Insights

Passive versus Active - Is it Time to Rethink Passive Bond Exposure?

Oliver Sinnott

Oliver SinnottFixed Income Fund Manager

FOR INVESTMENT PROFESSIONALS ONLY

It is staggering to think that nearly 60% of all German government bonds (bunds) are negative yielding. Even corporate bonds have not been immune to the ECB’s extraordinary monetary policies. Approximately 20% of corporate bonds with less than three years to maturity are also negative yielding as per the BofA Merrill Lynch Euro Large-Cap Corporate Bond Index. Equally staggering is the fact that investors continue to invest in passive bond funds which, running on autopilot, are compelled to invest in these negative-yielding bonds. We find this especially hard to fathom when so much can be done to avoid negative-yielding bonds without blowing the risk budget out of the water.

It is hard to rationalise investing in passive bond funds in today’s extraordinary negative-yield environment as it is a potential recipe for losing money. Investors in passive funds may not have noticed this until now because short-dated bond yields have been falling deeper into negative territory, therefore creating positive returns for even negative-yielding bonds (when bond yields fall, bond prices gain). Yields cannot continue to fall indefinitely and when yields stabilise, or especially when they go higher, we should begin to see a significant underperformance of passive funds relative to active managers who have been carefully avoiding negative-yielding bonds.

Danger signs

There are already danger signs signalling this trend in falling short-dated yields coming to an end. The German 2-year bund reached an astonishing low of -0.96% in late February.

Figure 1: German 2-year bund yield

Source: Davy Asset Management and Bloomberg as at 31st March 2017

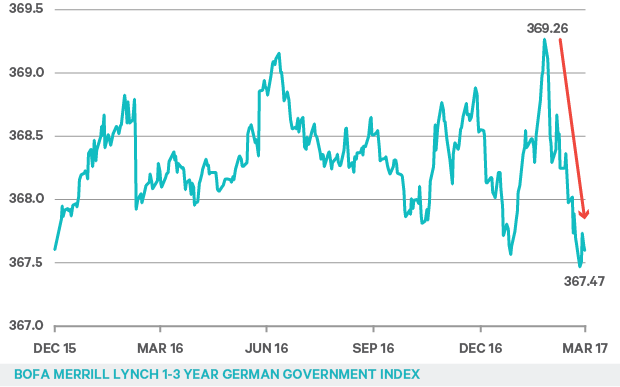

This essentially means some investors (including passive funds) were willing to buy German bunds which were guaranteed to lose almost 1% per annum if held until maturity. Since then, short-dated German bund yields have been moving higher, leading to losses (see Figure 2). This is in part due to speculation that the ECB may be prepared to increase short-dated interest rates (currently their deposit rate is -0.40%) sooner than the market has been anticipating, given the recent strengthening of Eurozone economic growth and inflation.

Figure 2: Bank of America Merrill Lynch German 1-3 year total return index

Source: Davy Asset Management and Bloomberg as at 31st March 2017

Advantages of active management

Investors need not invest in negative-yielding bonds. One of the big advantages of active management is the ability to seek out opportunities and positive yields across the entire investible universe. We look for the hidden value where many may have disregarded; in different regions and fixed- income sectors (e.g. government, government guaranteed, agency, supranational, corporate bonds … etc.) where yields are positive.

In addition, because bond yields are at their most negative at the front of the yield curve, where duration (interest rate) risk is lowest, replacing these negative-yielding bonds with positive-yielding securities from other fixed-income sectors with similar duration need not dramatically increase the portfolio’s risk budget.

Please click here for Market Data and additional important information.

To read more Insights click here.