Insights

The Low Volatility Phenomenon

Davan Byrne

Davan ByrneAssociate Fund Manager

FOR INVESTMENT PROFESSIONALS ONLY

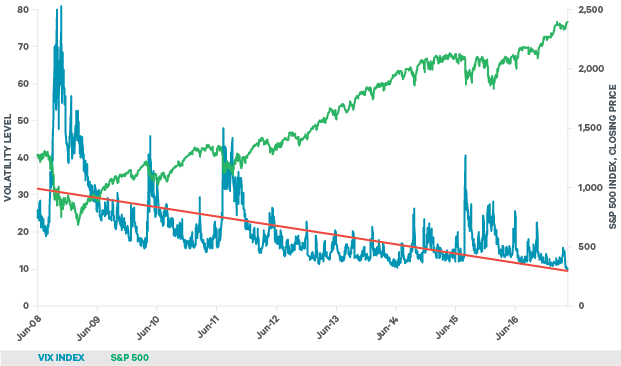

Following Emmanuel Macron’s French presidential election victory, volatility has fallen to the lowest levels witnessed in over two decades. In fact, since the inception of the VIX Index, or 'fear gauge' (a measure that tracks traders’ expectations of volatility on the S&P 500 for the coming 30 days) it has only closed lower than the recent reading of 9.77 on three occasions in its history.

The compression of volatility to current levels seems extreme but follows a broader pattern that has seen levels declining since the end of 2008 and the global financial crisis. While it's tempting to regard the VIX as a mispricing opportunity, this recent fall actually reflects what is happening in reality. Realised volatility has also been falling, with the 90-day realised volatility on the S&P 500 falling to just 6.7%, the lowest since 1995. This dampening of volatility is also reflected in the less well known European equivalent of the VIX, the V2X Index which is based on the Euro Stoxx 50 benchmark.

Figure 1: S&P 500 and VIX Index (30/06/2008 to 10/05/2017)

Source: Davy Asset Management and Bloomberg as at 10th May 2017

Given current elevated stock market valuations and heightened political risks, it might seem counterintuitive that volatility should be so low. Is investment risk as low as it has been since the early 90s or are there other factors that can explain the current low levels of volatility?

Market distortion

The distorting influence of the rise of smart beta and risk premia strategies may be one of the reasons that the VIX Index has fallen to current levels. Many of these strategies are centred on selling equity volatility futures and options to generate premium. These products are often leveraged, thereby amplifying the potential returns, but also the risk of significant losses in the event of a rise in volatility.

An unintended consequence of these strategies has been to provide a huge supply of volatility to the options market, artificially depressing its cost. The increased supply of options also has the effect of supressing market realised volatility through hedging activity and the popularity of these products has provided a positive feedback loop.

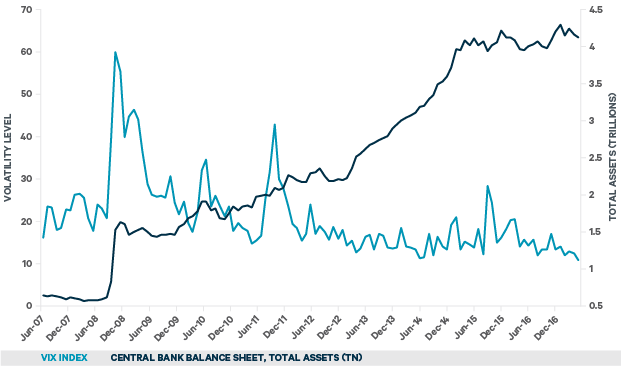

Central bank intervention

Additionally, when volatility has spiked in the years since the global financial crisis, central banks have been quick to step in to quell market turbulence, essentially placing a cap on volatility levels. Central bank intervention has also conditioned traders and retail investors to “buy the dip” which further acts to dampen volatility. As a strategy it has worked well in this equity cycle.

Figure 2: Central bank asset accumulation (30/06/2008 to 28/04/2017)

Source: Davy Asset Management and Bloomberg as at 28th April 2017. Central banks' balance sheet based on cumulative total assets held by the Fed, ECB and Bank of Japan

Stock correlations

The correlation between individual stocks has been falling since the Brexit vote, as the big rotation out of defensive stocks into cyclical stocks took hold. Rotations, by their nature, may lead to low volatility at the index level, as some stocks are sold and others bought.

When does it end?

What could take us out of this volatility torpor? How about a North Korea standoff, failing US tax reform, US/Russia tensions, hard Brexit, Fed rate hikes or tapering of ECB asset purchases? There is plenty going on in the world to concern investors. Any of the above would threaten the current calm.

It is possible that volatility will grind higher over time, or that a macro event will cause it to rise rapidly. History has taught us that periods of low risk aversion have tended to be followed by higher volatilities across asset classes, and that when volatility rises, it can rise rapidly. However, as we head into the summer months, those waiting for the VIX to explode may have to wait a little longer. Morgan Stanley point out that low volatility periods can last for 2-3 months after the VIX hits a level of 10.

The Davy Defensive Equity Income Fund uses an options overlay strategy to reduce the volatility of Fund returns and reduce drawdowns during periods of elevated market turbulence.

To read more Insights click here

To learn more about our investment strategies, please click here

To contact our relationship management and distribution team cick here