Insights

Equity Income Investing in Volatile Times

Mark Seavers

Mark SeaversChief Investment Officer

Davan Byrne

Davan ByrneAssociate Fund Manager

The Davy Asset Management Global Equity Income Fund has produced strong returns over the past two years. This performance was driven by our investment process, which is focused on identifying high-quality companies that generate cash flow from their operations and pay dividends consistently through time.

Compounding dividends

The compounding effect of the reinvested dividends is a powerful driver of long term returns for investors. At the end of 2016, the gross dividend yield of the Davy Global Equity Income Fund was 3.6%, one percent higher than the yield of the MSCI World Index, and considerably higher than most government bonds.

Table 1: Asset class yield comparison

Source: Davy Asset Management, UBS PAS and Bloomberg as at 31st December 2016. The gross yields are quoted for the Davy Global Equity Income Fund. The dividend yield on the MSCI World Index is quoted in euro terms

In targeting companies with sustainable business models, investors can also benefit from growing income. Companies with strong market positions and barriers to entry can ride out the business cycle and take market share from weaker players when the cycle turns down. This can allow companies to sustain their existing pay-out and grow their dividends over time. At the end of 2016, the portfolio was forecasted to deliver 4.9% dividend growth during 2017, thereby adding to the attraction of the initial yield.

For example, JP Morgan, the US-based financial, is an example of a cyclical stock that was one of the top performers in the portfolio this year, returning circa 35% during the calendar year in USD terms. US Financials continued to enjoy a strong rally on from Trump’s election win in November. The new administration is expected to be positive for financial stocks, favouring lower regulation, while Trump’s anticipated expected fiscal expansion plan may stoke inflation leading to higher interest rates. This may allow financials to earn a greater spread over their cost of borrowing (Net Interest Margin). JPM is an example of a well-run cyclical stock. It has a forecasted dividend growth of 4.6%.

Volatility reduction

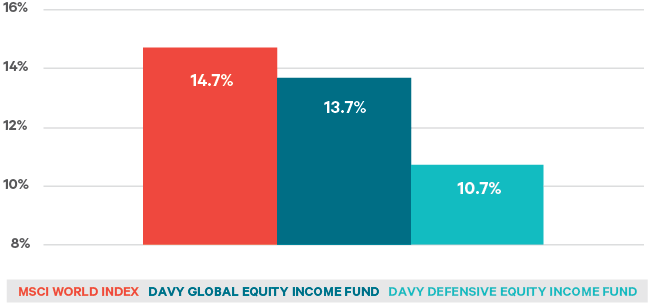

Stocks with the characteristics outlined above also tend to be less volatile than equity markets as strong balance sheets protect companies when the cycle turns down. Over the past five years, the annualised volatility of our Global Equity Income Fund and Defensive Equity Income Fund have been significantly lower than the market.

Figure 1: Equity income fund volatility

Source: Davy Asset Management and Bloomberg as at 31st December 2016. All volatility figures are quoted 5- year weekly volatility annualised from 31st December 2011 to 31st December 2016. Volatility in the above figure relates to the Global Equity Income Fund Class H and Davy Defensive Equity Income Fund Class A in euro terms.

The relatively defensive nature of our Equity Income Funds was evident throughout 2015 and 2016. The Funds outperformed strongly during the market rout that occurred from early-December 2015 through to mid-February 2016, and also performed well in the period leading up to, and immediately after, the Brexit vote.

Although we expect positive returns from equities in 2017, we believe there is potential for large drawdowns in what may be a volatile year ahead given the many risks to the global economy in 2017. The Davy Defensive Equity Income Fund uses an options overlay to further reduce volatility. Call options are sold on around half of the stocks in the fund and the proceeds go toward buying Index puts, which protect against falling markets. The fund strategy was tested severely over the past two years and performed strongly during periods of market weakness.

The value of protection

From end-July 2015 until mid-February 2016, equity markets experienced a period of elevated volatility and major drawdowns. Every time the equity markets lurched lower, the put protection in the Davy Defensive Equity Income Fund kicked in and the fund drawdowns were far less severe relative to the benchmark.

The extra level of protection afforded by the options strategy has helped reduce the volatility of the fund over time. In the last five years, the annualised volatility of the Davy Defensive Equity Income Fund has been 10.7% versus the market volatility of 14.7%.

Figure 2: The value of protection

Source: Davy Asset Management and Bloomberg as at 31st December 2016. Performance in the above figure relates to the Davy Defensive Equity Income Fund Class A in euro terms.

As we enter 2017 with the new policy regime that the Trump presidency will oversee, we expect that there will be further bouts of volatility in the markets. In this context, we believe that our focus on quality, dividend-paying stocks will serve investors well in the year ahead.

Please click here for Market Data and additional important information.

To read more Insights, click here.