Investment Approach

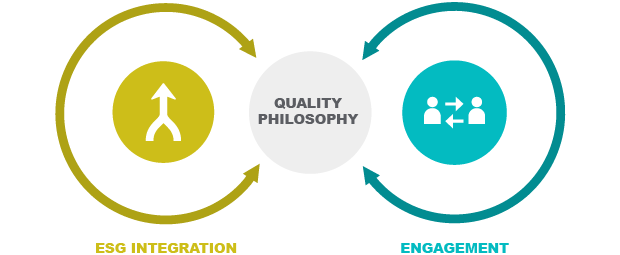

Davy Asset Management adopts a structured and disciplined Quantamental investment process which is applied to all investment decisions. These decisions are a by-product of the QUALITY investment philosophy we employ and are brought to bear across all strategies with the objective of ensuring long-term performance in a responsible manner.

Defining the QUALITY factor

We believe companies which are long-term winners exhibit identifiable common characteristics known as 'Quality Factors'. We believe the market systematically undervalues the prospects of these companies and an investment process focused on identifying Quality companies, at the right valuation, may deliver superior performance for our clients in the long term. Throughout our analysis we focus on understanding four key characteristics for a potential investment:

Our pursuit of Quality combines bottom-up quantitative and fundamental or Quantamental analysis to identify investment opportunities. Our Quantamental process ensures we can cover both a wide breadth of stocks through our Quality model while at the same time analysing individual companies in depth, giving us scale, insights and consistency.

The equity investment process is focused on identifying Quality stocks by leveraging our proprietary four factor Quality model. These four factors are incorporated into each stage of the investment process. It can be broadly divided into three interconnected stages:

As long term investors, business risks are important factors in our investment process. At Davy Asset Management, Environmental Social and Governance (ESG) criteria are integral to our decision making process. ESG is woven throughout our investment process from direct incorporation into our proprietary company valuations models through explicit screening and company engagement depending upon the strategy.

Source: Davy Asset Management - “Quality Matters” White Paper – Chantal Brennan, Paraic Ryan, Hannah Cooney: 2016

Source: Davy Asset Management - “Investment Process” White Paper – Chantal Brennan, Paraic Ryan, Hannah Cooney: 2016

WARNING: Please note the factors listed are neither comprehensive or exhaustive. There may be other factors that influence the investment process.

WARNING: This information does not constitute investment advice or a recommendation. The information contained herein does not purport to be comprehensive. It is strictly for information purposes only and should not be treated as constituting advice. No investment decision should be made on the basis of this information.

DOWNLOAD WHITE PAPER - QUALITY MATTERS

We have produced this white paper, QUALITY MATTERS, to explain why we adopt a quality investment philosophy at Davy Asset Management. In the paper, we detail the fundamentals that are most important, and present current academic evidence to support our convictions.

DOWNLOAD WHITE PAPER - INVESTMENT PROCESS - EQUITIES

The equity investment process is focused on identifying quality stocks through leveraging our proprietary four-factor quality model which can be broadly divided into the stages of: idea generation, research, portfolio construction and risk management.