Insights

The Fourth Industrial Revolution

Jonty Starbuck

Jonty StarbuckFund Manager

FOR INVESTMENT PROFESSIONALS ONLY

In this latest insight from Davy Asset Management, Jonty Starbuck, Fund Manager, for the Davy Global Brands Fund, looks at how global companies are adapting to the current period of profound systemic change. To describe this current period of transformation, commentators at the World Economic Forum have coined the phrase “The Fourth Industrial Revolution”.

From One to Four

The first industrial revolution used water and steam power to mechanise production. Electric power was employed to create mass production in the second, while the third developed electronics and information technology to automate production. This, “The Fourth Industrial Revolution” builds upon the third and refers to the rapid adoption of new technologies enabled by the digital revolution which began at the turn of the century.

In addition to this technological surge, we believe companies are also navigating rapid consumer-led modifications, driven by the preferences of millennials and digital natives within our society. In our view, the extent to which these technological changes are impacting different industries and business models varies significantly.

Figure 1: Industrial revolution timeline

Source: Davy Asset Management as at 30th June 2016

Challenges and Opportunities

Significant challenges are likely to arise with the fourth revolution, including exacerbated inequality and changes to the supply side in the form of production. In general, barriers to entry have been lowered, increasing scope for disruption. In our view, organisational speed and agility are at even more of a premium. Indeed, in some cases we have observed how rapid change has also exposed vulnerabilities in company portfolios and management capabilities.

However, fundamentally we believe that if the challenges of the fourth revolution can be navigated successfully, there is an inherent opportunity for global businesses to leverage their scale effectively and expand returns to a greater extent than was the case historically. This is because globally scalable companies do not incur diminishing returns to scale and therefore have the potential to deliver tremendous operating leverage.

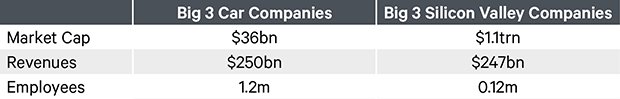

By way of illustration we can compare Detroit, Michigan in 1990 with Silicon Valley, California in 2014. In 1990, the Big 3 Car Companies in Detroit had a combined market capitalisation of $36 billion, revenues of $250 billion and 1.2 million employees. In 2014 the three biggest technology companies in Silicon Valley generated roughly the same revenue ($247 billion), had a considerably higher market capitalisation ($1.1 trillion) however, they accomplished this result with 0.12 million employees, 10 times fewer employees than their 1990 counterparts.

Table 1: Leveraging global scale

Source: James Manyika and Michael Chui, “Digital Era Brings Hyperscale Challenges”, The Financial Times, 13th August 2014

We believe the opportunity to leverage global scale effectively is open to a relatively small group of companies and when it’s combined with strong brands and franchises we believe it offers scope for sustainable and enhanced growth and returns.

Accenture, the market leader in consulting and outsourcing, provides an overall perspective of the transformation currently underway across its industries.

Accenture’s business is approximately 55% consulting and 45% outsourcing. Previously Accenture’s outsourcing business was its strongest component as businesses were looking for straightforward efficiency gains with a focus on costs in operations and information technology.

Over the last few years, however, its strength has shifted towards consulting, as businesses seek to leverage the digital transformation to modify ways of working in order to improve productivity and cost structures.

This trend is pervasive and if observed across industries and sectors we have witnessed global company management adapting in several ways:

1. Increasingly looking to differentiate through Research & Development (R&D), digital technology-led innovation and increasing investment in digital consumer marketing.

Some consumer companies now spend up to 25% of their consumer marketing budgets digitally, but over time this is likely to rise towards 50%. In addition, retailers such as Starbucks are increasingly using digital ordering and payment programmes to capture growing amounts of data about their customers, with loyalty programmes becoming a logical extension of this trend. Improved information about customers will assist marketing efforts through increased targeting.

2. Operating models are tilting more towards centrally managed category development teams with local execution focused on scaling global brands.

Global companies are typically managed through a matrix organisational structure with functional, category-based and geographic lines of report. To improve speed and efficiency, we are observing a progressive reduction of geographic teams and more emphasis being placed on category teams. For example, at Reckitt Benckiser, there is now one lead market for each global Powerbrand and the number of geographic areas has been reduced from three to two, bringing Developing Markets under a single leadership to deliver more scalable innovation and better in-country execution.

3. Cost structures are being attacked and ways of working assessed to free-up resources for investment and margin expansion.

At a recent investor seminar, Nestle detailed plans to make structural savings of more than 2 billion swiss francs (>2% of sales) over the next three to four years. They intend to achieve this by addressing global procurement, sweating assets more effectively and leveraging support functions.

Conclusion

As previously noted, we believe “The Fourth Industrial Revolution” is fundamentally changing the rules of the game across industries. Companies with strong brands or franchises are certainly not immune to the challenges, but with appropriate management actions, the fundamentals of the businesses are largely unaffected.

Indeed, in certain industries we believe embracing technological change offers scope to improve the economics of businesses beyond what was achieved historically.

Please click here for Market Data and additional important information.

To read more Insights click here.