Insights

Market Review & 2017 Outlook

Mark Seavers

Mark SeaversChief Investment Officer

In a year of astonishing surprises, November 2016 delivered perhaps the biggest: a Donald Trump victory in the US presidential election, followed by rallies in the dollar and global equity markets.

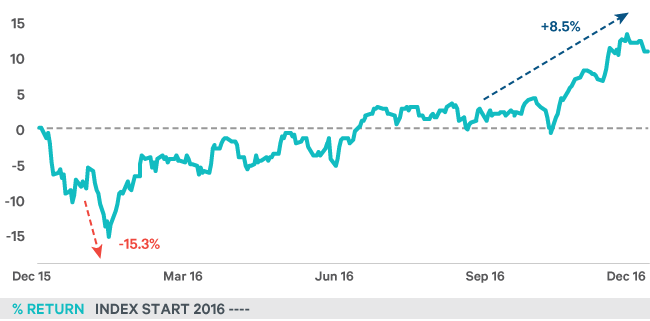

The MSCI World Index delivered a final quarter return of 8.5% to euro-based investors, and 10.7% for 2016 as a whole. As Figure 1 shows, after a volatile start to the year, much of the index’s performance came in Q4.

An 'Interesting' Start

We entered 2016 expecting mid-to-high single-digit returns from equity markets and negative returns from long-dated bonds for the year ahead. However, by mid- February global equity markets had fallen precipitously, driven by a falling oil price, a rising dollar, the collapsing Chinese stock market, declining Chinese FX reserves and concerns about subordinated bank debt. Against this torrid backdrop, central bankers did what they could to provide reassurance. The ECB increased QE, the Fed refused to raise rates, and the Bank of Japan moved its deposit rate into negative territory for the first time. Markets duly recovered and tracked sideways ahead of the Brexit vote.

Figure 1: MSCI World Index performance 2016

Source: Davy Asset Management and Bloomberg as at 1st January 2017

Brexit

The UK referendum result confounded most, including, it appeared, those on the winning side. The political upheaval that followed resulted in a couple of weeks of market turbulence, mainly affecting sterling and UK bank shares. A few weeks later, a subtle rotation within equity markets started as investors began to buy value stocks and sell defensive quality. This rotation was to become turbo-charged following the US election result.

Top Trump

Equity markets had made their preference clear in the run up to the 8th November vote in the US, weakening as Trump gained in the polls, and rallying the night before the vote on Clinton’s all-clear from the FBI. In the first hours after the result became apparent, Asian markets duly followed the ‘panic playbook’, selling equities and the dollar and buying bonds. By the time European investors arrived at their desks, a couple of hours earlier than usual, US equity futures were limit-down 5%.

What followed was an extraordinary demonstration of sangfroid by equity investors and panic in the bond markets. Trump’s relatively conciliatory acceptance speech set the tone, promising infrastructure investment and tax cuts; eulogizing America’s “tremendous potential”. “It’s going to be a beautiful thing,” said the president-elect. At that moment, it seemed as if Trump’s son Barron, who stood on the podium beside him, wasn’t the only person swooning. Equity investors in Europe gushed over the erstwhile Republican villain and filled their boots with cyclical stocks. Financial markets sensed another leg to the equity bull-run and a strong end to the year was ensured.

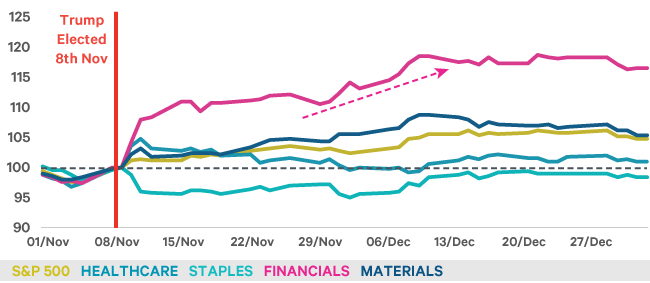

Figure 2: Market has been lead higher by financials

Source: Davy Asset Management and Bloomberg as at 1st January 2017

However, an altogether more nauseating sort of swoon was going on in the bond market. Yields were rising across the globe as the prospects of massive US bond issuance hoved into view. The dollar rallied as yields and inflation expectations rose. Within equity markets, the extent of the rotation out of quality, stable earners towards financials and cyclical stocks was notable. Healthcare stocks got a brief lift from Clinton’s defeat before resuming their descent relative to the rest of the market.

Having dispensed with Brexit and the Trump victory, the markets swatted aside the Italian referendum defeat and the much-anticipated rate rise from the Fed in December.

Market Outlook

The global equity market return for euro- based investors exceeded our expectations in 2016, helped, it must be said, by a stronger dollar. Looking out to 2017, it is tempting to think that some of what might be possible in the new policy environment had been priced in during the year-end rally. In September last year, we had noted that there was little scope in most developed markets for significant fiscal stimulus. The US was the exception, and a Donald Trump victory would inevitably result in higher yields. Little has changed since that analysis.

Figure 3: Yields jump following Trump’s election

Source: Davy Asset Management and Bloomberg as at 1st January 2017

Trump’s plans, focused as they are on tax reductions, should certainly worry bond investors. Bond yields look set to continue to rise in 2017. Our team forecasts US 10-year yields at 3.2% by the end of 2017, coupled with steeper yield curves across the globe, with most of the pain coming at the long end of the curve. The effect of rising US interest rates and a stronger dollar will offset, to some extent, the benefits from any fiscal expansion that may be undertaken.

Equity investors have narrowed the performance and valuation gap between defensive quality and cyclical value somewhat. The key to a continued rotation is underlying economic momentum. The US appears to be in good shape in this regard and the Eurozone’s slow recovery continues. For equities, we repeat our forecast of mid-to-high single-digit returns in 2017.

Once again we start a new year with bottom-up expectations of double-digit earnings growth for companies. While the markets have been disappointed by the earnings outcome for the past number of years, there is some cause for hope that the tailwind from rebounding commodity- related earnings, tax cuts in the US and improving margins for financial stocks will deliver the earnings forecasts for 2017. That would put the 2017 forward P/E ratio at 16.0, slightly above long-term averages.

Risks in 2017

As we look forward to renewed earnings growth and supportive changes to fiscal policy, it is worth considering the many risks to the global economy in 2017.

China’s increasingly desperate attempts to stem the capital outflows that are being driven by the rising dollar point the way to potential volatility in the year ahead. Dwindling FX reserves at the People’s Bank of China (PBOC) were cited as one of the causes of the market swoon in early 2016, so why ignore them now?

Chinese firms that have borrowed in dollars are likely to continue to try to pay these debts down, thereby pressuring reserves. The market is starting to fixate on the $3 trillion reserve level and the CNY 7.0 exchange rate, both of which will be tested in 2017.

China also appears to be a popular target for Trump’s anti-trade rhetoric. I wonder has the president-elect taken personal offence to a 2012 quote from Xi Jinping that we included in our roadshow during the summer of 2016. At the time, the Chinese premier was complaining that “some foreigners with full bellies and nothing better to do, engage in finger-pointing at us.” Something tells me that finger pointing will be the least of the Chinese president’s worries in 2017.

US/China relations are sure to feature in market reviews through 2017. Any counterproductive attempts by the Trump team to impose punitive tariffs on one of the America’s largest trading partners will undoubtedly knock equity market sentiment in 2017.

For emerging markets in general, the dollar will be watched carefully. The US currency bottomed out around the time of the Brexit vote but has moved higher ever since. It is now above the level that contributed to the market weakness in Q1 2016, supported by widening interest rate differentials. Moreover, the president-elect’s stated intentions regarding trade agreements argue for caution on emerging market investing.

Closer to home, the Brexit process will start in earnest before the end of March and, once again, the markets will be focused on the economic data that will emerge in the following weeks and months, looking for signs of the economic downturn that failed to materialise previously. We had expected that GDP growth would be slowing at the end of 2016, and we think it unlikely that the UK economy will escape 2017 without a negative Brexit effect on growth.

The packed 2017 political calendar in Europe is likely to deliver a further shift from the mainstream towards the populists in some key economies. This, in turn, may lead to further bouts of existential angst around the Euro project. A general election in the Netherlands in March will be followed by the French presidential election in April and German federal elections in October. Throughout Europe populist parties are polling strongly.

Concluding Remarks

Against this uncertain background, we remain committed to our process of identifying quality companies at the right price. The earnings season will be upon us around the time of the presidential inauguration and the outlook statements from the managements of many of the cyclical stocks that have run hard since the summer will be pored over with interest.

In spite of the risks highlighted above, we continue to favour quality equities over bonds for the year ahead.

Please click here for Market Data and other important information

To read more Insights please click here.