 2005, the Fund offers exposure to a diversified portfolio of global mid-cap equities. The Fund invests in companies that have established profitability early in their life cycle and then sticks with them through their core growth phase. The Fund has strong exposure to the technology and healthcare sectors. Discovery has an excellent track record of risk adjusted returns.

The Fund is a unit linked fund of New Ireland Assurance Company plc and is available through a life assurance policy. The value of an investor’s policy is linked to the performance of the Fund. The Fund is available through New Ireland, via its website, www.newireland.ie.

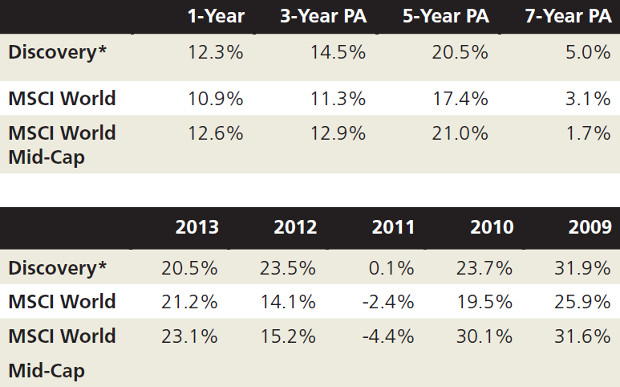

Table 2: Performance as at 31st March 2014

Source: New Ireland Fund Centre, Davy Asset Management, Bloomberg.

* Performance is quoted gross of taxation and fund management charge. The fund management charge and product charges will vary depending on the terms and conditions of your policy.

Investments in mid-cap companies may involve greater risks than those in larger, more well-known companies. Mid-cap equitites generally tend to be less liquid than their large-cap peers and therefore the share price performances of mid-cap equities may be more volatile than that of large-cap equities.

Please click here for additional important information

1 MergerMarket M&A Trend Report: 2013, January 2014.

2 Bloomberg article, Will Robinson, 29 April 2014

3 2014 M&A Outlook Survey, KPMG, www.kpmg.ie

4 Deloitte M&A Perspectives, May 2013

5 Financial Times, "Private equity considers where to splash the cash", 15 December 2013

6 Legg Mason, "Why we view Mid-Caps as a 'sweet spot", January 2013

CONTACT THE TEAM

For more information, call or email us to discuss your requirements or arrange a meeting.