Insights

Sustainable Investing - Not Just an Environmental Issue

Chantal A. Brennan

Chantal A. BrennanResearch Director

Jeremy Humphries

Jeremy HumphriesFund Manager

Many of the dynamics which drive and influence company performance are secular and long term in nature. From an investment perspective, it is the combination of financial and non-financial data which is used to identify sustainable businesses. This can be challenging in the small and mid-cap universe given the reduced level of non-financial reporting data. At Davy Asset Management, we have a robust, repeatable investment process, focused on Quality, which incorporates both financial and non-financial data to assist performance. This can be seen in the Davy Discovery Equity Fund, which has outperformed the MSCI World SMID Index by 5.3% to the end of Q3 2017.

It is also important to understand how a company will react to changes in its environment. An effective framework that measures this consistently is a firm’s environmental, social and governance (ESG) practices using an array of interesting non-financial information. In this article, we will discuss a selection of the metrics used to create ESG scores, their relevance and how we apply this in the small and mid-cap space.

Background

Historically, investors viewed sustainable investing as an investment approach which was purely values-based, known as socially responsible investing (SRI). SRI strategies were aligned with certain values, typically excluding particular industries for ethical or religious reasons. Stocks which had exposure to alcohol, tobacco, weapons, gambling and fossil fuels, so-called ‘sin stocks’, were excluded. In contrast, sustainable investing takes a positive approach, rewarding companies with strong ESG attributes instead of excluding them.

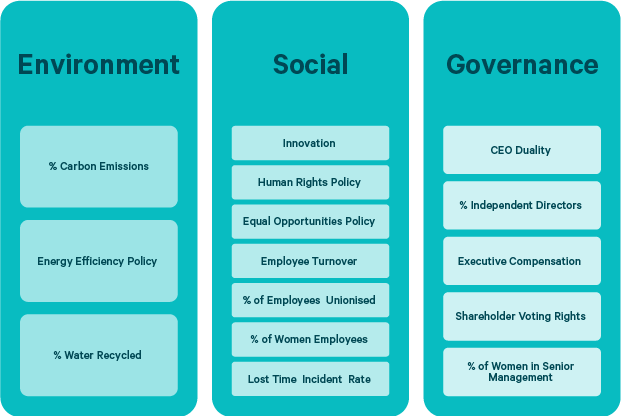

There are no hard definitions of what data points should be used to constitute each of these ESG criteria. Some criteria are easily included quantitatively others are better addressed qualitatively.

Figure 1: Sample ESG criteria

Source: Davy Asset Management, September 2017

Businesses are increasingly addressing sustainability issues. According to PriceWaterhouse Coopers (PwC) 17th Global CEO Survey, 80% of the CEOs surveyed think reporting non-financial ESG type metrics contribute positively to their long-term success. They believe fulfilling these criteria will result in:

- Improved risk management: Social and environmental risks are not as obvious and immediate as certain business risks. They appear over longer periods of time and can have a huge negative impact if they are not adequately prepared for. When management focus on longer term risks, they make investment decisions based on the long-term and develop dynamic strategies which allow a company to adapt when market, environmental and social conditions change.

- Brand and customer loyalty: There is an increasing amount of evidence to suggest today’s consumers, look at more than quality and price when making purchasing decisions. A 2014 Nielsen study, “Doing well by doing good”, showed a majority of consumers surveyed globally prefer to buy products and services from companies committed to having a positive social and environmental impact. ESG compliance reflects on how companies are perceived by society in a way they cannot ignore.

- Improved financial performance:Improving the efficiency with which resources are used can lead to significant cost savings as well as improving the company’s environmental performance. A high ESG score may be viewed as a proxy for firm efficiency and stability, indicating a well-managed firm which should also be reflected by a superior Quality rank and outperformance over the long-term.

- Enhanced stakeholder engagement:By engaging with all stakeholders, communication improves and cooperation increases. Firms are potentially better positioned to avoid costly controversies and operate on schedule, without disruptions.

- Inspires Innovation: Discovering sustainable solutions, either as a result of changing consumer preferences or new regulations, may result in ideas which become a source of competitive advantage.

The use of ESG criteria is supported by an emerging body of research which suggests companies’ ESG performance is intimately connected to its financial performance. The value of the ESG score is it incorporates non-financial data which can be used to gauge how corporate risks such as legal threats and or activist investor challenges can negatively affect stock performance. Therefore monitoring the risks associated with ESG policies can pre-empt issues that may ultimately impact a firm’s stock price performance.

Small and mid-cap companies and ESG

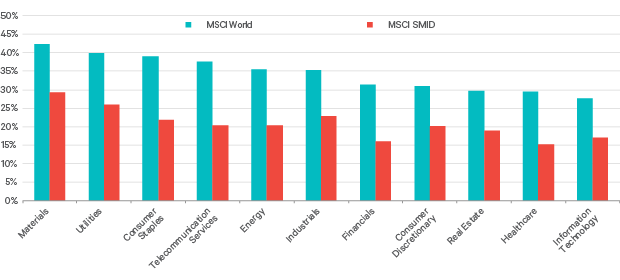

Despite ESG being a hot topic, many companies do not provide a high degree of disclosure as it is voluntary. Davy Asset Management’s database consists of approximately 6,000+ developed markets smaller companies whose market capitalisations are less than $15 billion. Although companies with larger market capitalisations provide greater details about their ESG policies than small-cap companies, it doesn’t always mean the quality and reliability is better. The higher disclosure rate may be seen in the chart below where large companies tend to have better ESG scores, due to the greater completeness of the dataset. Disclosure is higher in regulated industries such as Materials, Utilities, Telecommunications and Energy as it is mandatory.

Figure 2. Average Bloomberg ESG disclosure score

Source: Davy Asset Management and Bloomberg, October 2017

At Davy Asset Management, we focus on investing in high Quality companies as defined by our four pillars (Profitability, Persistence, Protection and People). The connection between ESG and company performance is intuitive, i.e. good ESG policies should serve as a proxy for Quality management, and a Quality stock. We also use MSCI’s data as a source of information as it is the most complete. They have created a framework which enables stocks to be compared across industries and geographies, which we complement where appropriate with data from other sources for smaller companies.

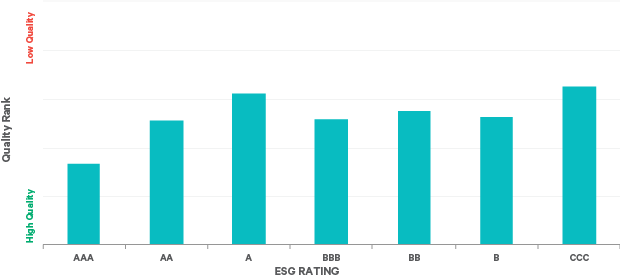

We have found companies with high ESG scores as measured by MSCI tend to be positively correlated with those companies who score favourable in our Quality Rank. AAA companies, have the best (i.e. lowest) Quality rank where as CCC companies have the worst (i.e. highest) Quality rank. This further supports our earlier findings about high quality stocks and performance; the higher the ESG rating the better (lower) the Quality rank.

Figure 3. MSCI World Index average Quality rank and ESG score

Source: Davy Asset Management, September 2017

Sustainable smaller companies

As investors focused on owning high Quality stocks, robust correlation between high ESG scores and our holdings within the Davy Discovery Equity Fund can be expected. During our research, however, we found a couple of surprises which were easily explained.

For example, the ESG score for Republic Services Group, the US waste management company, was rated CCC (low score). As waste management is a highly regulated industry, this raised some serious questions. Its financial data show it’s a high Quality business and the stock had beaten consensus expectations over the last four quarters. We contacted management and the database provider to better understand the issues. We were pleased to discover management was working with the data provider to ensure in future the data would be presented in the format they required. We believe this will result in a higher ESG rating for the stock once the database is updated.

Another positive surprise was Boliden’s AAA ESG score. Boliden is an integrated the zinc and copper miner and smelting company. Mining is well known for being a ‘dirty’ business due to its high degree of labour and capital intensity, therefore it was a surprise to find it had the highest score. In fact, only two companies in this sector globally have AAA ratings, Norsk Hydro and Boliden. Of the two, Boliden has a better Quality rank as its profitability, persistence, protection and people ranks are better.

Conclusion

What we have learned from this analysis is the importance of combining financial and non-financial data in our investment process. By focusing on Quality we are ensuring the Fund is exposed to companies which are better able to weather regulatory changes and potentially react faster to changes in the economy. As we are tackling a large opportunity set, having a scalable, robust and speedy idea generation process is advantageous.

To learn more about our investment strategies, please click here. Alternatively please don’t hesitate to contact our relationship management and distribution team, click here.

Please click here for Market Data and additional important information.

To read more Insights please click here.