Insights

NIRP: What Does it Mean?

Mark Seavers

Mark SeaversChief Investment Officer

Oliver Sinnott

Oliver SinnottFixed Income Fund Manager

Davan Byrne

Davan ByrneAssociate Fund Manager

FOR INVESTMENT PROFESSIONALS ONLY

Beating negative interest rates

Since he promised to do “whatever it takes” to save the Eurozone in 2012, nobody could accuse ECB President Mario Draghi of lacking endeavour. The same could also be said of the other main central banks who have pushed the boundaries of unconventional policy further than most had ever expected. But, have they gone too far with their latest innovation – a Negative Interest Rate Policy (‘NIRP’)? We are sceptical that this policy will be successful in significantly boosting economic growth, although there can be no doubting its impact on markets, where to the dismay of investors it has driven deposit rates and bond yields lower into negative territory. In this article we discuss the experience of NIRP so far and what options investors might consider in a low rate environment.

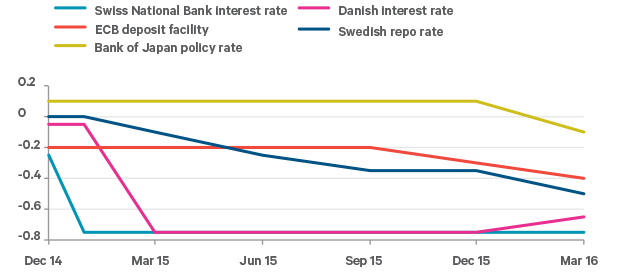

NIRP is the ECB’s latest attempt to suppress borrowing costs, encourage lending to the real economy and weaken the euro, in the hope that this will stimulate growth and raise inflation expectations. The ECB joins the central banks of Sweden, Switzerland, Denmark and Japan in effectively increasing banks costs for depositing excess savings with it (see Figure 1). NIRP has the potential to produce perverse outcomes for the economy and investors. So, based on the others’ experiences, what can the ECB hope for as it steers the Eurozone deeper into the Wonderland of negative rates?

Figure 1: Negative interest rate policies in action

Source: Davy Asset Management and Bloomberg as at 31st March 2016

In Switzerland and Denmark, where the highest negative interest rates exist (-0.75% and -0.65% respectively), NIRP has resulted in fewer new loans and higher mortgage rates for borrowers . This is the exact opposite of what the central banks had intended.

How did lower rates lead to higher borrowing costs? Well, it seems that banks are recouping the cost of losing money on deposits from borrowers, since it is difficult to pass it on to retail depositors. This may change, but nobody can predict what may happen if retail depositors see negative rates. So it seems that NIRP hurts banks’ margins and, where possible, they will seek compensation from borrowers if they can.

As for the expected currency devaluations, which we regard as one of the key aims of NIRP, it is impossible for a monetary authority to devalue its currency when everyone else is using the same tactic. While the Swedes, Swiss and Danes would no doubt argue that without NIRP their currencies would be a great deal stronger, so far, the US has refused to go down the NIRP route, seeking instead to use “forward guidance” to keep the dollar steady and interest rate expectations under control. Perhaps the US is protecting its banks from further profit erosion.

The longer term effects of stifling the cost of capital to such an extent are uncertain and may result in a misallocation of capital that ultimately leads to lower productivity and lower growth. It could be argued that we are seeing this already.

For investors looking for income, the landscape is bleak. We estimate that as much as 37% of Eurozone government bond market and 24% of global bond market is negative yielding . For the non-Irish Eurozone depository institutions that we track, 12 month wholesale fixed deposits are now yielding -0.24%. This means that wholesale investors are effectively paying for the privilege of lending money to governments and banks.

Investing in a negative world

In the Wonderland of NIRP, we face difficult choices. Central bank policies are driving investors, particularly those who require an income from their portfolio, in the direction of real assets such as equities and property (see Equity Income below).

Equity income

We have long believed that focusing on dividend paying stocks with sustainable business models and a culture of rewarding shareholders is the key to long term investing. While dividend payments from companies are not guaranteed, an Equity Income solution has many potential benefits:

- Source of income: The dividend yield on the Global Equity Income funds compares favourably, from a yield perspective, with other asset classes.

- Inflation protection: Central banks are trying to ward off deflation by raising inflation expectations in the market. Equity Income investing offers some protection to investors in an inflationary environment as companies can grow their dividends as economies and profits grow.

- Resilience of dividends: Dividend payments from companies are not guaranteed but tend to be more resilient than company earnings. Companies tend not to cut dividends as doing so can send a very negative signal to the market and adversely affect share price.

- Dividend contribution to total return: The compounding effect of reinvested dividends is a powerful contributor to long term equity returns. Investors who don’t require the dividend income on an ongoing basis can benefit from compounding returns.

Conclusion

Central banks have pushed the boundaries of unconventional policy further than most had ever expected. We are sceptical that they will be successful in significantly boosting economic growth with their latest innovation - Negative Interest Rate Policy (NIRP). However there can be no doubting its impact on markets, where to the dismay of investors it has driven deposit rates and bond yields lower into negative territory.In the Wonderland of NIRP, we believe that an Equity Income strategy offers potential solutions to those who have been affected most by central banks latest acronym.

Please click here for Market Data and additional important information.