Insights

Investment Outlook 2018: Synchronised Growth

Mark Seavers

Mark SeaversChief Investment Officer

Financial markets were supported by improving economic momentum in many economies during 2017. The IMF estimates that three quarters of countries saw accelerating growth last year. That momentum should carry through to 2018, bringing us into the 10th year of the recovery from the global financial crisis.

Firsts in 2017

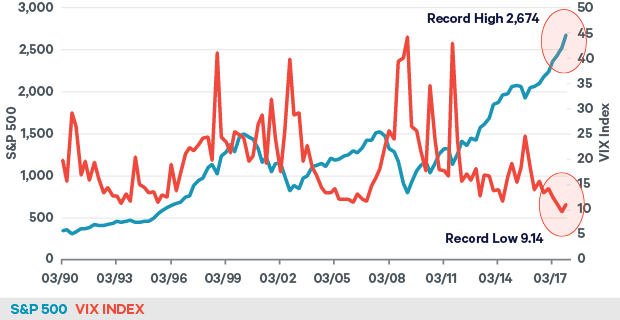

Some notable records were set in 2017. For the first time in history, the S&P gained in every single month during the year, US equities made new all-time highs and the VIX Index set a record low during the summer (see Figure 1).

At an asset allocation level, we prefer equities over bonds or cash for the year ahead. The supportive economic backdrop of accelerating growth combined with low inflation is positive for equity markets for 2018. For the third year in a row, we expect equities to return mid-to-high single digit returns.

Figure 1: A record year

Source: Davy Asset Management and Bloomberg 29th December 2017

Global growth

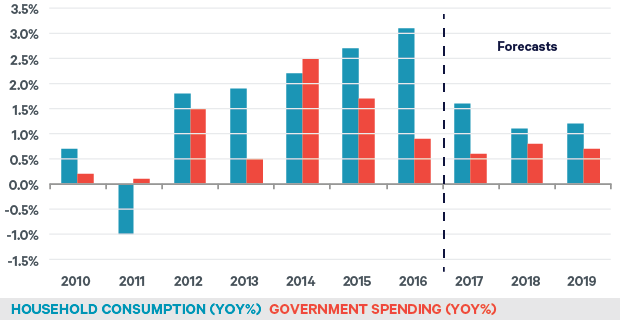

Business investment is picking up across the globe, consumer spending remains robust and global trade continues toimprove. We think GDP growth in the US will reach 2.6% in 2018, up from 2.3% in 2017. This is being driven by continued strength in consumption and a pickup in business investment. We believe that economic growth in the euro area will moderate somewhat from last year’s 2.2%, the region’s strongest growth in the current cycle. The Japanese government has been raising its forecasts for fiscal 2017 and 2018 to 1.9% and 1.8% respectively as manufacturing and exports continue to improve. The UK economy bucked the global trend, slowing in 2017, and is forecast to remain sub-par in 2018 as the Brexit uncertainty and real wage pressure dent confidence (see Figure 2).

Figure 2: Brexit hits the UK economy

Source: Davy Asset Management and Bloomberg 29th December 2017

The Chinese economy may slow somewhat in 2018 as President Xi presses ahead with tightening financial regulations aimed at curbing property speculation and wasteful

investment by local governments. The drive to tighten environmental regulations through the temporary closure of polluting industries will also weigh on growth.

However, consumption will be supported by wage growth and exports should benefit from the improving global trade environment. Donald Trump’s recently announced national security strategy does pose a risk to the trade picture. A number of investigations are currently underway in the US into China’s trade practices and it once again raises the spectre of a trade war between the countries.

Fixed income

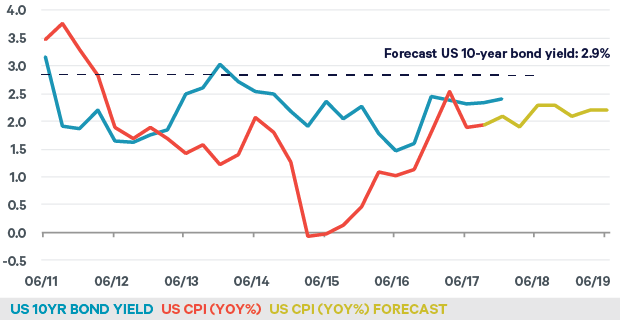

So far, this economic expansion has failed to ignite inflation, allowing monetary authorities to take a ‘steady-as-she goes’ approach to monetary policy. Our 2017 year-end forecast of 3.2% for the US 10-year benchmark yield was wide of the mark. The bond yield peaked at 2.6% back in March 2017 at the height of the post-election euphoria. It drifted lower for most of the year as inflation undershot expectations persistently and the timeline for fiscal stimulus was pushed out.

We think that continued economic momentum coupled with the withdrawal of liquidity will push the benchmark 10-year yield higher in 2018 – our Fair Value Model suggests 2.9% by December 2018 (see Figure 3). Elsewhere, rates are expected to rise in Canada, the UK, Norway, Sweden and Australia in the year ahead.

Figure 3: Inflation expectations and the US 10-year bond yield

Source: Davy Asset Management and Bloomberg 29th December 2017

Equities

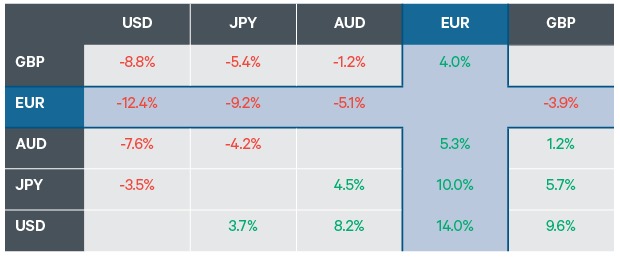

The positive global growth environment produced double-digit earnings growth for companies and drove equity markets higher in 2017. A year ago, we outlined our expectations for “mid-to-high single digit returns” for global equities in 2017. By year end the MSCI World had returned 7.5% for euro-based investors (see Table 1). Global equity returns would have exceeded our expectations were it not for a stronger euro, which benefited from a relatively benign set of election results last year and positive economic momentum.

In spite of mid-teens earnings growth, equities have become more expensive as we enter 2018. Developed markets now trade on 17x 2018 earnings and are expected to deliver 10% earnings growth this year. The US market is the most expensive of the developed markets, trading at around 19x 2018 P/E, whereas Europe looks relatively cheap in comparison at 15x.

Table 1: Strong euro performance in 2017

Source: Davy Asset Management and Bloomberg 29th December 2017

It should be said that the composition of the US market, with its large exposure to Technology stocks and its superior return on equity justifies much of this relative premium. From autonomous cars to factories populated by robots, Technology is penetrating and disrupting more and more industries. This trend presents opportunities for stock-pickers within the Technology sector and existential threats for a whole range of industrial and consumer-facing companies.

US companies are expected to outgrow their European competitors this year, partly as a result of belated fiscal reform. It took a year, but the US administration managed to deliver a tax package that will support US company earnings’ in the year ahead.

Expect the unexpected

As always, there are risks to investment returns in 2018. A year ago, with the US at trend growth and the new administration planning to add a substantial fiscal stimulus, we worried that inflation would spur the Fed to raise rates faster than expected and pressure asset prices. Instead, core inflation in the US has fallen.Factors such as ageing demographics andthe price transparency that the internet has brought us may have permanently reducedthe potential for inflation in the modern economy, and lowered equilibrium interest rates. If true, this would support equity valuations at current levels. Although with volatility hitting record lows in recent times and valuations above historic norms, any unexpected reappearance of inflation would be a significant risk to our markets outlook.

Do you trust your central banker?

We believe monetary policy will be less accommodative in 2018. The Fed has outlined its intention of reducing its balance sheet in 2018, and is slated to raise rates three times this year, taking the Fed Funds rate to 2.25% by year-end. However the market is only fully pricing in two rate hikes at the time of writing.

Having halved its bond purchasing programme to September 2018, we believe the ECB may end its purchases completely by the end of this year. The Bank of Japan, the other big buyer of government bonds, is also expected to reduce its rate of buying in 2018. Although central banks have stressed the gradual nature of the liquidity withdrawal, there is considerable uncertainty as to how markets will react to the changed environment.

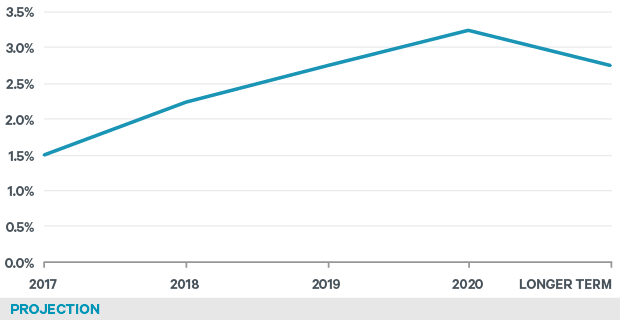

Figure 4: Fed FOMC plot

Source: Davy Asset Management and Bloomberg 29th December 2017

Old Faithful

Political risk will remain a concern for investors in 2018. Tensions on the Korean peninsula will persist, while in Europe investors will have to contend with the ongoing constitutional crisis in Spain, the Brexit process, and elections in Italy planned for 4th March. Polls in Italy suggest that there may be a hung parliament with no obvious grouping getting enough support to form a government. In the US, opinion polls will be watched carefully to see if the new tax legislation will help Republicans at the midterm elections in November. Markets will be wary of any signs that the Republican Party is likely to lose ground in Congress.

The current extended period of low volatility is not without precedent, but periods such as these increase the likelihood of elevated volatility and meaningful falls in equity markets in the future. We believe that our focus on building Quality equity portfolios provides investors with protection in such an environment.

Please click here for Market Data and additional important information.

To read more Insights please click here.