Insights

Investment Outlook Q2 2019

Mark Seavers

Mark SeaversChief Investment Officer

Equity markets have rebounded strongly in 2019, recovering all of the losses incurred in the final quarter of last year. The rally has been sustained by a change in policy at the Federal Reserve back in early-January. In this update, we examine the events that have been driving returns, including the “pivot” in the Fed’s policy stance and the global growth backdrop.

Global equity markets have recovered all of the losses suffered in the final quarter of 2018. The rebound has been accompanied by rising bond prices as global yields fell back to levels last seen at the start of 2018. Euro-based equity investors achieved a return of 14.5% from the MSCI World Index during the quarter, while bond investors gained 2.0% as represented by the JPM Global Bond Index. The change in market sentiment has been attributed to a remarkable change of tune by the Federal Reserve in the US.

Patience a Virtue

Last year’s selloff started with a comment from Federal Reserve Chairman, Jerome Powell, on 3rd October. Powell was referring to the Fed’s target rate of interest when he said: “we’re a long way from neutral now, probably.” In raising the prospect of a prolonged monetary tightening cycle, Powell spooked investors. This culminated in the worst December for US equities since 1931.

In our update in January, we noted the pressure that was being exerted on Powell by the White House to put an end to interest rate rises. Nevertheless, while acknowledging some softening in economic growth, the Fed went ahead and raised interest rates anyway for the fifth consecutive quarter on December 19th. The S&P fell by almost 8% in the days following the decision.

Whether or not the pressure from the president and falling equity markets influenced their decision, within two weeks of that December rate rise, the Fed abruptly changed tack and set the scene for the recovery in markets that we have seen so far this year. Patience was the key: “with the muted inflation readings that we’ve seen coming in, we will be patient as we watch to see how the economy evolves,” said the Chairman on January 4th. The Fed cited persistently low inflation as its rationale for what has become known as the Fed’s “pivot”. Almost immediately, interest rate futures markets started to price in a rate cut later in 2019.

Figure 1: US core inflation figures

Source: Davy Asset Management and Bloomberg 31st March 2019

The new, more dovish policy stance was confirmed at the Fed’s January 30th meeting when the Chairman announced that all further rate rises were off the cards for 2019 and that balance sheet reduction would end this year. While the Fed’s credibility will be questioned if the economic data picks up again in the months ahead, for now, it seems they are prepared to take that risk.

With higher rates off the agenda, markets are now focussed on the outlook for global growth and company profits, and here there are grounds for optimism.

Responding to Stimulus

The Chinese authorities performed their own pivot last year in the face of an economic slowdown that had been part of their own making. A year ago, policy was being tightened to curb excessive lending. However, a weakening economy and the uncertainties caused by the trade war with the US caused a rethink. A series of measures, including injecting funds into the banking system, VAT cuts and infrastructure investment has been implemented and now appear to be having a positive effect.

The Chinese economy has typically responded well to stimulus and investors were watching out for signs of an inflection in economic conditions. Recent sentiment data from the manufacturing sector has indeed shown improved confidence among managers. Clearly, much will depend on the US and China reaching an agreement on trade. If that deal is done, then this nascent recovery in the Chinese economy could gain momentum.

Figure 2: Chinese manufacturing purchasing managers index

Source: Davy Asset Management and Bloomberg 1st April 2019

It is a recovery that many in Asia and beyond are depending on. Japan and Germany, for instance, are feeling the chill from reduced trade with China, as are many emerging economies. Investors are expecting current negotiations between the US and China on trade to bear fruit perhaps within weeks. The outstanding issues cover some contentious areas, including the design of an enforcement mechanism and whether all the current tariffs will be removed immediately. However, there appears to be a political will to get a deal done.

No Respite Yet for the Euro Area

Elsewhere, there was a growing concern among EU officials that if the US comes to an agreement with China on trade, the Trump administration will turn its attention towards Europe. To the dismay of European leaders and US auto dealers alike, the president is reviewing a report on whether car imports to the US constitute a national security risk. Trump has until mid-May to decide on whether to impose tariffs on imported cars. The imposition of tariffs would be yet another blow to an industry that is struggling with a wide range of long-term threats. The health of the auto sector is an important driver of growth in Germany and was a drag on GDP in 2018.

The US is also considering another $11bn of tariffs on European goods including aircraft and cheese following a WTO ruling against illegal subsidies to Airbus. However, it will be for the WTO to decide what will be the appropriate monetary response.

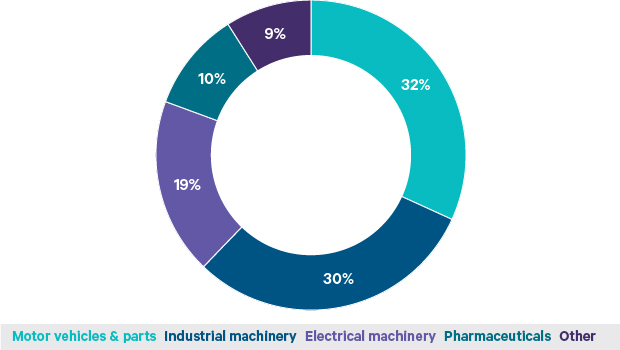

Figure 3: Composition of German exports

Source: UN Comtrade and Davy Asset Management based on 2017 exports

Since the start of this year, we have been expecting the outlook for eurozone growth to improve given the one-off nature of many of last year’s shocks. At a press conference in early March, ECB President Mario Draghi acknowledged these “idiosyncratic” factors but noted a “sizeable moderation” in growth in recent months. Draghi announced a reduction in the ECB’s eurozone GDP forecast for this year to 1.1%, down from 1.7% in December, and pushed back the expected timeframe for an interest rate increase to the end of this year. The ECB President also referenced Brexit uncertainty as a factor weighing on sentiment within the eurozone.

Brexit

Our view on the most likely outcome of the Brexit process has always been that a deal would be agreed after an extension to the Article 50 deadline. That extension is now in place and will run until October 31st. With Labour and the Tories engaged in negotiations for a compromise, it is possible that the UK could leave with a deal before the deadline. However, the two parties are far apart on fundamental issues such as a customs union, so the likelihood is that the process will drag on past the EU Parliament elections on May 23rd. From an economic perspective, the worst-case scenario of a hard Brexit has been postponed, but the uncertainty for companies planning to invest continues. It is also possible that the inventories that have been built up and stored in warehouses as a hedge against a hard Brexit will be run down during the summer months, putting a damper on output.

Bond Markets

The Fed and ECB are not alone in turning dovish: other central banks such as the Bank of England, Reserve Bank of Australia and the Reserve Bank of New Zealand have also turned more dovish. This has helped to push global bond yields circa 30 basis points lower during the first quarter and generated a return of over 2% for the JP Morgan Global Bond Index (euro hedged).

The rally in bonds briefly took ten-year US Treasury yields below 3-month cash rates for the first time since 2007. This so-called “inverted yield curve” is often regarded as a harbinger of recession, albeit with a long lead time. However, if the economic recovery in China is sustained and the US leading indicators are a borne out, then we would expect longer-dated yields to rise and the inversion to be reversed. As such, we believe that longer dated global bond yields are biased modestly higher in the coming quarters from these very low levels.

Equity Markets

Following the super-charged performance of earnings last year - tax cuts helped US company profits rise by over 20% in 2018 - momentum has been slowing since the Q3 peak. During the next six weeks or so, companies across the globe will report first quarter 2019 earnings, and many will comment on the outlook for the rest of the year. We are looking for confirmation that the recent positive sentiment revealed in the surveys is being reflected in the expectations of company management.

It will be an important earnings season because renewed traction on profit growth is required to sustain equity market momentum. In my opinion, equity markets are already reflecting the Fed’s new policy stance and the likelihood of a US/China trade deal being completed. The recovery in share prices that we have seen so far in 2019 has taken the MSCI World Index valuation level from the cheapest it had been in five years at the start of this year, back to the long-term averages now. Therefore, it will be very sensitive to earnings momentum in the near term.

QUALITY* Investing

As active managers, we have the scope to adapt to changing drivers of the global equity markets. In our opinion, the combination of higher volatility and a broader range of stocks and sectors driving equity returns will give active investors a greater opportunity to outperform the market in 2019. The degree of macroeconomic and political uncertainty that markets may have to endure in 2019 underlines the importance of having a disciplined investment process focused on Quality investments for the long term.

*Davy Asset Management - “Quality Matters” White Paper – Chantal Brennan, Paraic Ryan, Hannah Cooney: 2016.

Please click here for Market Data and additional important information.

To read more Insights please click here.