Insights

Quality Matters - Asymmetric Returns

Jonty Starbuck

Jonty StarbuckFund Manager

In our white paper, we analyse the performance of our proprietary definition of Quality (QUALITY) over the last 15 years comparing the risk and return profile to the MSCI definition of Quality. Our more complex definition has delivered better returns and risk-adjusted returns based on traditional portfolio metrics.

The unique attribute of equity investing compared with other asset classes, such as bonds or real estate, is the ability to reinvest excess profits at higher rates of return.

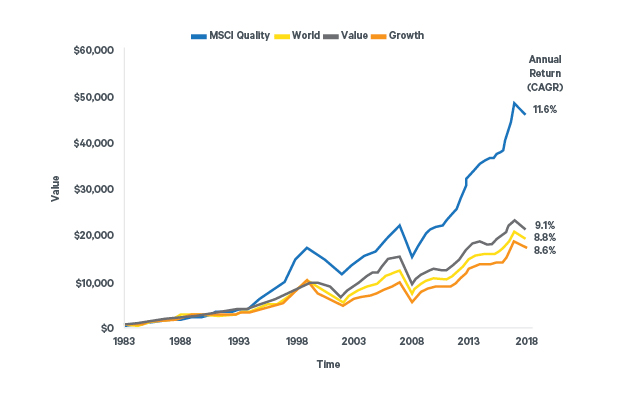

Figure 1 shows the representative total return on $1,000 invested over the last 35 years (1983-2018) in the MSCI World Index (World) and three-factor indices: MSCI World Quality Index (MSCI Quality), MSCI World Growth Index (Growth) and MSCI World Value Index (Value). The chart demonstrates that a Quality approach to equity investing, as defined by MSCI, has generated higher investment returns compared to global equity markets and other factor styles such as Growth and Value, as defined by MSCI, over long periods of time.

Figure 1: Growth of $1,000 invested in MSCI Quality, World, Value and Growth

Source: Davy Asset Management, MSCI, and Bloomberg as at 31st December 2018

The above excess returns were generated by the indices in quarterly “down” markets. “Down” markets are defined as periods when the World returns are negative, during this 35 year period. We believe the defining feature of MSCI Quality is the ability to deliver significant downside protection compared to equity market returns when equity market returns are negative, while also capturing strong returns when equity market returns are positive.

Our Definition of Quality

Finally, we have analysed the investment returns of our proprietary definition of Quality (QUALITY), comparing the risk and return profile to MSCI Quality and the World.

Figure 3 shows the representative total return on $1,000 invested over the last 15 years (2003-2018) in QUALITY, MSCI Quality and World. The chart shows QUALITY outperforms MSCI Quality and the World, returning 9.0% net on a CAGR basis compared to 8.2% and 6.2% respectively.

Figure 3: Growth of $1,000 invested in QUALITY, MSCI Quality and World (2003 to 2018)

Source: Davy Asset Management, MSCI, and Bloomberg as at 31st December 2018 data in USD.

The strong cumulative performance is the combination of similar downside protection and significant outperformance in “up” markets over the period relative to the MSCI definition of Quality. The QUALITY portfolio has a strong return capture of 99% versus just 95% for MSCI Quality in “up” markets.

This insight is from our latest white paper ‘Quality Matters, Asymmetric Returns’ by Jonty Starbuck.

Download full white paper here

*Davy Asset Management - “Quality Matters” White Paper – Chantal Brennan, Paraic Ryan, Hannah Cooney: 2016.

Please click here for Market Data and additional important information.

To read more Insights please click here.