Insights

Pensions Inc

Pat Ryan

Pat RyanHead of Retirement Solutions

FOR INVESTMENT PROFESSIONALS ONLY

Incorporating your business and your retirement fund

The new Companies Act introduced in 2015 makes it easier and less cumbersome for business owners to run their business through a limited or unlimited company structure.

One of the major and sometimes overlooked benefits of running your business via a company is the ability to convert significant pre-tax trading profits into personally owned retirement assets through company contributions rather than personal pension contributions.

This means that substantial tax savings may be made by the business pre-retirement which may be turned into retirement capital and income structures post retirement for the benefit of company directors and their families.

To fully appreciate the additional retirement tax planning scope available for company pension funding it is worth comparing how company funding compares with making personal pension contributions to a traditional personal pension or a Personal Retirement Savings Account (PRSA).

Personal pension contributions

Maximum personal pension contributions are limited for tax relief purposes to an age related contribution percentage. This percentage ranges from 15% of relevant earnings for contributors under age 30 to 40% of earnings for contributors aged 60 and over. In addition relevant earnings are capped at €115,000 in any tax year. In situations where contributions exceed the relevant percentage limit, the unrelieved balance may be carried forward and allowed against the relevant income in future years. In terms of funding scope this means that a self-employed business owner with relevant earnings of €115,000 per annum from age 40 who pays the maximum tax allowable contribution each year between the ages of 40 and 59 will have contributed a total €661,250 (average of €33,062 per annum over 20 years) to his or her personal retirement fund by age 60.

To evaluate the benefits of this it is worth comparing the tax savings incurred in funding the maximum total of €661,250 in pension fund contributions as could be accumulated over the 20 years above by the self-employed individual with earnings of €115,000 per annum.

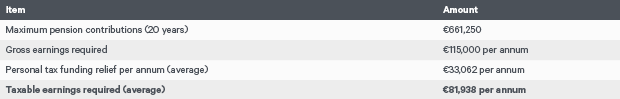

During this retirement funding period, Universal Social Charge (USC) and PRSI will remain payable on full earnings of €115,000 per annum. However, income tax will be payable only on earnings (€115,000 less allowable pension contributions - average of €33,062) of €81,938 per annum.

Table 1: Example of earnings cost of funding personal retirement fund

Company paid retirement funding

Revenue’s rules for company pension funding are drastically different. The tax deduction operates on the basis of allowing the employer entity (now the company) to deduct the full cost of providing pensions to company directors and other selected key employees. The maximum salary related retirement packages would have to be equivalent to those awarded to top public servants.

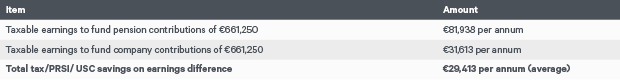

Under employer funding rules the company could fund the same level of contributions from age 40 to age 59 at the Revenue approved rate of 108% of salary from age 40 . This significant improvement in funding scope means that the salary (which the director needs to draw from the company to support company funding of €33,062 per annum for 20 years) is now reduced to only €30,613 per annum.

Table 2: Example of earnings cost of funding similar company retirement fund

Tax savings to fund retirement assets

The above represents a sizable benefit as it provides PRSI and USC savings on the difference in earnings required between €115,000 and €30,613 per annum (at say an average of 11% per annum) = €9,283 per annum.

Income tax is saved on average of €50,325 per annum (difference between self-employed taxable earnings of €81,938 per annum and taxable company salary of €31,613 per annum). At the marginal income tax rate of 40%, this is a net tax saving of €20,130 per annum. In total net tax/USC /PRSI savings come to €29,413 per annum.

In other words, the net savings alone would fund an additional salary and maximum pension fund for either a spouse or other key employee working in the business.

Table 3: Example of tax savings

Pension funding audit

Sole traders considering the benefits of incorporation could gain from evaluating the potential savings to be made by implementing company pension funding as an integral part of the incorporation plan. Likewise many SME companies will soon approach mid-year business review dates. Now is a suitable time to conduct a pension funding audit to establish scope for further tax efficiencies by optimising use of company funding facilities for directors, employed family members and other key staff.

Please click here for Market Data and additional important information.

To read more Insights, click here