Insights

Data Inspired

Chantal A. Brennan

Chantal A. BrennanResearch Director

Jeremy Humphries

Jeremy HumphriesFund Manager

In an ever diversified and boundary free investment world, at Davy Asset Management it’s all about a quality approach.

At Davy Asset Management, we have found that companies with enduring competitive advantages can resist market forces independent of economic conditions and are long-term winners. These ‘quality’ companies exhibit common identifiable characteristics, such as higher returns and margins that are sustainable over a cycle. Equally their share prices are less volatile; they demonstrate lower leverage and have superior capital allocation. This isn’t just our perception but a demonstrable fact. We define quality using fundamental financial data and have created a multi-factor model that we define by four pillars: profitability, persistence, protection and people. Each pillar is composed of its own distinct measures. The ratios used reflect those employed by traditional fundamental analysts in assessing and forecasting the value of a business and are further supported by academic research.

Our evidence shows that the market systematically undervalues quality companies. We find that higher-quality companies outperform both the broader market and low-quality companies and are therefore even less volatile. We believe an investment philosophy and process focused on identifying quality companies, at an appropriate valuation, is likely to deliver superior risk-adjusted returns for clients over the long term with potentially lower risk. Unlike other firms, we can assess thousands of stocks at a glance. Our quality model allows us to conduct our analysis consistently and in a scalable way. Through this we have created a proprietary global database of 15,000 ‘live’ stocks. Unlike many frameworks, we don’t exclude any stocks. Instead we rank the whole investment universe.

A key feature of investing is to understand a business’s relative attractiveness at both a regional and global level. Globalisation has blurred boundaries. Experience has taught us the importance of creating an ecosystem that can evolve. You want to incorporate your most up-to-date findings into your models. Our objective is to understand the drivers of quality not just for each stock but for the investable universe, too. We have created a framework that enables us to reflect changing industry and/or regional dynamics over time. Equally, we have developed separate proprietary models for growth, valuation, environmental and social governance, which we lay alongside our quality model. This ensures the datasets are discrete, complementary and that our research efforts are focused on the present.

This is important as at our core we are fundamental analysts who believe in fully understanding the dynamics driving the underlying businesses we are looking to invest in. We consider our approach to be data-inspired, not data driven, using up-to-date quantitative tools to create a disciplined research process.

By combining the strengths of both quantitative and fundamental analysis we can improve our insights, delivering consistent performance for all of our strategies – a best of breed approach. The result is an integrated philosophy and process, culminating in high-conviction portfolios of high-quality stocks held at appropriate valuations. We manage a range of strategies that all employ our quality model and framework and further have an emphasis on either growth or value.

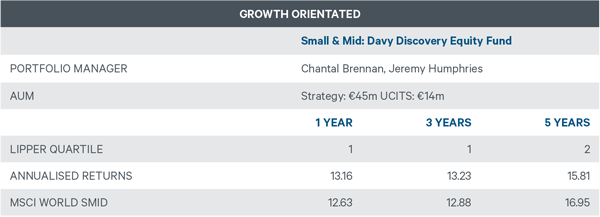

Table 1: Small and mid: Davy Discovery Equity Fund

Source: Davy Asset Management 30 September 2016. All returns are in euros.

In 2016, markets have absorbed the US interest rate increase, Brexit, the collapse of sterling and the US presidential election. Volatility is unlikely to subside. We expect continued short-term uncertainty with an Italian referendum due in November and another US interest rate hike as we approach the end of the year. Next year will most likely be equally as eventful. Historically, interest rates have been a barometer of confidence among borrowers and lenders, but as they are at historically low levels a 25 or 50 basis point rise makes little difference.

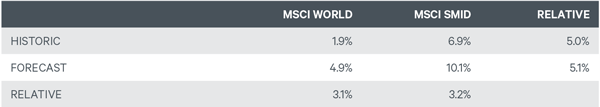

What makes this interest rate cycle unique is the level of central bank intervention. In their desperation to avoid deflation they are insistent on making investors forget there is such a thing as credit or interest rate risk. To date, ultra-low interest rates and QE have done little more than keep economic growth anaemic. Where can you find growth in a low growth world? One opportunity: invest in small and mid-cap equities. We examine growth prospects by analysing the historical and forecast sales growth of the stocks in our ecosystem.

Table 2: Sales Growth

Source: Davy Asset Management, MSCI, Bloomberg as at 31st March 2016

Figure 1: P/E of MSCI World v SMID

Source: Davy Asset Management, Bloomberg, MSCI as at 31st Aug 2016

Our research shows that over time small and mid-caps are growing twice as fast as their large-cap peers. Our fundamental database of stocks enables us to look deeper into this number by region and sector, helping us to hone in to the highest growth: healthcare, IT and consumer discretionary. Of course, within these sectors we are selective by region and focus on the stocks fulfilling our four investment pillars. These companies generally tend to have good cash flow, low capital intensity and are growing. Many of today’s small and mid-cap stocks are the large caps of the future. Although, in this low interest rate environment, small and mid-cap stocks are ideal acquisition targets as they have higher growth and make excellent bolt- on acquisitions for large-cap companies looking for faster ways to drive growth. Our research shows that the cash on large-cap balance sheets alone represents about 40% of the aggregate market cap of small-caps globally (Europe 72%, US and Canada 56%). This is supported by independent research that shows serial acquirers buy higher growth companies irrespective of market volatility and are willing to pay higher multiples for them.

This could be one of the reasons underpinning the valuation differential between large, small and mid-cap companies. We can see from the graph that large-cap stocks have become increasingly expensive since the 2011 credit crunch. In the case of small and mid-cap stocks, while valuation reverted to their pre-credit crunch levels, it has surprisingly remained relatively static.

Of these lines the important one is the green one. It shows the valuation differential between large and small and mid-cap equities. In fact, small and mid-cap equities are almost as attractively valued versus large caps today as they were in 2011. This spread is supported by their higher relative growth prospects and undiminished global merger and acquisitions activity. Periods of market volatility over the past five years have not affected this trend.

Since 2001, SMID caps have generated an impressive 8.4% per annum, outperforming their larger cousins in MSCI World. The environment in 2016 and into 2017 continues to be supportive of small and mid-cap stocks and year to date the MSCI SMID Index has outperformed the MSCI World Index by 2.7%. Even when markets were weak at the beginning of 2016, they outperformed, which is not what investors would typically expect.

One would have expected large-caps to outperform in a ‘risk-off’ environment given their greater geographic diversification, whereas small and mid-cap stocks tend to have greater exposure to their domestic economies. The difference, we believe, is their higher growth prospects and relatively attractive valuation levels. Our emphasis on investing in quality businesses ensures our portfolios have lower volatility and leverage than the market. Recent experience shows the power of investing in quality businesses during periods of volatility. In Q1 2016, for example, in the immediate aftermath of the US interest rate increase, quality outperformed. Equally, when Brexit happened in Q2 2016, quality outperformed again.

The performance of the Davy Discovery Equity Fund during these periods was robust because we have not just ensured we are invested in quality stocks but the positions are scaled according to their quality, growth prospects and potential market impact. So, the highest quality, growing, least volatile stocks have the highest relative positions. This process has been developed so that it is monitored on a continuous basis rather than in a discrete way. One of the most important trends over the past few decades has been globalisation. This has changed the investment landscape because it blurs boundaries. For example, a stock listed in the UK may have most of its revenues generated in US dollars not sterling. The country of listing is not as important as where revenue and profit is generated. If you apply this concept at a fund, index or universe level it will significantly alter your opinion as to where your actual economic exposure is and how interrelated or not the various stock ‘networks’ within a fund or index are.

We have been developing ways to analyse and visualise these patterns to provide greater insight into the risks. It is also adding greater depth to our fundamental research as we are able to better understand the power of suppliers and customers (Porter’s five forces) and how they are driving our microenvironment. To achieve our goal we use the most up-to-date systems to not only select stocks, but to construct portfolios, dynamically monitor risks and assess them. Using a ‘best of breed’ approach to research and incorporating both quantitative and qualitative analysis we have created an environment that can adapt. It ensures our quality investment philosophy is integrated at each stage of our investment process. It is important to “know what you own, and know why you own it”

Please click here to download our whitepaper 'Quality Matters'.

Please click here for Market Data and additional important information.